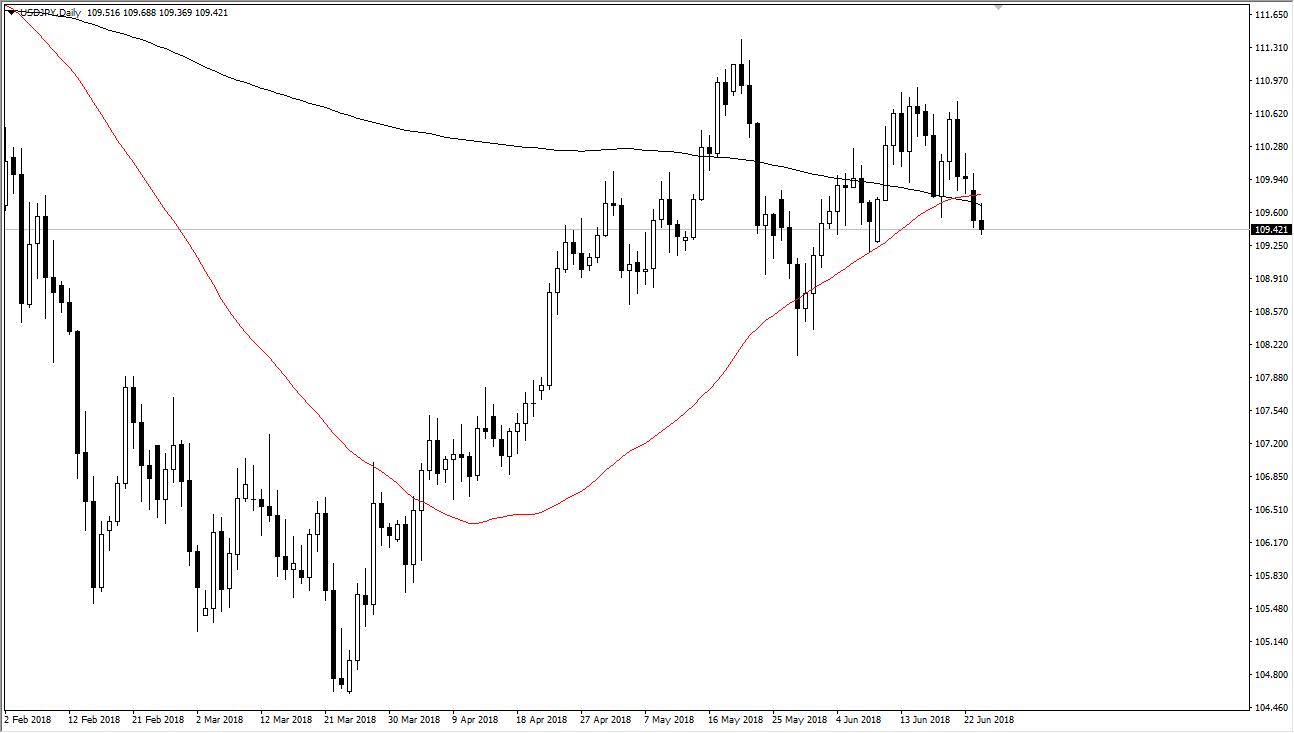

USD/JPY

The US dollar has initially tried to rally during the day on Monday but turned around to break below the ¥109.50 level again. By doing so, the other thing that I would point out is that we struggled at the 200 day SMA, we ended up forming a shooting star. The shooting star of course is a sign of weakness, and I think we may continue to go a little bit lower. However, if we were to turn around and break above the top of the shooting star, that would be a very bullish sign and could send this market to the ¥110.50 level. In general, I think that this market continues to react to the trade war concerns coming out of the United States and China specifically, and that will continue to weigh upon this market and keep gains somewhat subdued.

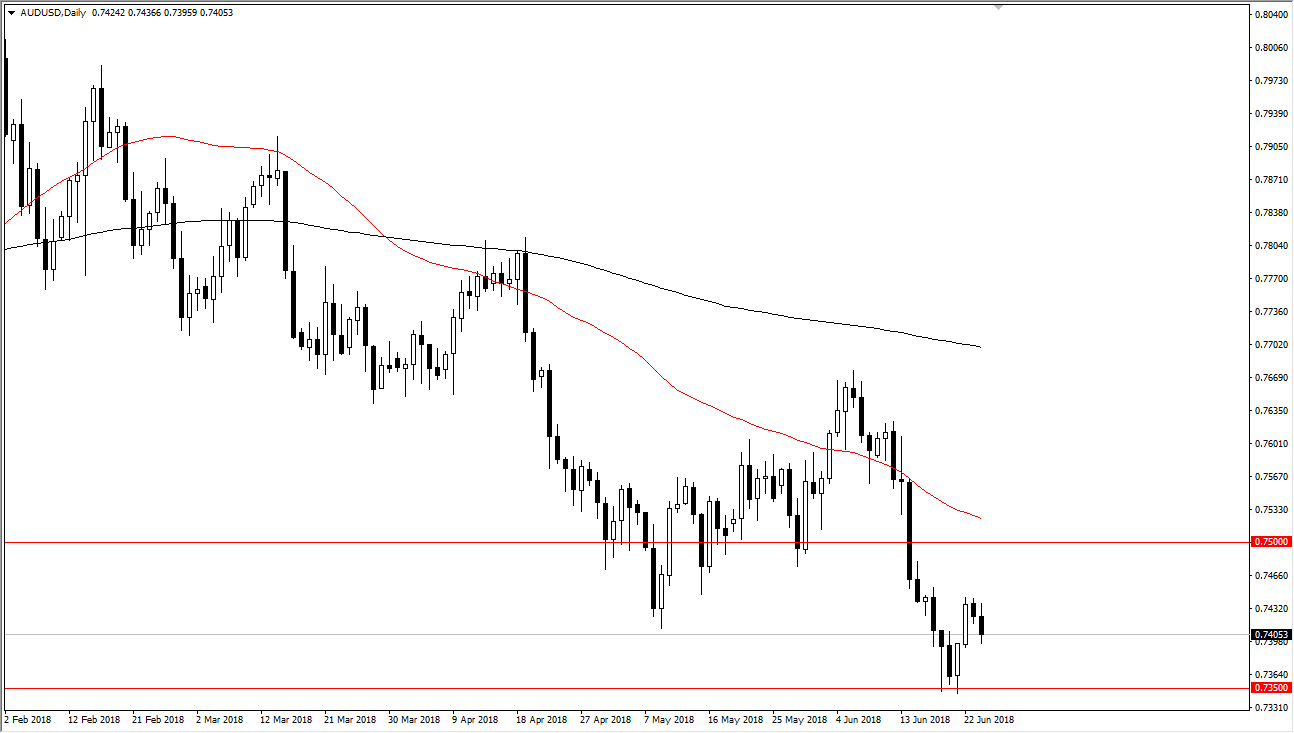

AUD/USD

The Australian dollar went back and forth during the trading session on Monday, initially trying to rally but found enough resistance to roll over again towards the 0.74 level. The 0.74 level should continue to find support though, extending down to the vital 0.7350 level underneath, which has been not only supportive over the last couple of days, but support on the longer-term charts as well. We did of forming a hammer for last week, and I think that the buyers will probably continue to look at this as a market that they can be involved in. I like buying dips, but if we broke down to a fresh, new lows, that would be a very bad sign indeed. I also recognize that the 0.75 level above is massive resistance, so clearing that level is a must for longer-term move.