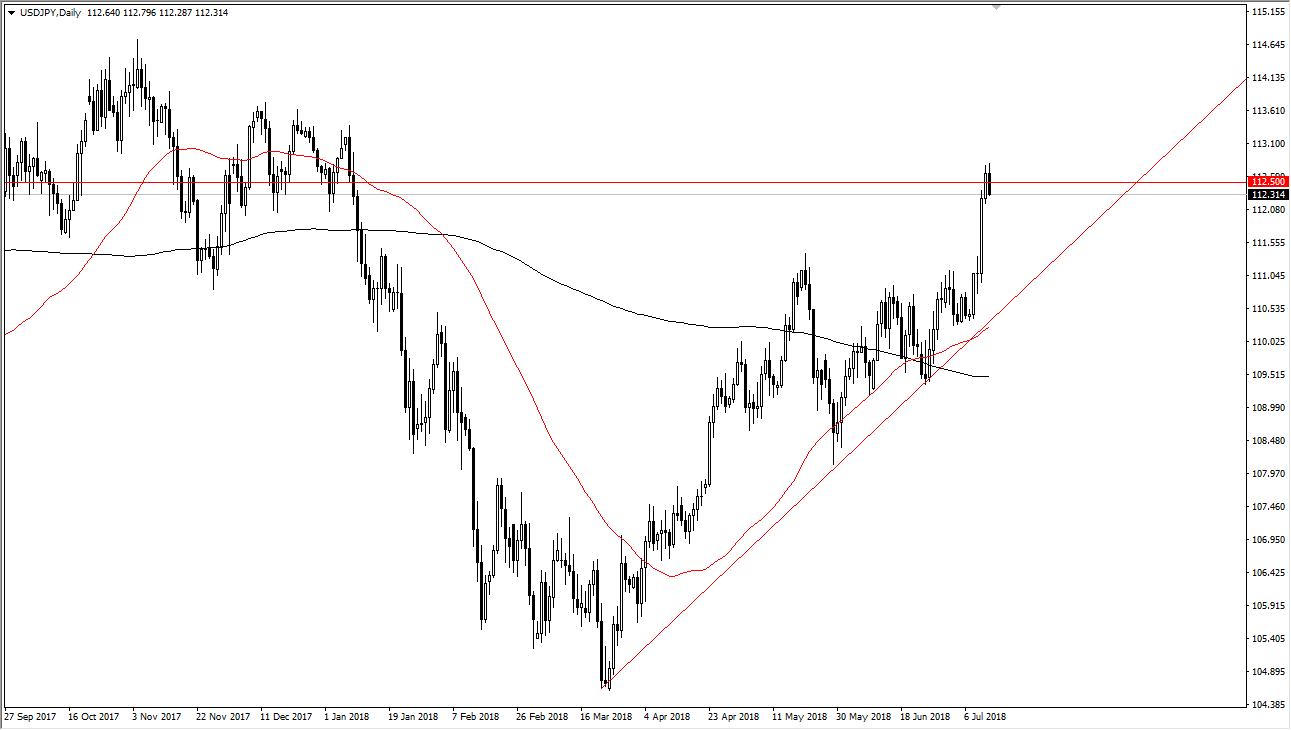

USD/JPY

The US dollar has rolled over against the Japanese yen during trading on Friday, as we had most certainly gotten a bit overextended. When I look at this chart, it’s easy to extrapolate a shooting star on a 48 hour candle, and this tells me that we are likely to see a bit of a pullback. Beyond that, the US dollar looks to be a bit on its back foot against other currencies around the world so it makes sense that we may pull back from this area. Nonetheless, I am bullish longer term, but I think that we will probably get a drift lower, perhaps down to the ¥112 level, perhaps even followed by the ¥111.25 level underneath which had been previous resistance.

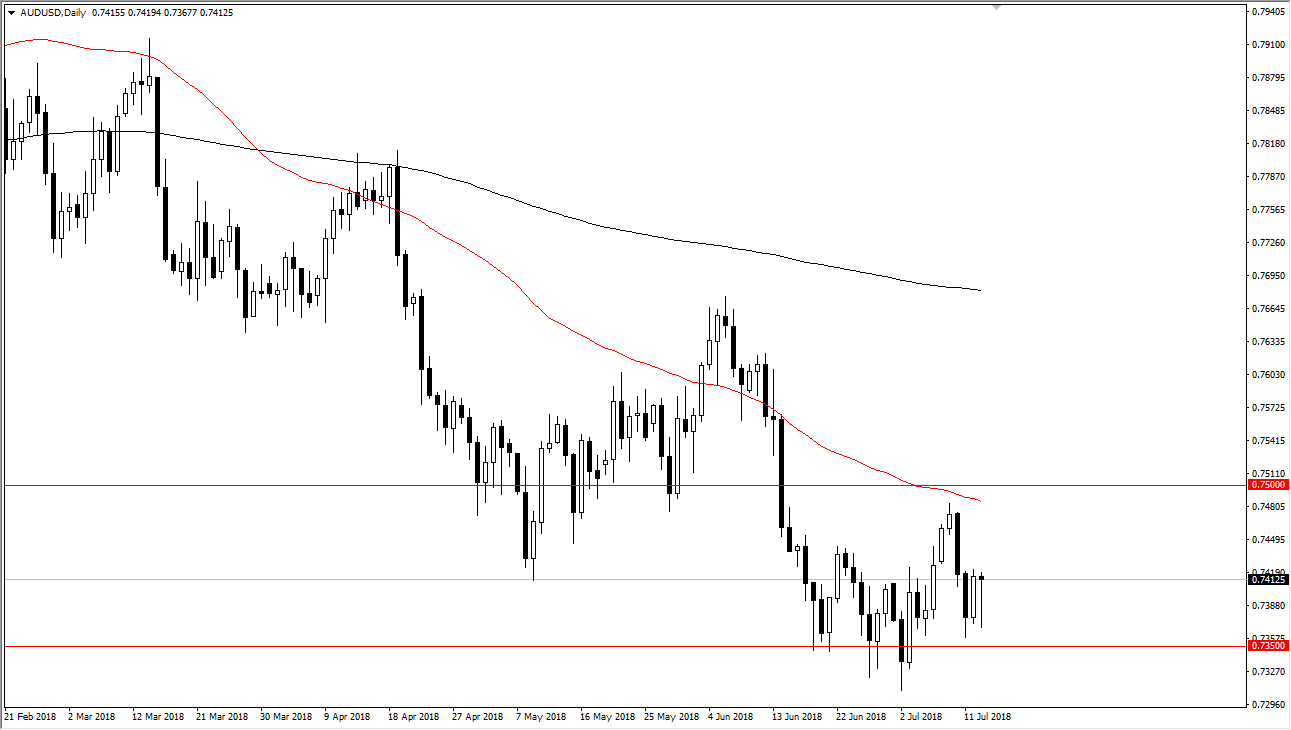

AUD/USD

The Australian dollar initially spent most of the day on Friday falling, but found enough support above the 0.7350 level to turn around of form a nice-looking hammer. The hammer of course is yet another reason to think that perhaps we are going to see a significant fight in this region. Right now, I look at this as a market that’s consolidating between the 0.7350 level on the bottom, and the 0.75 level on the top. If we can turn around and break above the 0.75 level, I think this would kick off a major recovery in the Australian dollar, and I would be buyers at dips at that point. Between now and then, I look at this is a market that’s likely to go back and forth between the areas, and I would be a short-term trader looking for signs of either exhaustion or support depending on which side of the range that you are on.