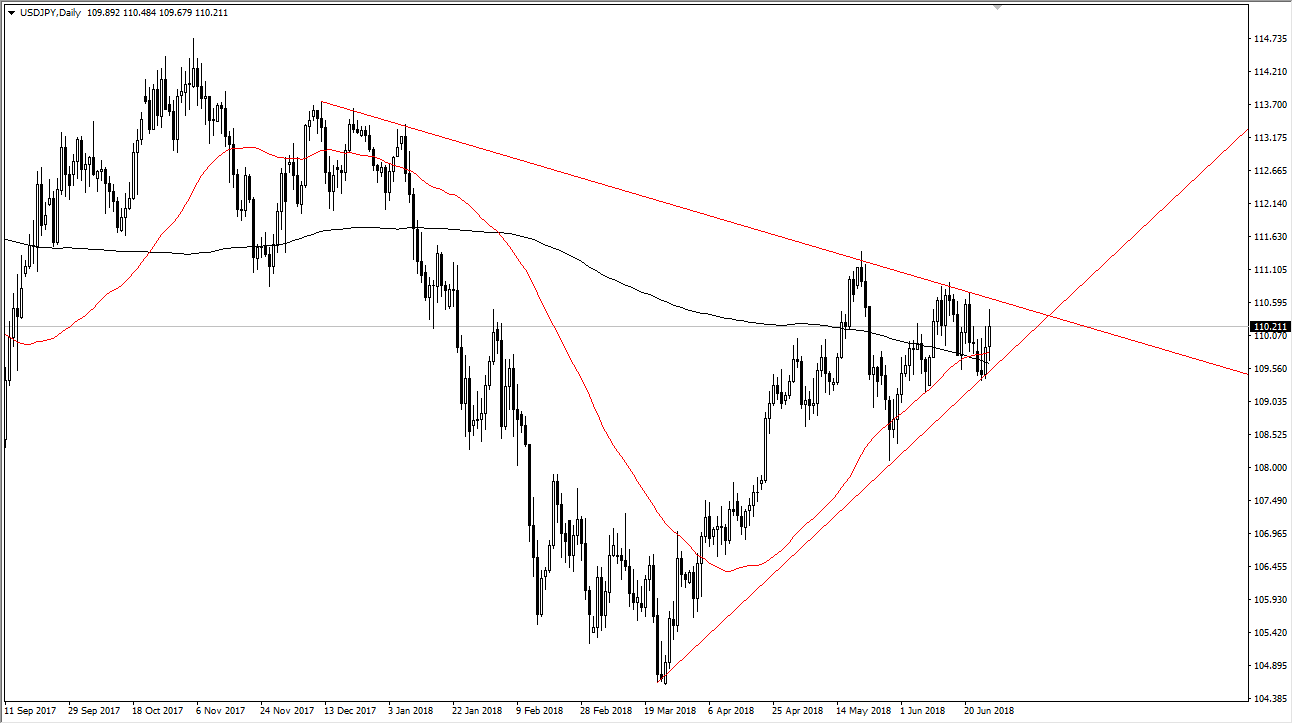

USD/JPY

The US dollar initially pulled back against the Japanese yen, and then shot higher. However, you can see on the chart that we continue to find ourselves stuck in essentially a couple of major trendlines. If we can break out and above those trendlines, then obviously that’s a very bullish sign, essentially making a move above the ¥111 level very bullish. Otherwise, if we turn around and break down below the ¥109 level, then we break down through the uptrend line and that of course would be a very negative sign. I anticipate a lot of sideways and noisy trading in the meantime, as we have just formed a “golden cross”, but we still have plenty of resistance we need to chew through. The US dollar continues to strengthen, but not necessarily against the Yen.

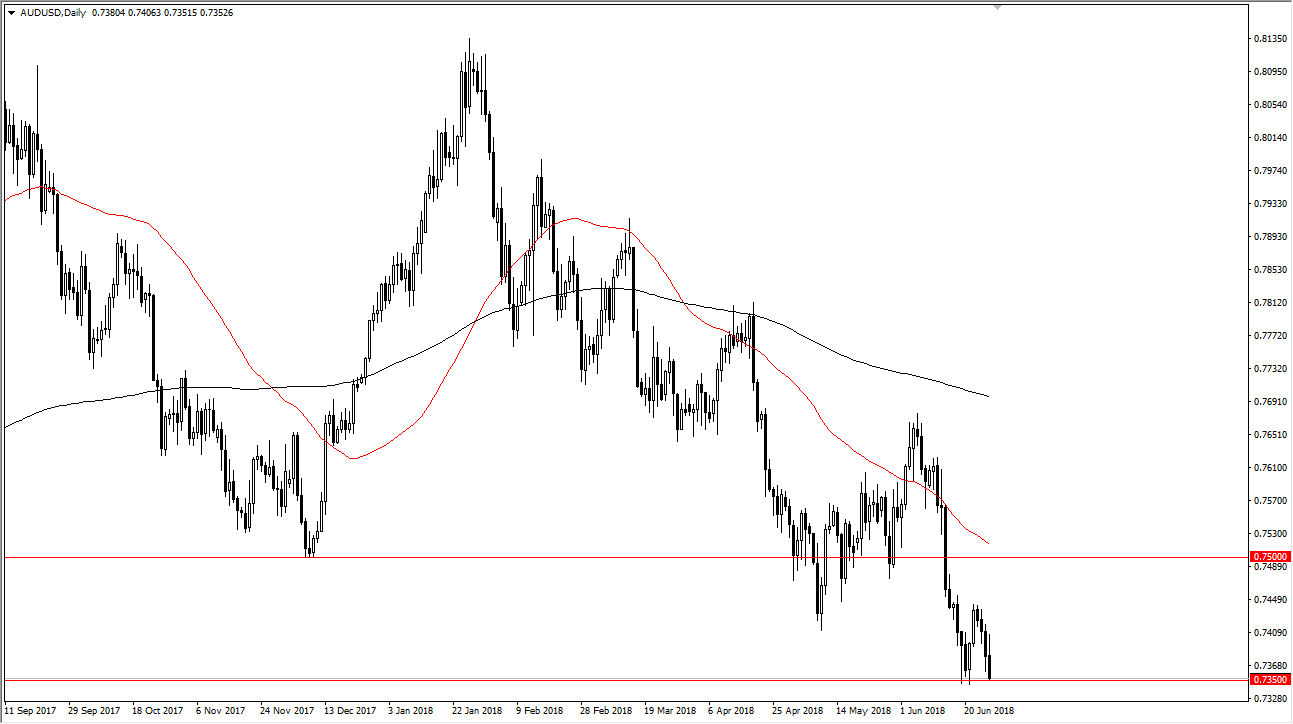

AUD/USD

The Australian dollar rallied a bit during the trading session on Wednesday but turned around at the 0.74 level to fall significantly towards the 0.7350 level again. This is an area that has been massive support more than once, so I think at this point it’s likely that the market goes even lower, down to the 0.73 handle, possibly even as low as the 0.70 level after that. I believe that the market is very likely to continue to break down, and that will be especially true if we continue to find a lot of risk aversion out there, which with the massive amount of headlines crossing the wires at any given moment, it certainly seems as if we will continue to have a lot of negativity, and therefore it makes sense that the US dollar may strengthen. Certainly, the Australian dollar will suffer as trade war fears continue, and Australia is so highly levered to Asian growth.