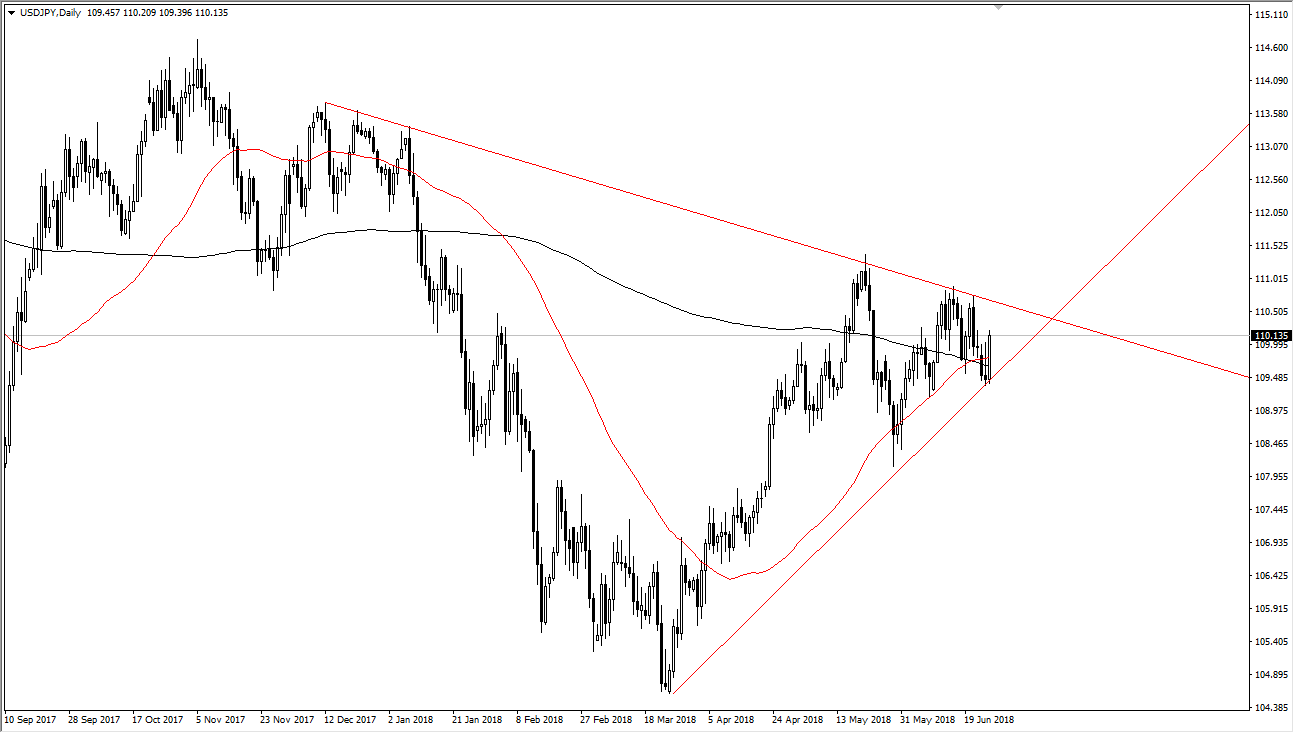

USD/JPY

The US dollar has had a very bullish run on Tuesday, reaching towards the ¥110.20 level again. However, we do have a significant amount of downward pressure as well, so this is a market that I think is still trying to figure out what to do longer term. With that in mind, I am going to wait until we break above the downtrend line or break below the uptrend line that I have marked on the chart. It’s not surprising that we would have a lot of issues here, because the market is highly sensitive to global headlines and shocks not to mention the least of which would be risk appetite. As trade tensions ratchet up, it’s likely that this market will continue to struggle. All things being equal though, I do prefer the upside as the interest rate differential favors the US dollar.

AUD/USD

The Australian dollar fell during the day, but remains above the vital 0.7350 level, an area that is important going back several months. We did of forming a weekly candle in the shape of a hammer last week, so I think as long as we can stay above that level, there is still the opportunity for value hunters to come back in and take advantage of this level. However, if we were to break down below the 0.7350 level, then it’s likely that we go to the 0.73 handle, followed by the 0.72 level. While I recognize that the trend is most decidedly negative over the last several months, when you look at the longer-term charts there is a significant amount of interest in this general vicinity, so it is possible that we get the occasional bounce, if not an attempt to turn things around.