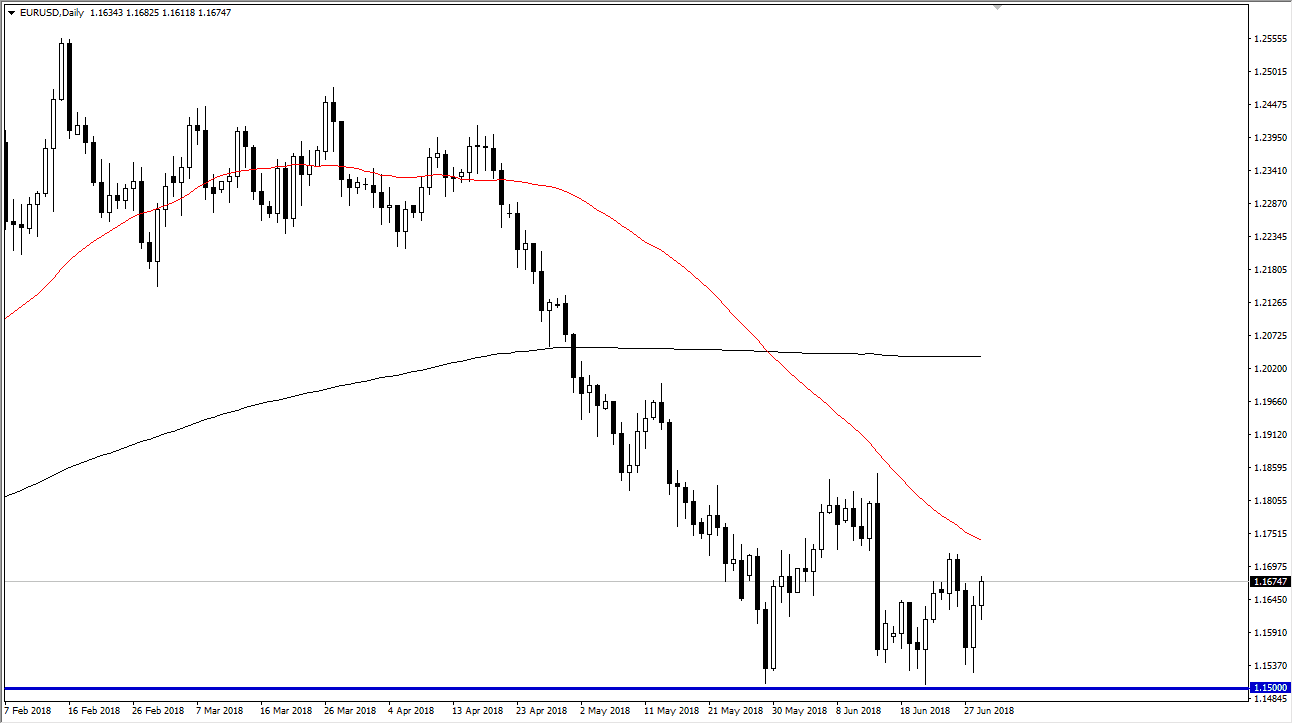

EUR/USD

The Euro pulled back slightly during the trading session on Friday but found enough buyers underneath the turn around and push to the upside. It looks as if the 1.15 level continues to offer significant support, and I believe that the 1.15 level is essentially the “floor” in the market. I believe that the 1.1850 level above is significant resistance, based upon the horrific candle from a couple of weeks ago. This is a very back-and-forth type of market, and I believe that we will continue to trade in consolidation more than anything else. However, if we were to break above the 1.1850 level, I think that the market probably makes a move towards 1.25 above there, although it would take a significant amount of time to happen. There are a lot of questions when it comes to the European Union still, and of course trade war fears can come into play as well.

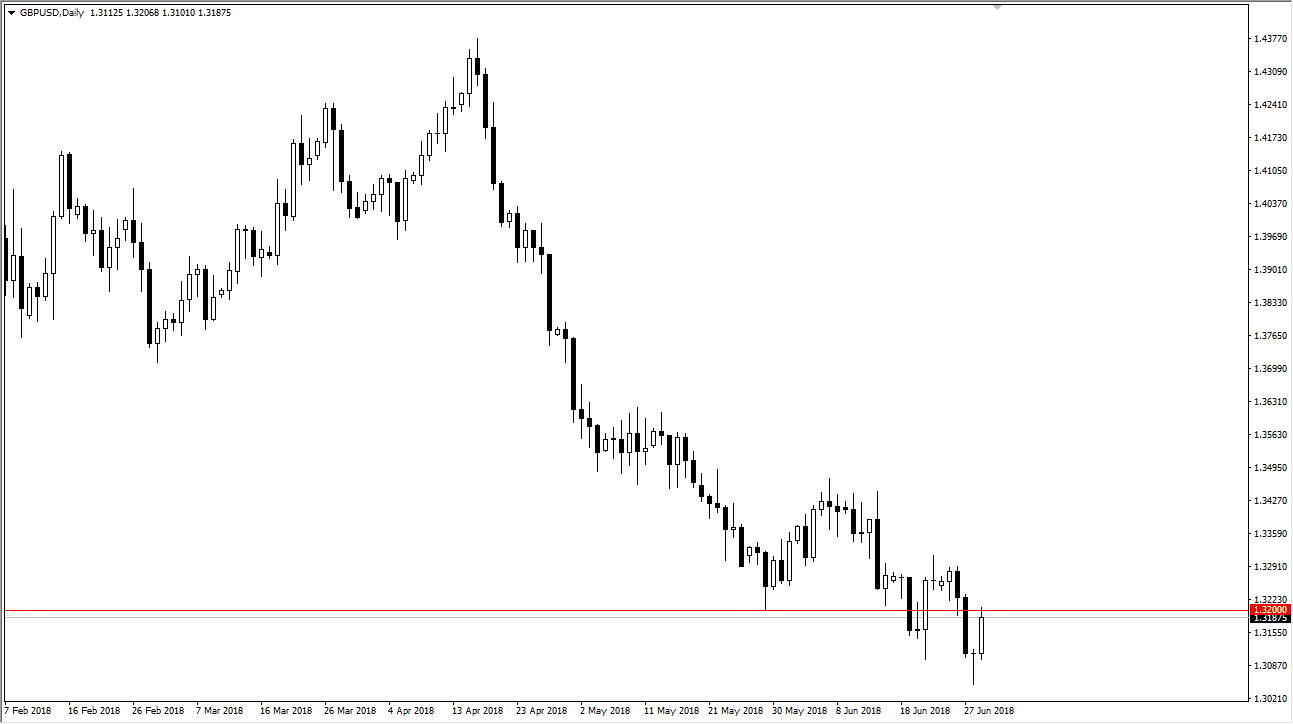

GBP/USD

The British pound broke higher during the day on Friday, testing the 1.32 level, after forming a perfect camera on Thursday. This is a very good sign, but I think we need to break above the 1.33 level to take this move seriously, because that would confirm the hammers that have formed over the last couple of weeks on the weekly chart. I think at this point, it’s likely that we will continue to see a lot of volatility, but at the first signs of exhaustion I imagine that the British pound will fall. If we do break out to the upside, the 1.35 level would be the next target, as it has caused a lot of noise more than once. This is a market that continues to react to risk appetite.