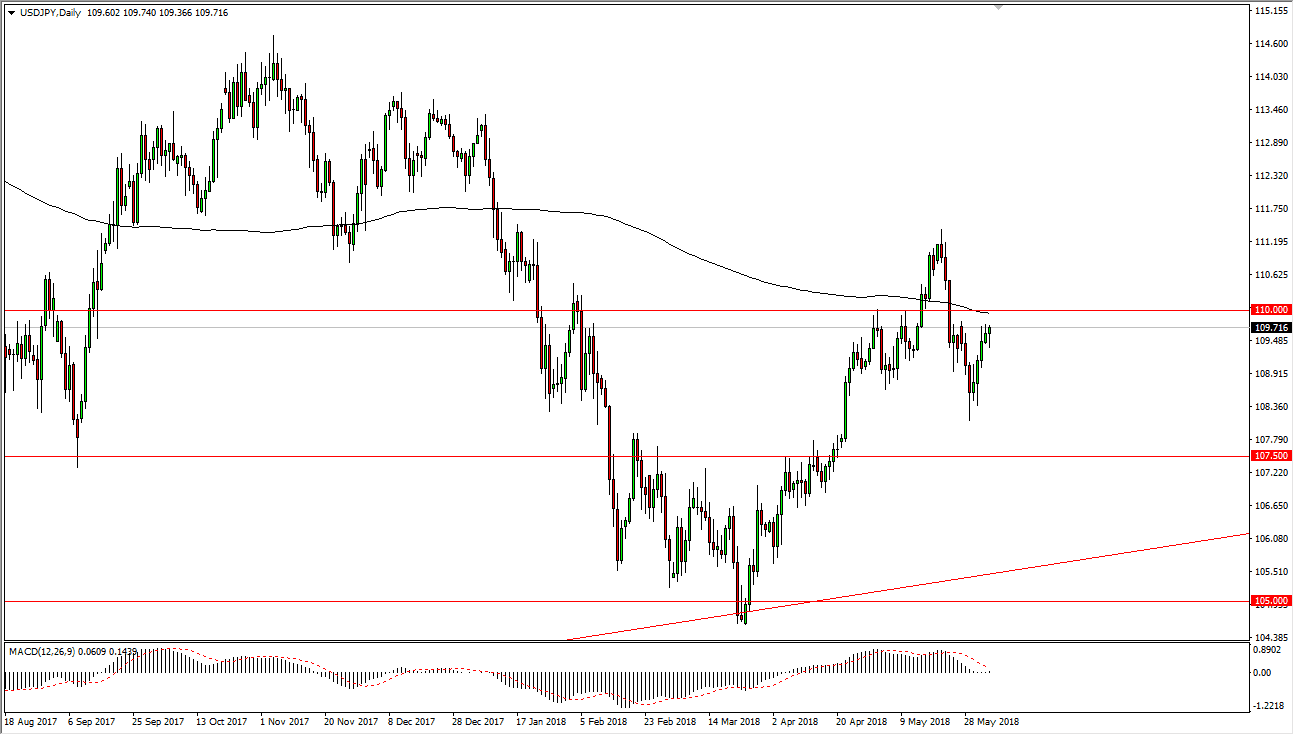

USD/JPY

The US dollar initially fell during the trading session on Monday but found enough support below to turn around and form a hammer. This tells me that the momentum is still building up to make a break above the ¥110 level again, and perhaps breakout again. The 200 day moving average is just above that level, and that should offer a bit of resistance as well. That will attract a lot of attention, so obviously we have major decisions to make. Nonetheless, I think it’s only a matter of time before we break out to the upside and reach towards the ¥111 level, perhaps the ¥112.50 level above. I think every time we pull back, it’s likely that we will find buyers underneath. I think that the ¥107.50 level underneath should continue to be supportive, and I would be surprised to see this market break down below there. However, this market is sensitive to risk appetite and of course talks of trade wars.

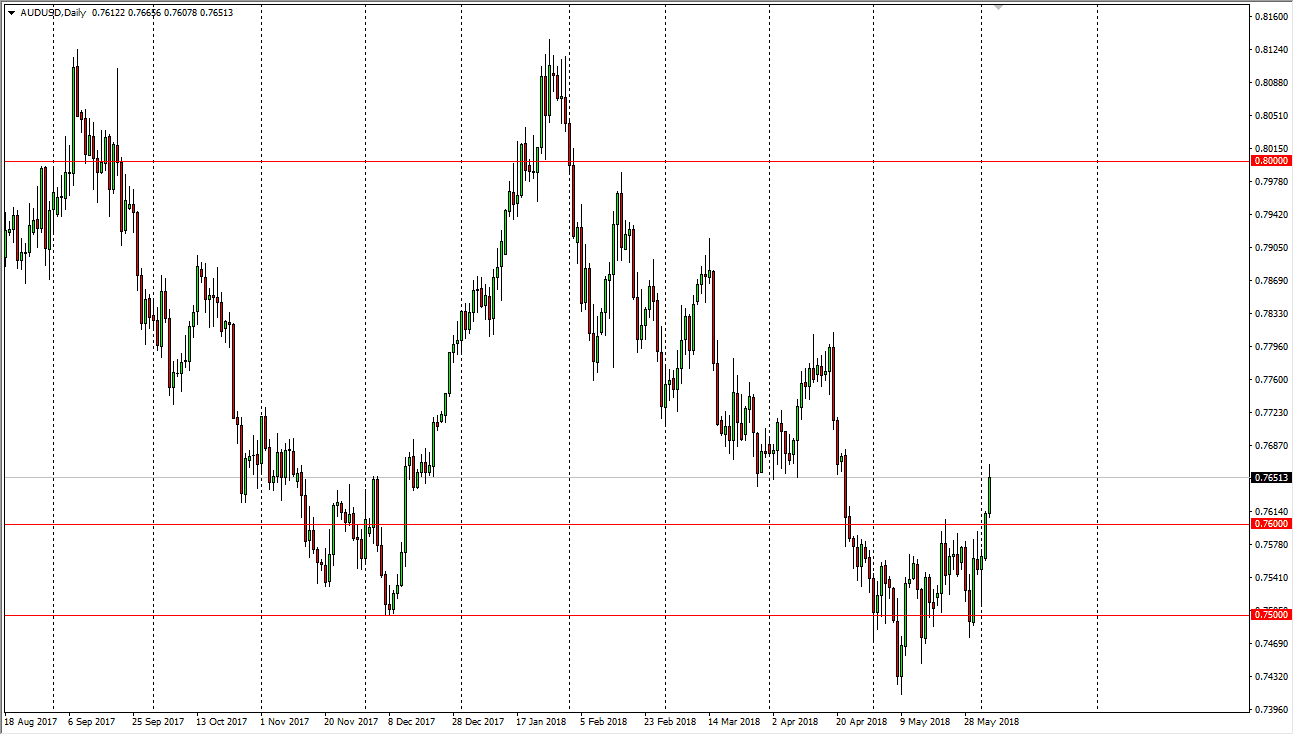

AUD/USD

The Australian dollar broke hard to the upside on Monday, reaching towards the 0.7650 level. This was an area that was previous support, and now offers a bit of resistance. I think that we will probably pull back a little bit to try to build up the necessary momentum to break out above there, but the most important thing that I am paying attention to is the weekly chart. The weekly chart has formed multiple hammers based around the 0.75 level, and that tells me that a bounce is a long-overdue. I look at pullbacks as opportunities to take advantage of value in the Aussie dollar, and don’t have any interest in shorting this market currently. Not to say that can change, but in the short term it certainly looks as if we should continue to gain.