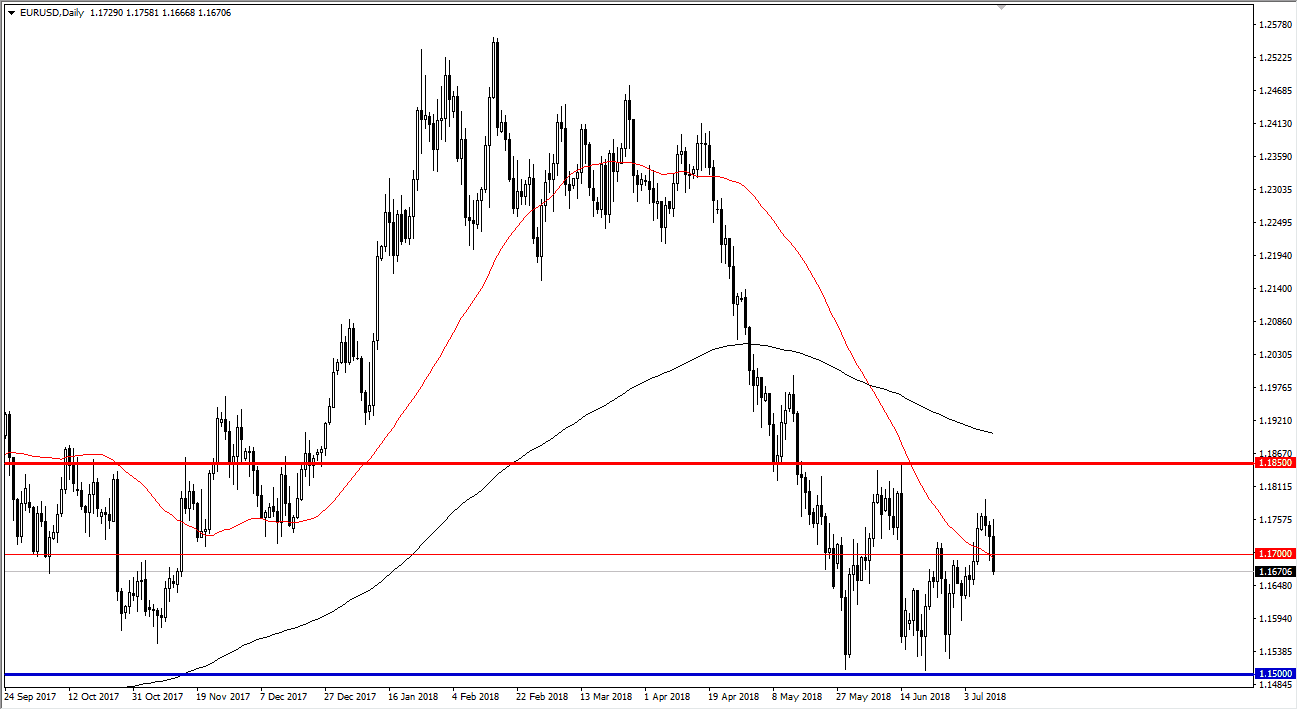

EUR/USD

The EUR/USD pair initially tried to rally during trading on Wednesday but turned around at the 1.1750 level to break down rather significantly. In fact, we broke down through the bottom of a hammer that of course is a very negative sign. That being the case, the market looks as if it could drift a little bit lower, but I see a lot of support underneath as well. We are essentially bouncing around in a longer-term consolidation area between the 1.15 level on the bottom and the 1.1850 level on the top. With this being the case, I think that the market continues to be very erratic, and the market should be looked at as one that is to be traded back and forth more than anything else.

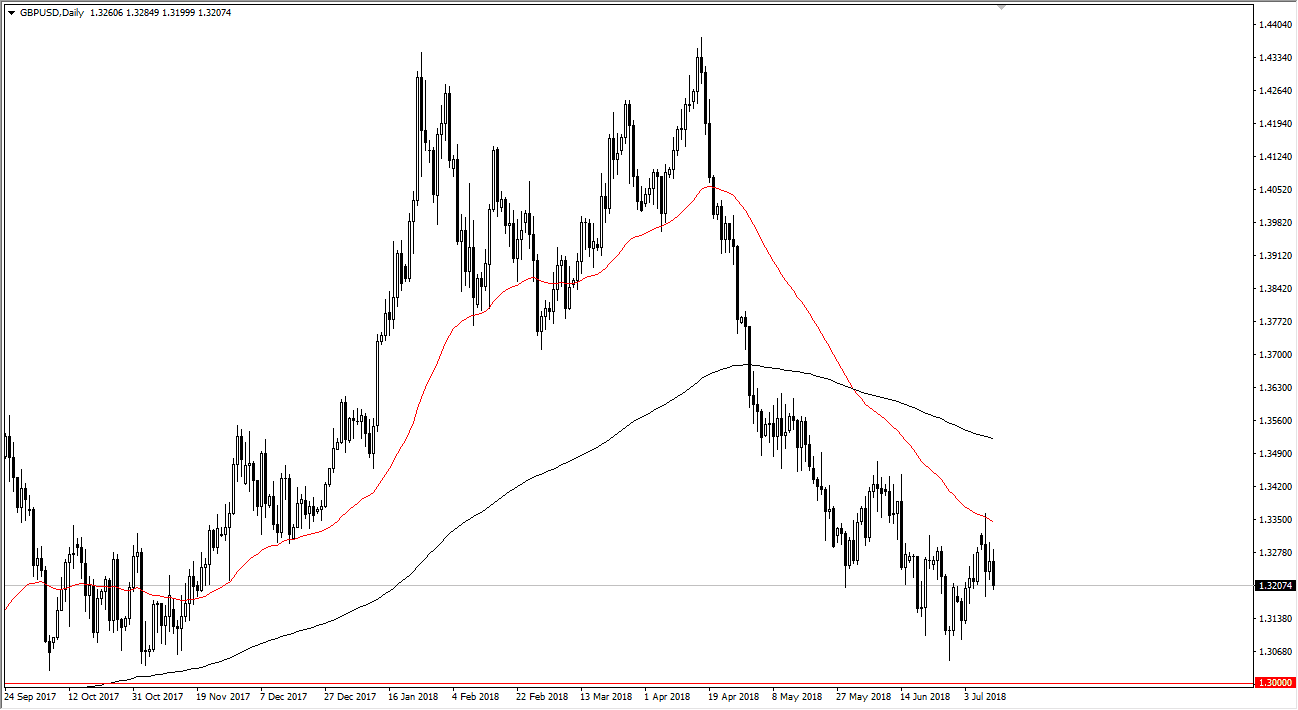

GBP/USD

The British pound broke down towards the 1.32 level, an area that has been supportive in the past. I think that the market is essentially trying to figure out what to do next, as we have seen the real threat of a “no confidence vote” against Teresa May down the road. That of course will throw the negotiations with the EU into disarray, and people will typically sell the British pound quicker than anything else, as it gives too much uncertainty. I believe that the 1.30 level underneath is massive support, and I think at that point it’s likely that it is almost impossible to think that the market can recover anytime soon. Ultimately, if we can turn around and break above the 1.33 handle, then I think the market could go much higher. I believe that this market is driven by headlines more than anything else, so keep very tight stops.