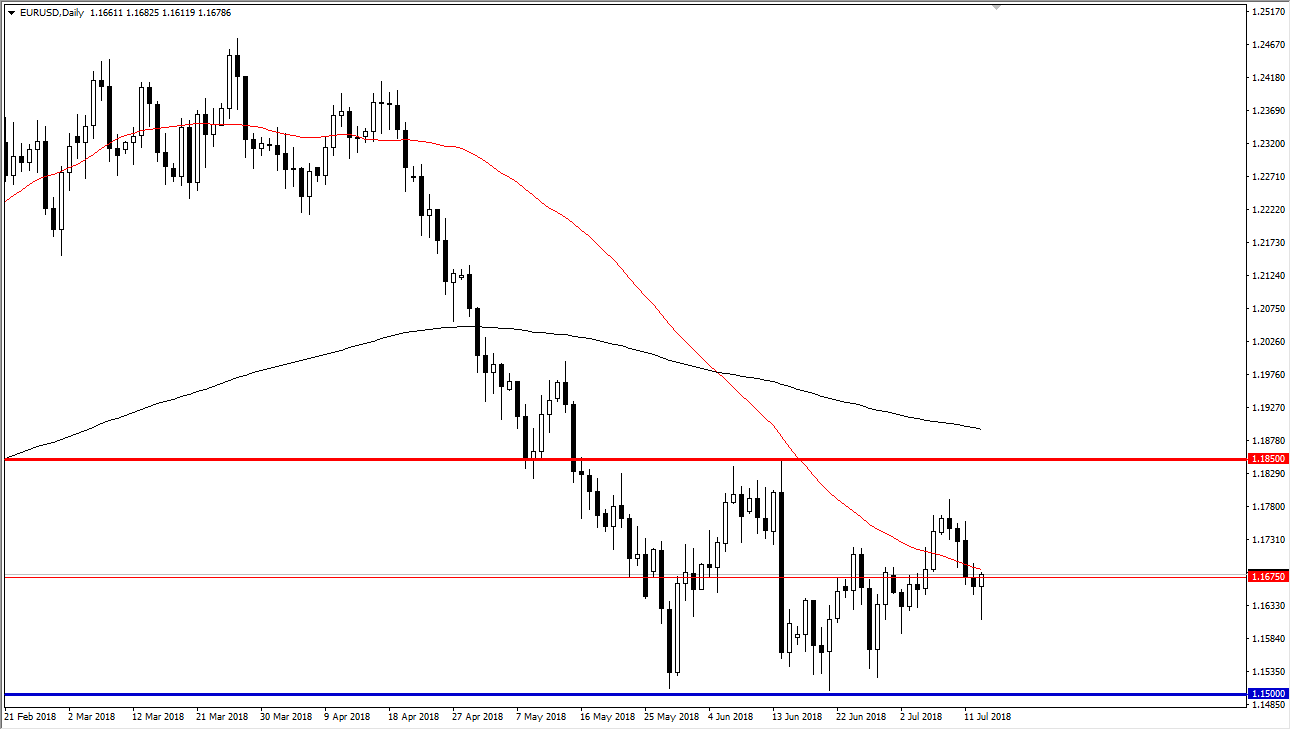

EUR/USD

The Euro fell initially during the trading session on Friday, reaching down to the 1.16 level before turning around and bouncing significantly. As I record this, we are forming a nice-looking hammer, and that of course is a good sign. We are essentially in the middle of the overall consolidation, which I have marked on the chart as the 1.15 level on the bottom, and the 1.1850 level on the top. I think that given enough time, we will decide to try to reach the highs again, based upon the hammer that we just formed. On a break above the 50 day EMA, I’m more than willing to start buying this market. Otherwise, if we were to break down below the hammer for the Friday session, I think we will probably go looking for the 1.15 region underneath.

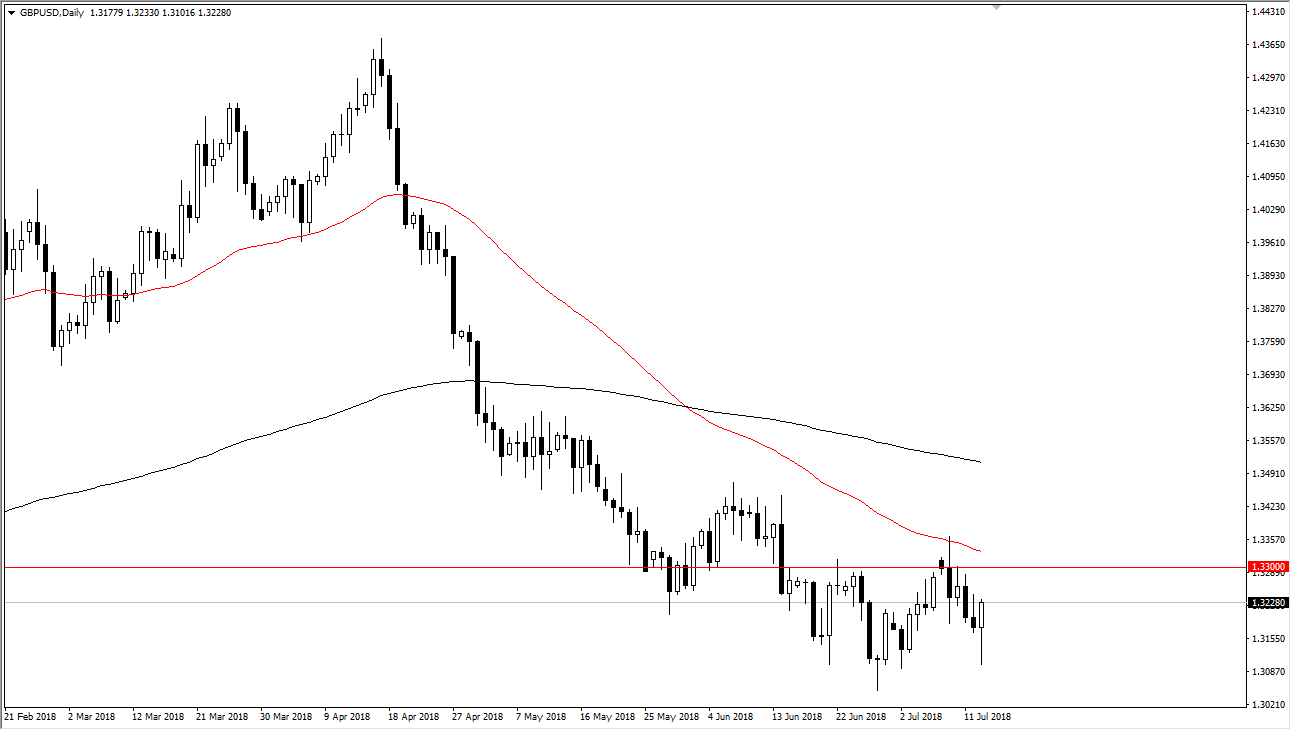

GBP/USD

The British pound initially fell during trading on Friday but found enough support near the 1.31 level to turn around of form a hammer. The hammer is a positive sign obviously, and it does suggest that we may be trying to make a “higher low.” If that’s the case, we will probably go looking towards the 1.33 level above which has been resistance more than once. Beyond that, we have the 50 EMA on the daily chart, so I think at this point any rally will probably be somewhat short-lived. With the way that the Euro has recovered and the British pound looks to be facing a lot of noise above, it’s possible that the best trade in this scenario is going to be buying EUR/GBP over the next several weeks. Although I believe that the British pound could rally, I think it’s going to struggle in relation to the Euro.