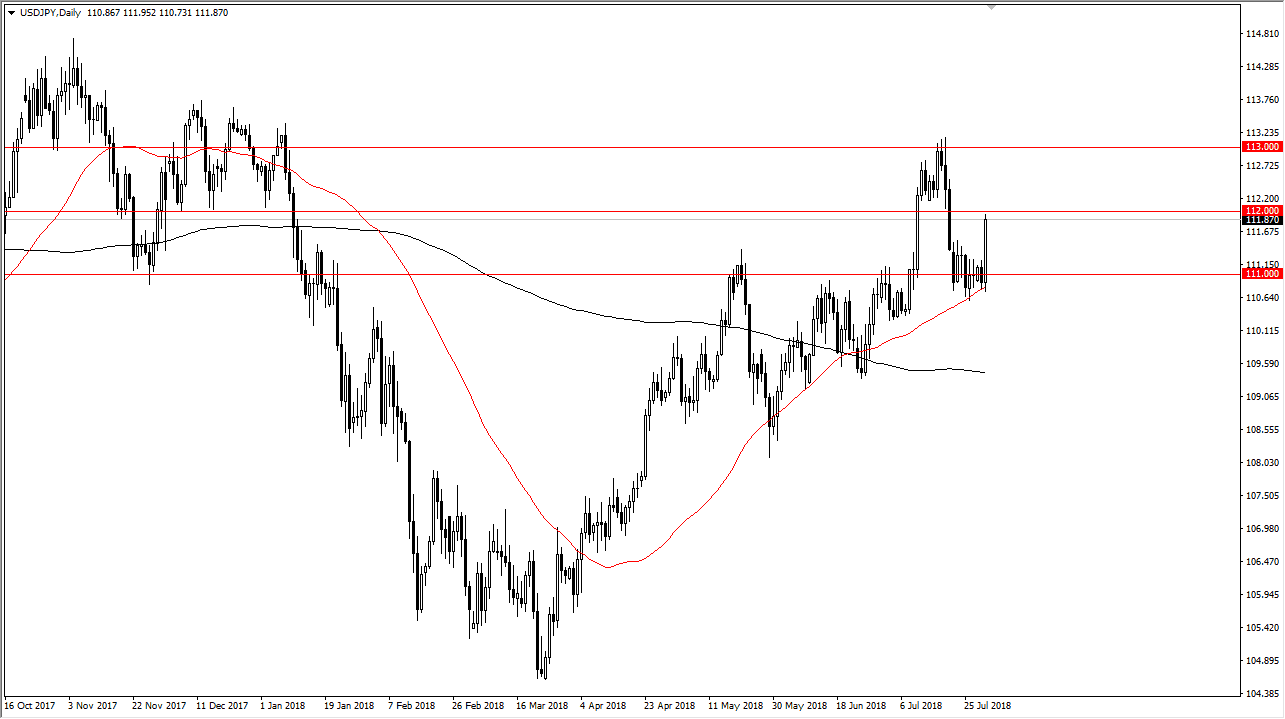

USD/JPY

The US dollar has exploded to the upside against the Japanese yen, as the Japanese yen was one of the weakest currencies that I follow. After the Bank of Japan meeting, the Japanese yen sold off rather drastically, and slammed into the ¥112 level, an area that of course has caused a bit of psychological resistance. If we pull back from here, it’s likely that we would find buyers closer to the ¥111 level, and I think with the Federal Reserve coming and the jobs report on Friday, it’s very likely that we will see a lot of noise. I believe that it’s only a matter time before buyers jump in on value though, as we bounced nicely from what has been a significant demand level. I think the next couple of days will be choppy, but I still have an upward bias overall.

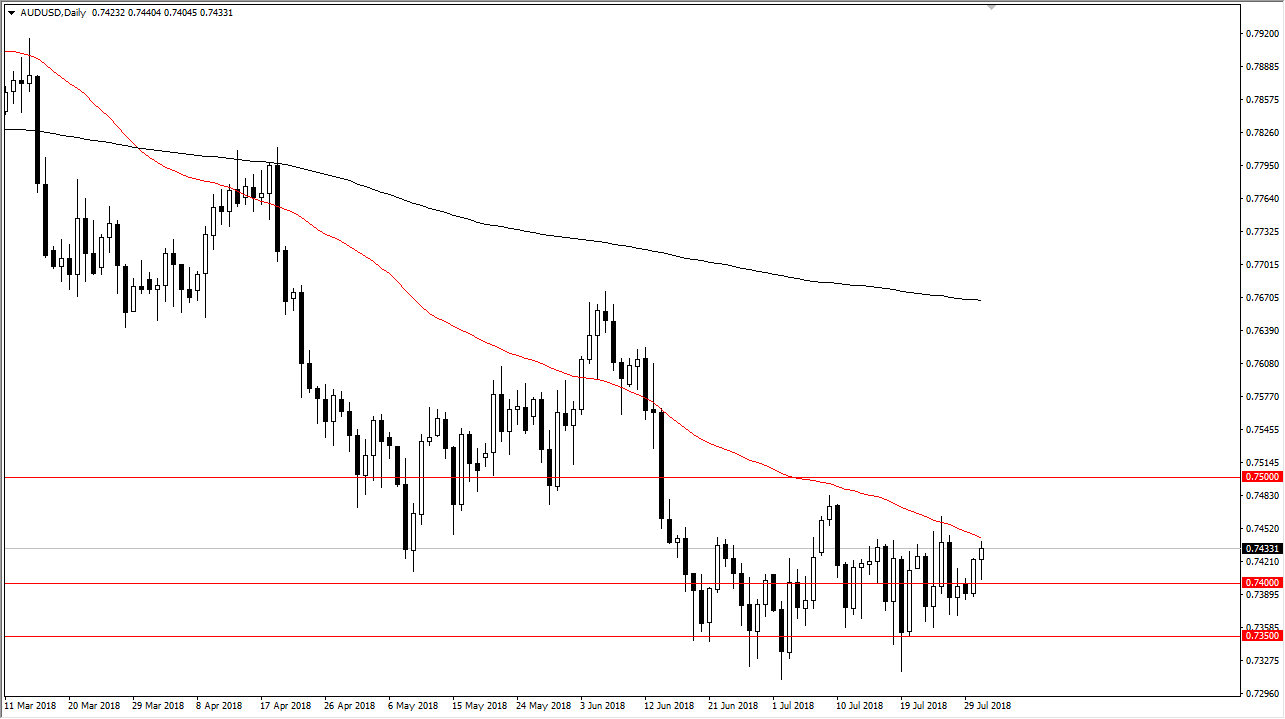

AUD/USD

The Aussie dollar was noisy as well, printing what amounted to a relatively neutral candle. I think that the 0.74 level is the beginning of somewhat significant demand level, that extends down to at least the 0.7350 level, perhaps even the 0.73 level. I think that longer-term, we do have a nice-looking bottom trying to form in the market, but obviously we have a lot of work to do. With the jobs number coming out on Friday, I think we need to get through all of that before we get any significant amount of momentum. It’s probably going to take more of a “buy on the dips” mentality to go forward, and I would do so in small bits and pieces. If we break down below the 0.73 level, then the market will unwind to the 0.70 level longer-term.