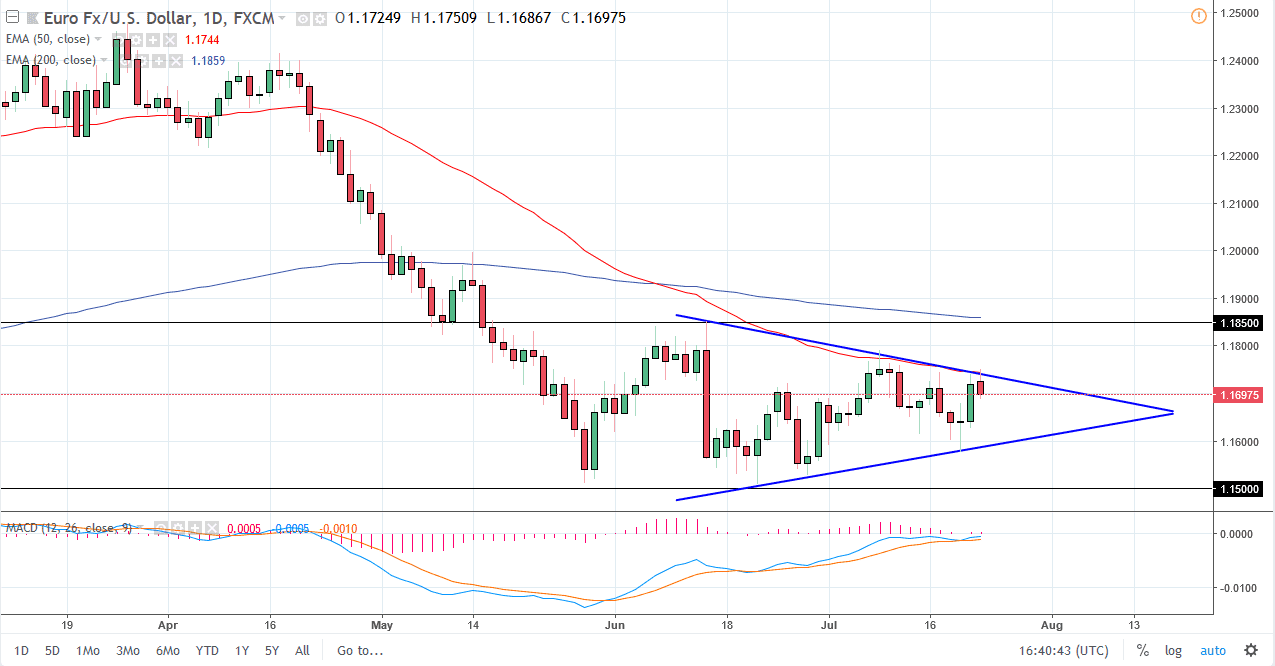

EUR/USD

The EUR/USD pair initially tried to rally during the trading session on Monday to start the week but has ran into trouble at the 50 day EMA, and of course the downtrend line that I have drawn on the chart. It looks as if we are consolidating in a symmetrical triangle, and I believe that this triangle is going to continue to be an issue in this market, and it makes quite a bit of sense as well, because there are so many issues out there that can move the US dollar. The political situation in the European Union of course is a major issue. I believe that the best thing to do in this market is to wait for a daily close outside of the symmetrical triangle, and then aim for one of the two black lines I have of the chart, be at the 1.15 level on the downside, or the 1.1850 level on the upside.

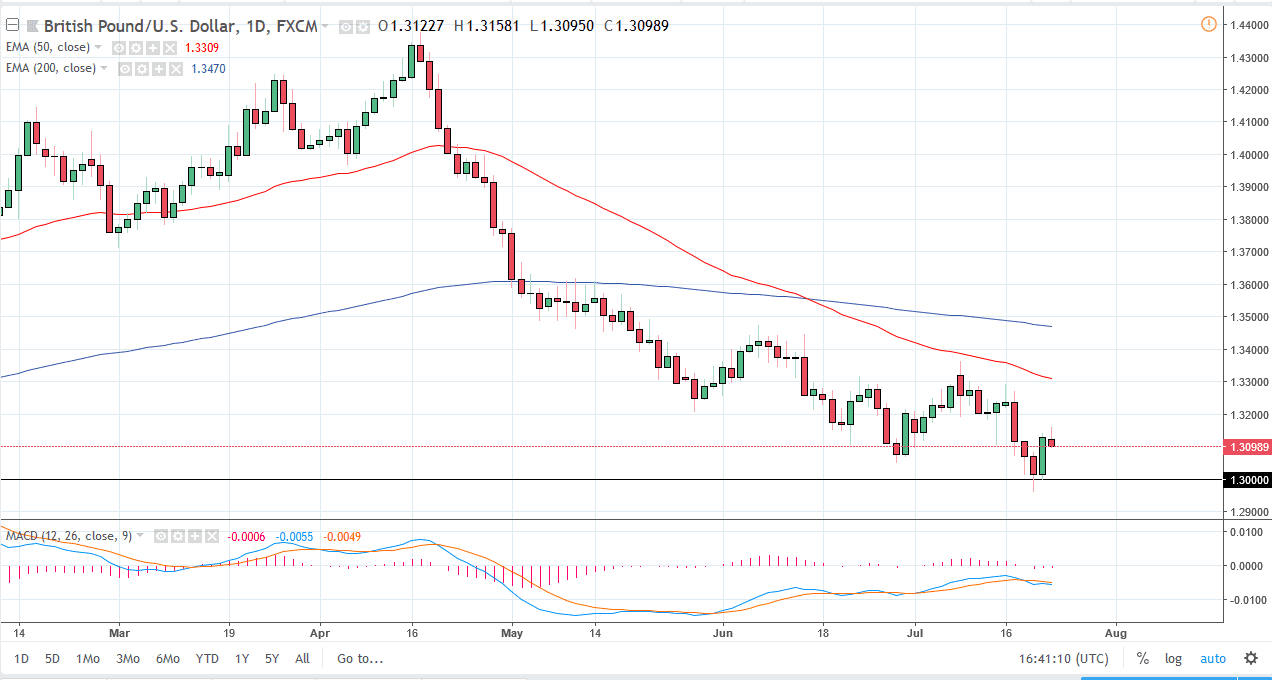

GBP/USD

The British pound initially tried to rally during the trading session on Monday but turned around of form a bit of a shooting star. The 1.31 level has been resistive, and by forming this shooting star it's looking very much like we are ready to roll over again. If that's the case, I think the 1.30 level will be the next target, and I suspect that it will have to be tested yet again. It is a significant support level though, so keep that in mind. I think we will get a short-term pullback, but beyond that I would not look for a major move in the short term. Alternately, if we break above the top of the shooting star, then I think the market could go as high as 1.33 over the next several days.