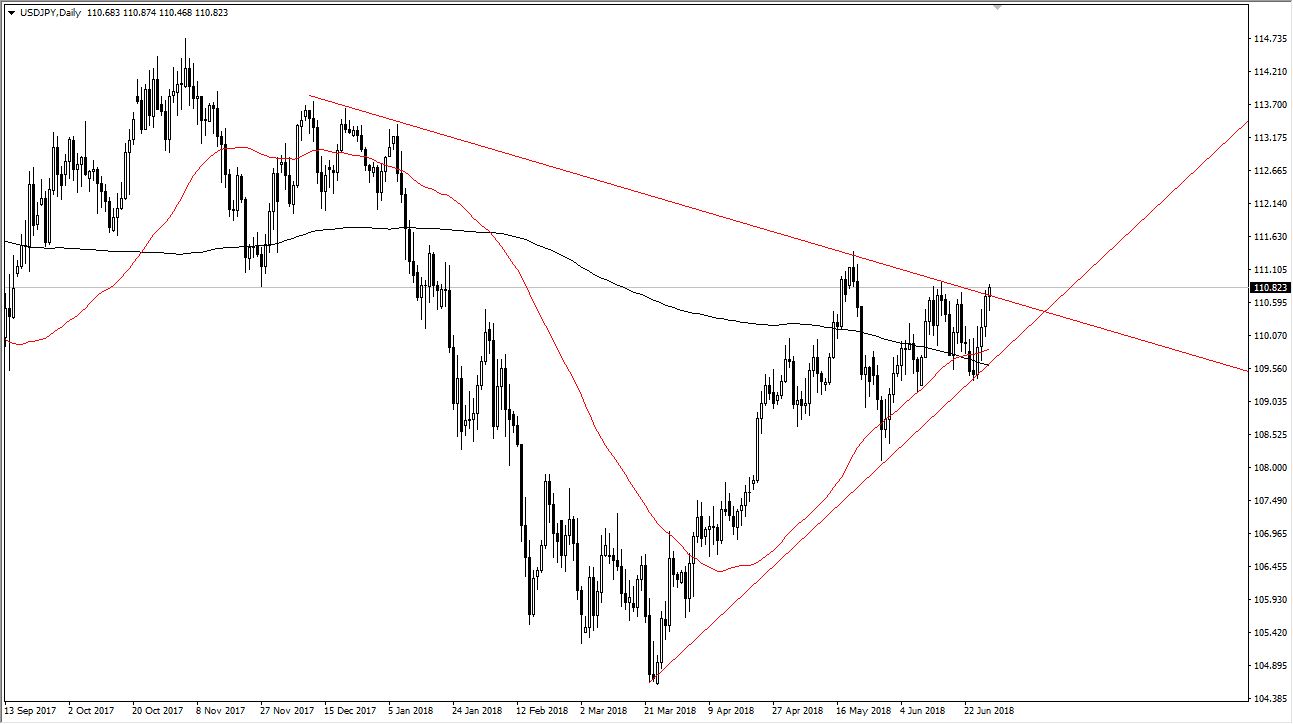

USD/JPY

The US dollar initially fell during the trading session on Friday but turned around the show signs of strength and we broke above the downtrend line that has been such a major influence on this market. I believe that the ¥111 level above is significant resistance, but it’s probably only a matter of time before we can break above that level continue to go higher. I would target the ¥112.50 level, on the breakup. Otherwise, I suspect that we will continue to go back and forth, as we have plenty of support underneath, especially near the uptrend line. I believe that we are trying to break out, but it may take a bit of time and momentum to have that happen. Expect volatility, as this market is very sensitive to risk appetite in general and of course we have plenty of headline risk going around the world right now.

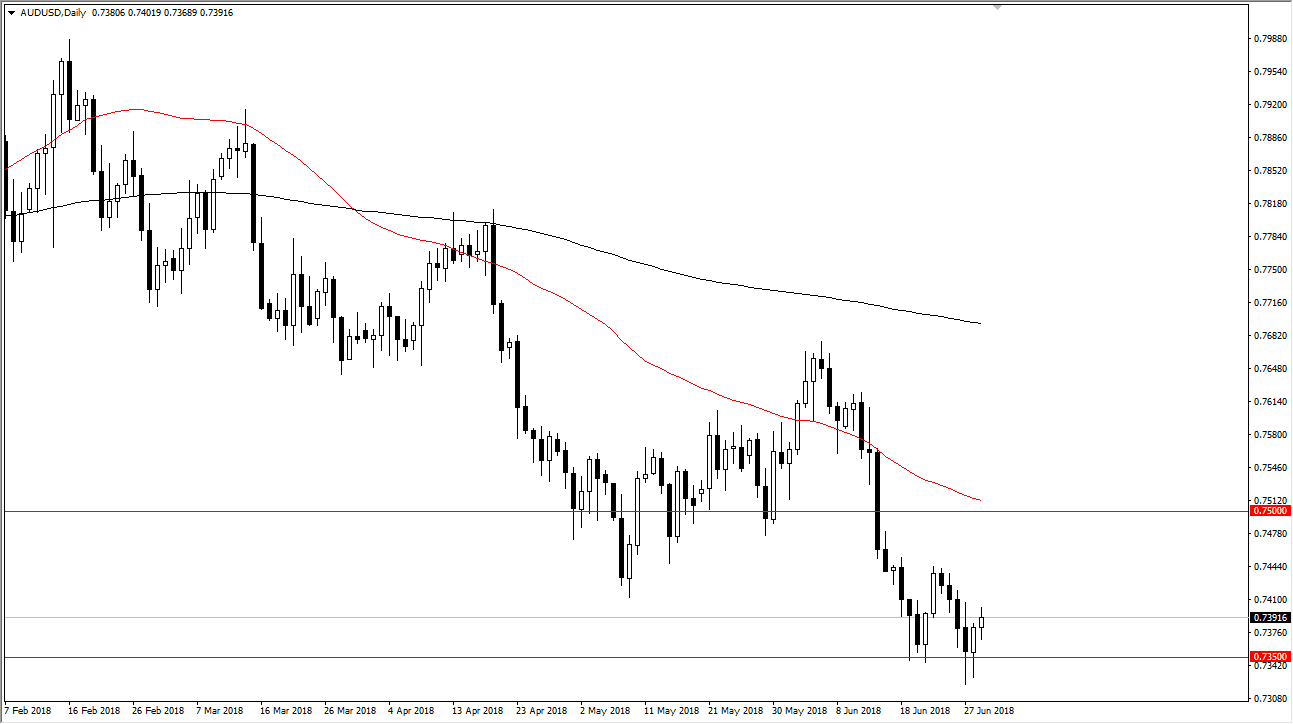

AUD/USD

The Australian dollar initially fell as well but found enough support underneath the turn around and form a positive candle. This is a good sign, as market participants will undoubtedly look at the bounce from the 0.7350 level as supportive. Beyond that, we have formed a hammer on the weekly chart, so that of course is bullish as well. I believe the 0.75 level above is resistance, so if we can break above that level we could go much higher. In the meantime, I would expect a bit of a bounce from here, but I wouldn’t put too much faith into the move and I think that at the first signs of trouble, people will probably bail on any long positions they find their selves then. A fresh, new low opens the door to the 0.73 level after that.