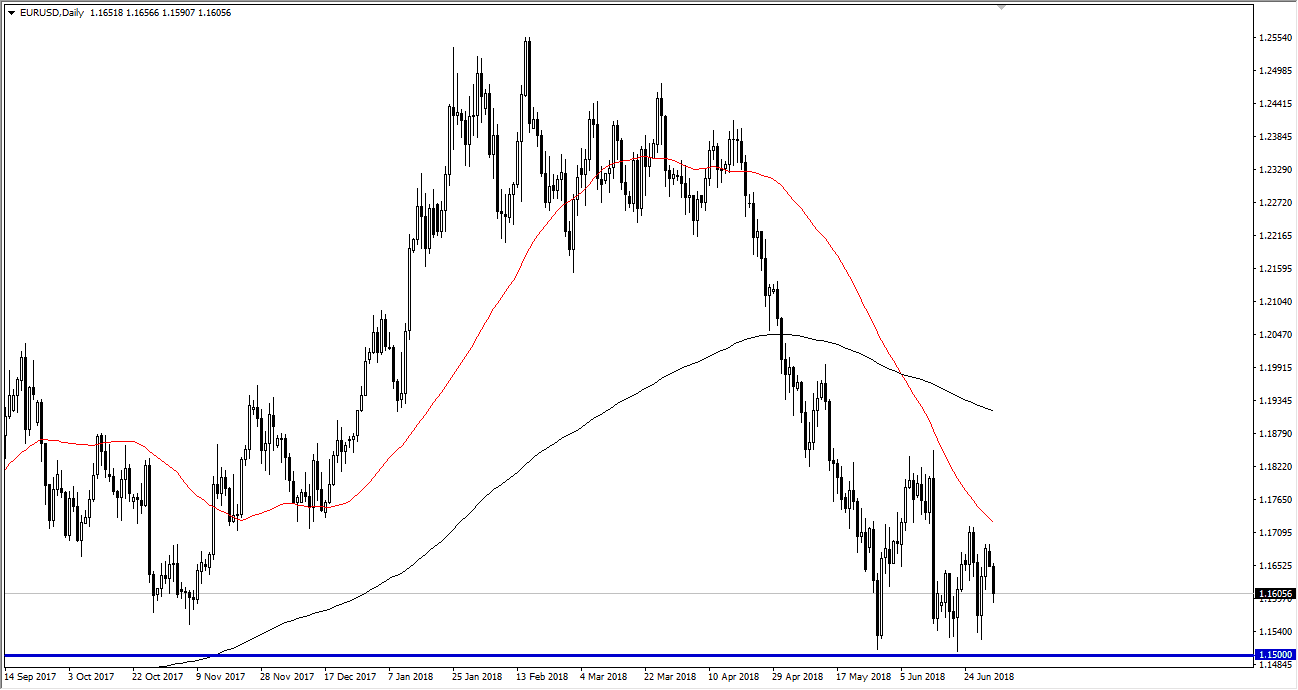

EUR/USD

The Euro fell during the trading session on Monday to start the week, as we have seen a lot of “risk off” trading after it has become obvious that the Americans are in fact going to slap more tariffs on the Chinese this Friday. Obviously, the Chinese will retaliate, and that of course has the markets nervous. That has people buying US treasuries, which drives up the value of the US dollar. Beyond that, Europe is especially sensitive to the potential trade war around the world, and that is showing itself in the common currency. The 1.15 level underneath should be supportive, as it has been massive support lately, and beyond that it has been massive resistance in the past. If we can break below that level, that would be a very negative turn of events for this market. As far as buying is concerned, I would be hesitant to do so unless we got some type of good news from the trade war front.

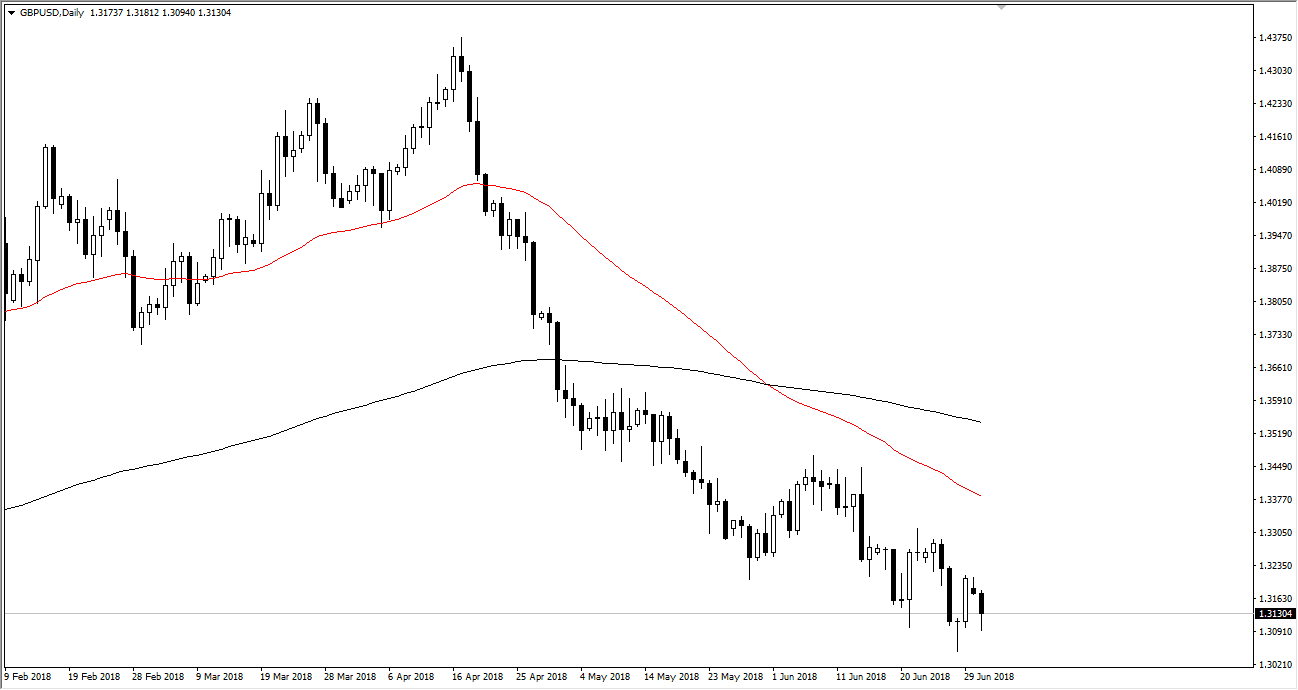

GBP/USD

The British pound has broken down a bit during the day as well, and for many of the same reasons. The hammer from last week continues offer support above the 1.30 level, so at this point I think that although this market is likely to go lower, it’s probably going to be a bit more difficult the short this pair and break it down in the short term. I think rallies are to be sold on short-term charts, and I think that will continue to be the way this market is played: selling short-term signs of exhaustion. It’s not until we break above the 1.35 handle that I would be coachable going long at this point, or perhaps off of a bounce from the psychologically important 1.30 level. However, that’s probably good to be a short-term buying opportunity at best until the overall attitude of the markets change.