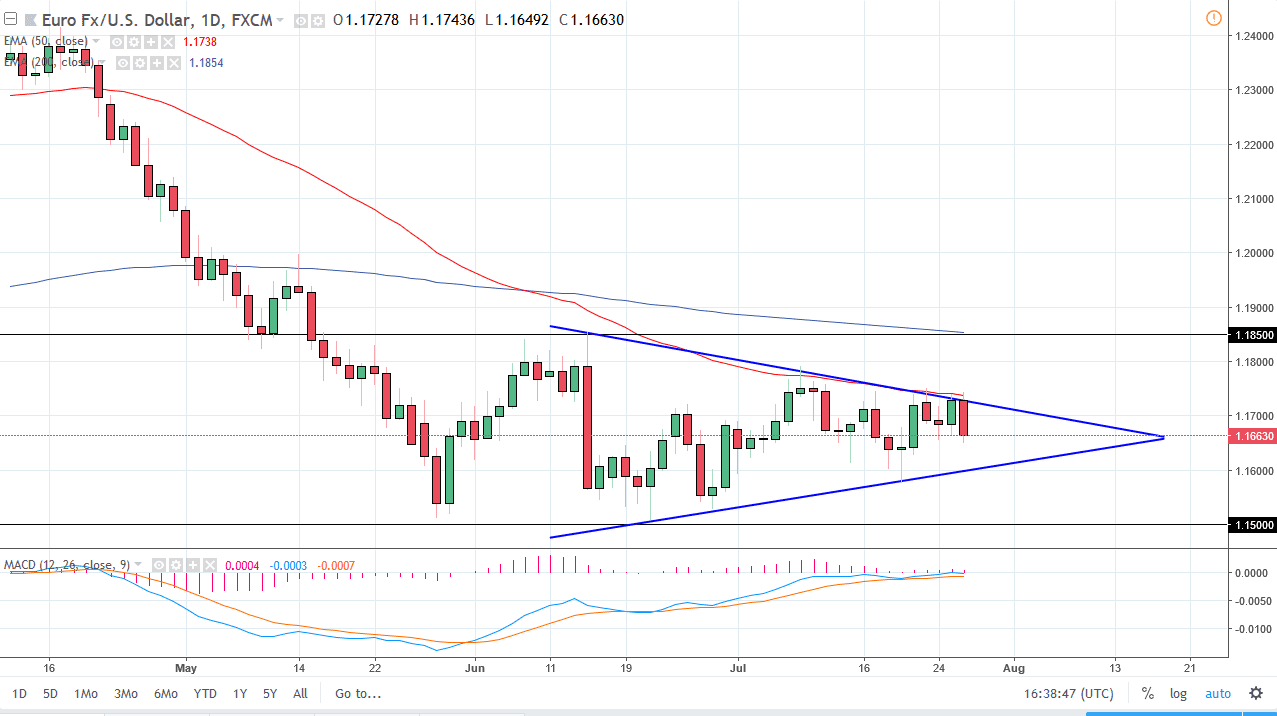

EUR/USD

The Euro fell during the trading session on Thursday as the 50 EMA has offered resistance on the daily chart, and of course the down trending line from the symmetrical triangle that I have drawn. Beyond that, Mario Draghi suggested that we needed to see low interest rates in the European Union for the foreseeable future, and that of course has weighed upon the value of the EUR overall. With that in mind, we are simply consolidating still, and I think that most prudent traders are waiting for this market to break either above or below this triangle to start putting money to work. If we break out to the upside, I suspect that the next target will be the 1.1850 level. On the other hand, if we break down below the uptrend line, will drop to the 1.15 handle at that point.

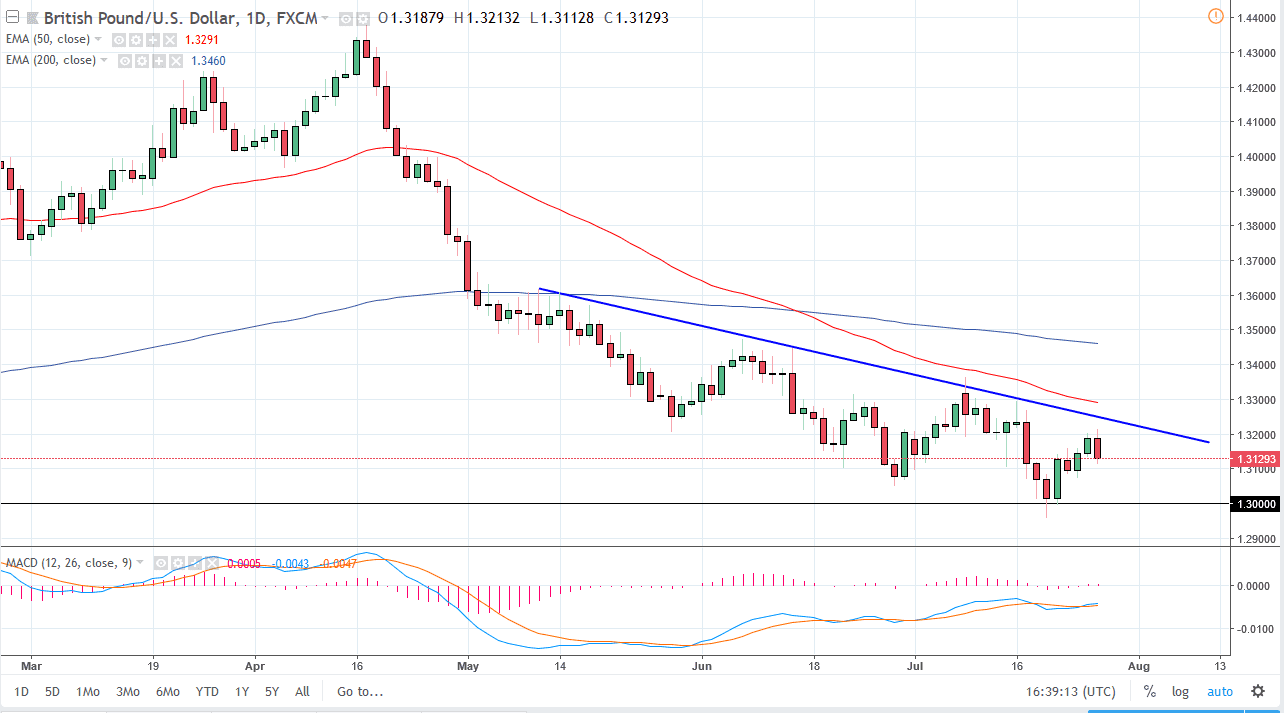

GBP/USD

The British pound initially tried to rally but then rolled over as well as a key part of the Brexit plan was rejected by the EU. However, at the end of the day I believe that the British pound has plenty of support below, especially near the 1.30 level. As you can see on the chart, I have a downtrend line and I think that if we can break above that downtrend line it’s very likely that the fix will be end, we will continue to go much higher and rally towards the 1.36 level, and perhaps beyond that given enough time. I believe that we are in the middle of trying to change the overall trend of this market, as there are so many bears out there. However, it’s going take a bit of a basing and obviously a bit of time to make that happen. Longer-term though, I fully anticipate seeing the British pound rally towards higher levels.