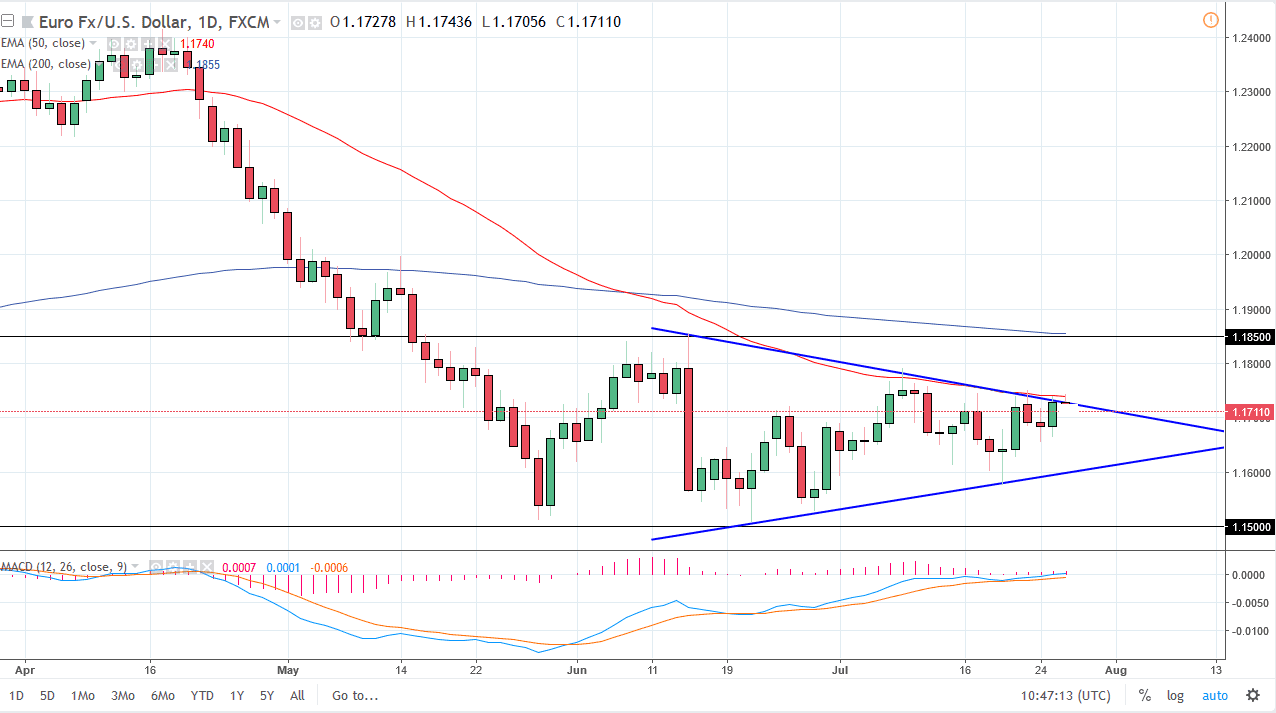

EUR/USD

The Euro continues to be very choppy and range bound, as the market looks too tight to move. I think that the market will eventually make a decision, and as you can see on the chart I have a symmetrical triangle showing both support and resistance. The day ended up relatively unchanged, and that of course shows just how little faith there is an either currency right now. Overall, I think that if we can break out to the upside, it’s likely that we go to the 1.2500 level. Otherwise, if we break down below the uptrend line, then we go looking towards 1.15 handle. I suggest though that perhaps we are trying to form a bit of a basing pattern, and therefore a bit more comfortable for a move to the upside.

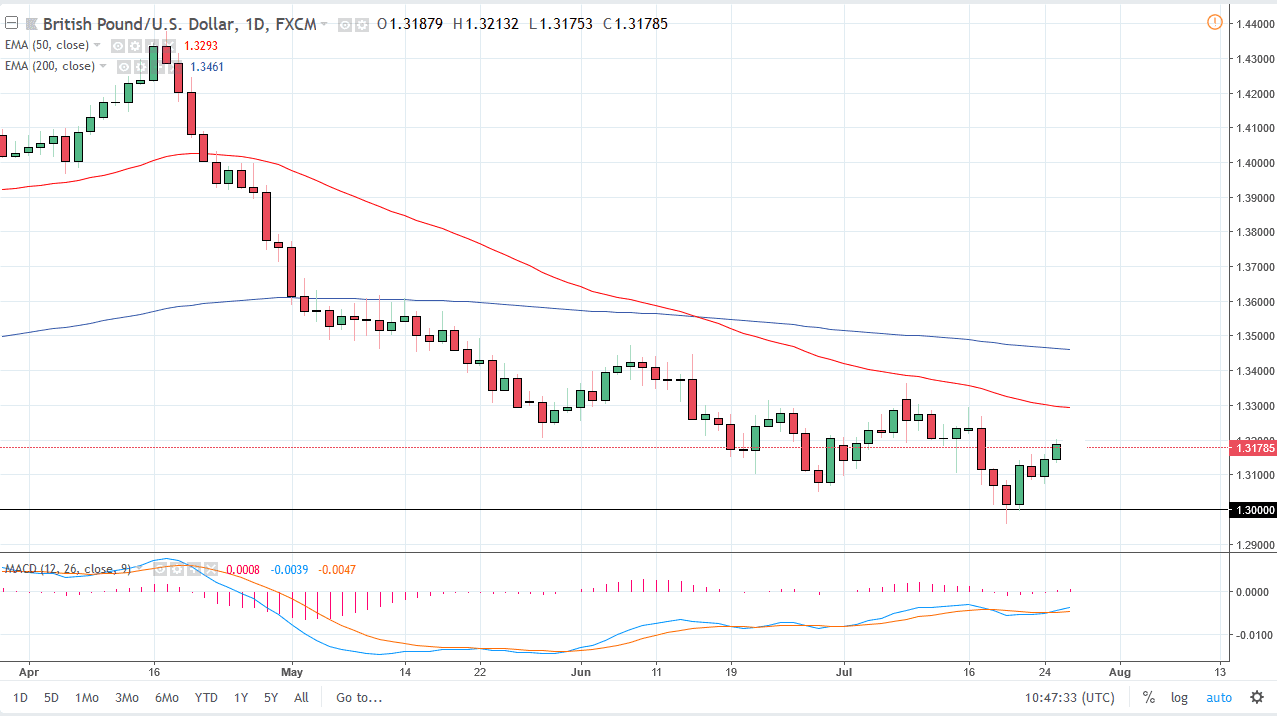

GBP/USD

The British pound rallied a bit during the trading session on Wednesday, reaching towards the 1.3175 level as I record this. The market does look healthy though, as if we are trying to retake the 1.3250 level above, an area that had a lot of supply. Ultimately, I think that the market probably continues to find reasons to be very noisy, not the least of which will be political theater coming out of the United Kingdom, but in the end I think it looks as if the 1.30 level could offer a bit of a “floor” for the overall trend. If we are going to turn things around, that’s never a clean affair, so it would not be surprised at all if we had to pull back to find value hunters underneath. I look at the 1.33 level above as significant resistance, and the clearance of that level would be very bullish.