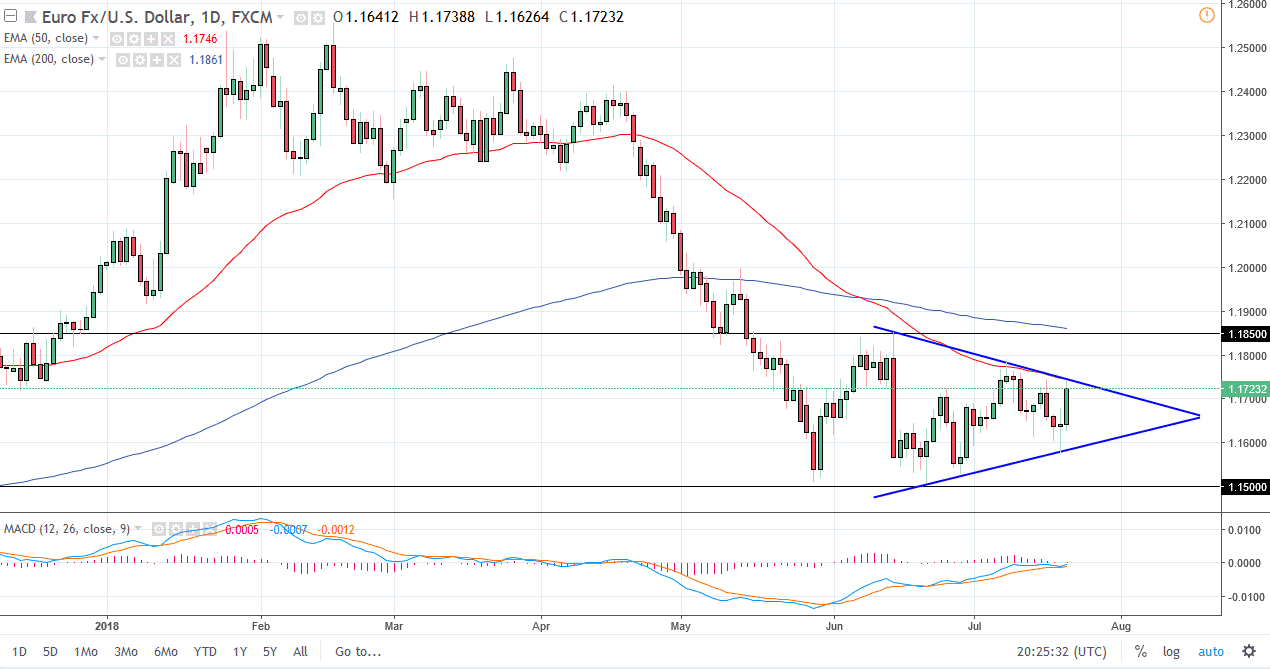

EUR/USD

The EUR/USD pair initially dipped a bit during the day on Friday but turned around to explode to the upside. I have drawn a couple of trendlines now to sketch out a symmetrical triangle that I think is starting to come into play. If we can break higher, sensibly making a fresh, new high, then the market probably then goes to the 1.1850 level, perhaps even the 1.20 level which is even more resistive. However, until we exit this symmetrical triangle, I’m not willing to trade this market as it think it is simply far too noisy, especially with the political theater going on in the European Union and of course the random tweet from the president of the United States dealing with trade and interest rates.

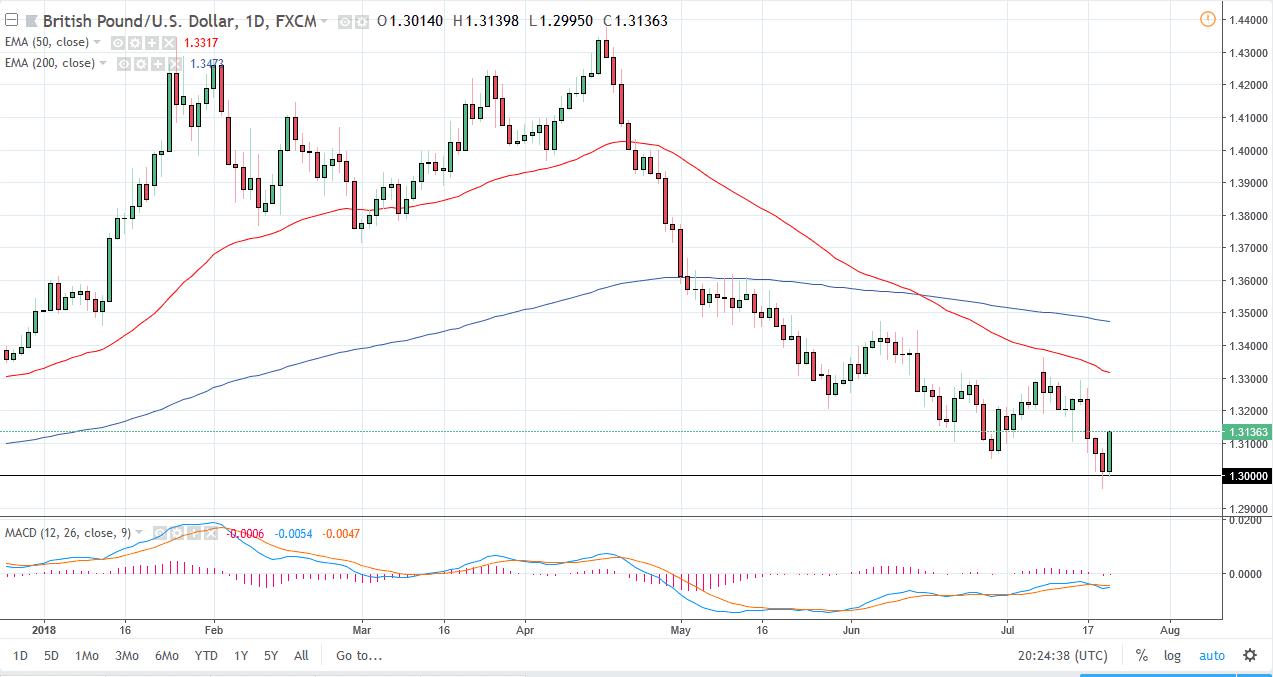

GBP/USD

The British pound exploded to the upside during the day on Friday, using the 1.30 level as massive support. Because of this, the market gained almost 1% for the day, clearing the 1.31 handle. I think that short-term pullbacks could come, and once they do they could be nice buying opportunities. The 1.30 level has proven itself to be rather supportive, and I think should continue to offer a bit of a “floor” in the market. I think that floor extends down to the 1.29 level, and that we are in the midst of forming some type a basing pattern to turn things around and start going higher again. This isn’t to say that it’s going to be easy to rally in this market, but I think that we will eventually find reasons to go higher. This will be especially true if we can get some type of political resolution between the Conservatives and Teresa May.