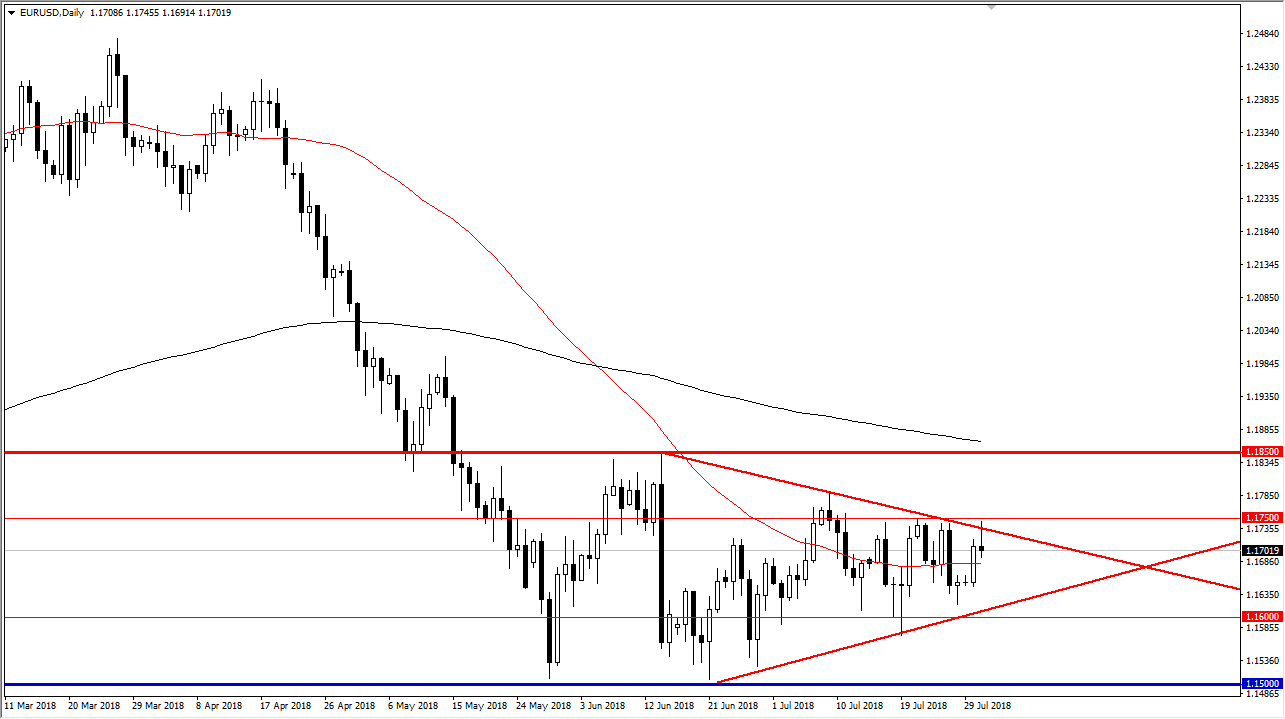

EUR/USD

The EUR/USD pair initially tried to break out during the trading session on Tuesday, reaching towards the 1.1750 level. We have turned around of form a massive shooting star though, and of course signify that the downtrend line is very much intact. By doing so, I think we stay within the overall symmetrical triangle, and I believe that makes sense because quite frankly there are too many news worthy events over the next several days for traders to take on a lot of risk. Because of this, I think we continue to bounce around in the symmetrical triangle and I will continue to trade this market from the short term because of this situation. If we were to break above the 1.1750 level, then the market should go to the 1.1850 level. If we break down below the 1.16 level, then will go looking towards 1.15 handle after that.

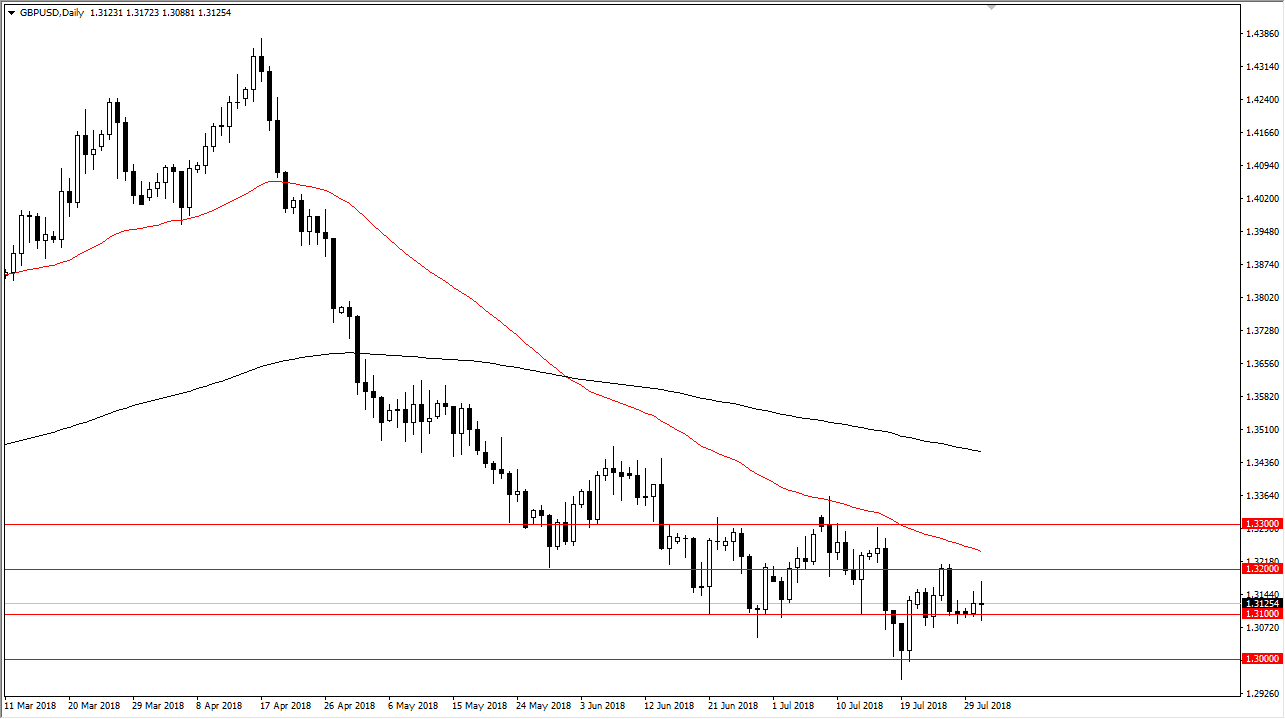

GBP/USD

The British pound has gone back and forth during the day in a very violent session, and it looks likely that we are going to continue to see a lot of noise in this market. We are in an overall downtrend, but we have the Bank of England meeting on Thursday, which of course will dictate where we go next due to interest rate outlook. The 1.30 level underneath is essentially a bit of a “floor” from what I see, and I think it’s only a matter of time before buyers would jump in at that area, unless of course the Bank of England seems extraordinarily dovish. If that’s the case, then we could see a breakdown but at this point I think the next couple of days are going to be very crucial, and therefore you may wish to sit on the sidelines until we get an impulsive candle, and then simply follow it.