Even with all the tweets from President Trump threatening Iran and tariffs on trade, the U.S. stock market was still able today to make a technically significant move up. I’m writing this only a couple of hours after the New York market has opened, but that is usually late enough to judge a move up as having some legs. I think this is a significant development for the U.S. stock market.

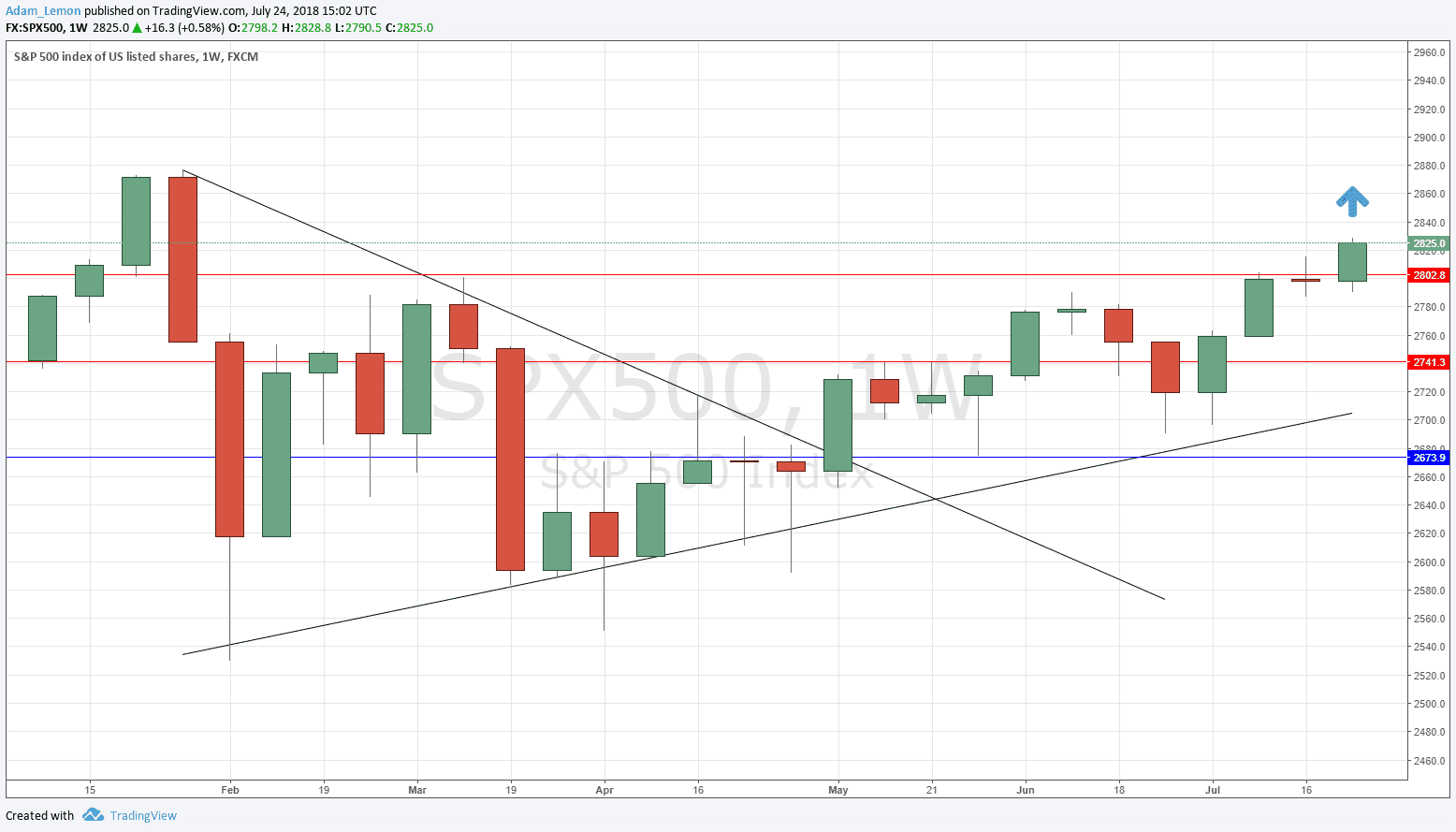

In my “Pairs in Focus” piece last Sunday, I wrote about the S&P 500 Index, saying that “If the price can break strongly above last week’s high, we could see a firm continuation of the bullish movement last week. However, any unwelcome news on trade or tariffs can sink the market in an instant, so it is important to either be very careful, or to take a long-term investment approach.” The price has now broken above last week’s high of 2815.4 by more than 10 points, which is strong enough for me. There is now a further good technical reason to be bullish on stocks, and we are only a relatively small 50 points below the all-time high of 2877 which was recorded right at the end of January. This is the only remaining major technical hurdle for stock bulls now, as can be seen in the weekly price chart below:

Whether you trade the Index or try to pick individual best-performing stocks to try to beat the Index’s momentum is up to you. These are not recommendations but I’m happy to share which S&P 500 stocks I currently own in my momentum portfolio, which I will be rebalancing next week as the month comes to an end:

Aboimed (ABMD)

Adobe (ADBE)

HollyFrontier (HFC)

Adobe is doing the best. I don’t account for fundamental analysis in the construction of this portfolio, so I won’t speculate as to why.