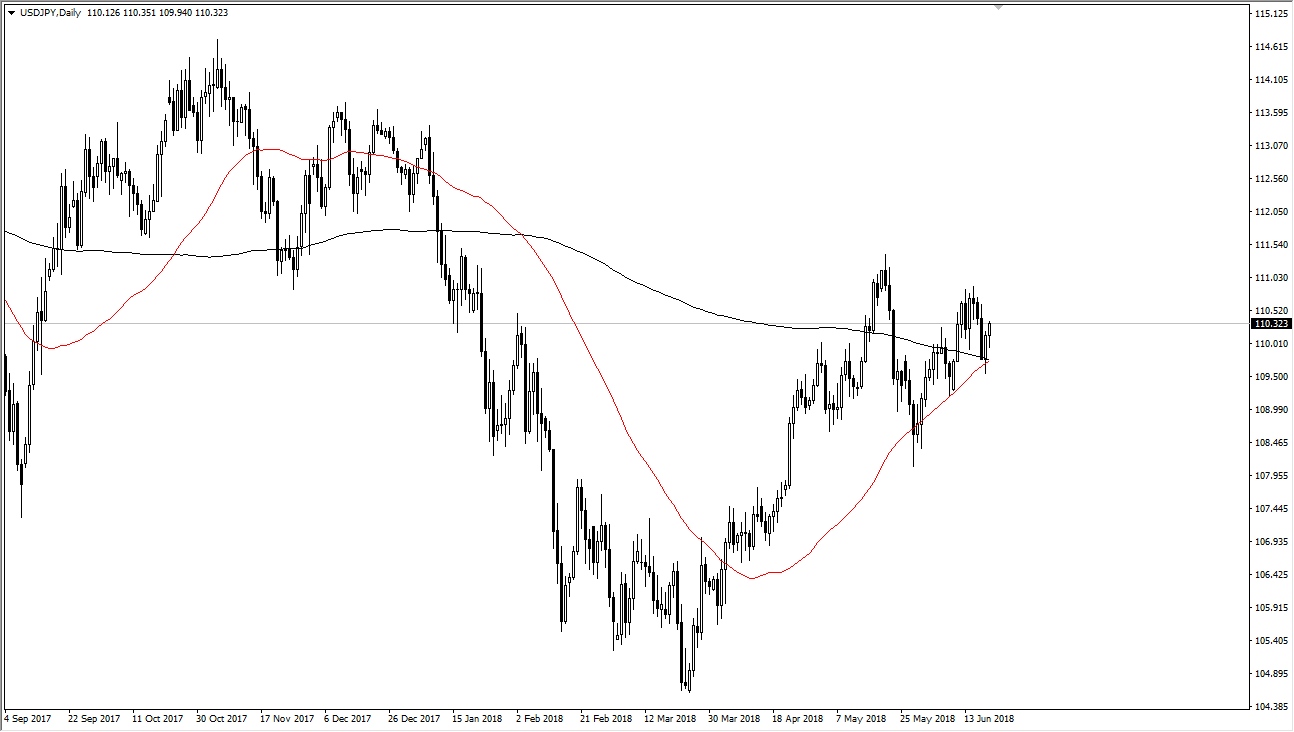

USD/JPY

The US dollar has initially pulled back against the Japanese yen but turned around to rally again. It looks as if the market is getting ready to have a “golden cross” form, which is when the 50 SMA crosses over the 200 SMA. The ¥110 level has offered a significant amount of support, and I think that the market will continue to try to grind to the upside. This will be especially true if the trade tariffs situation calms down, and the market continues to digest it as a potential bargaining chip more than anything else. I believe that given enough time, the market is going to continue to try to find buyers, and therefore I like the idea of looking for value underneath. Longer-term, I anticipate that this market may go towards the ¥111.50 level.

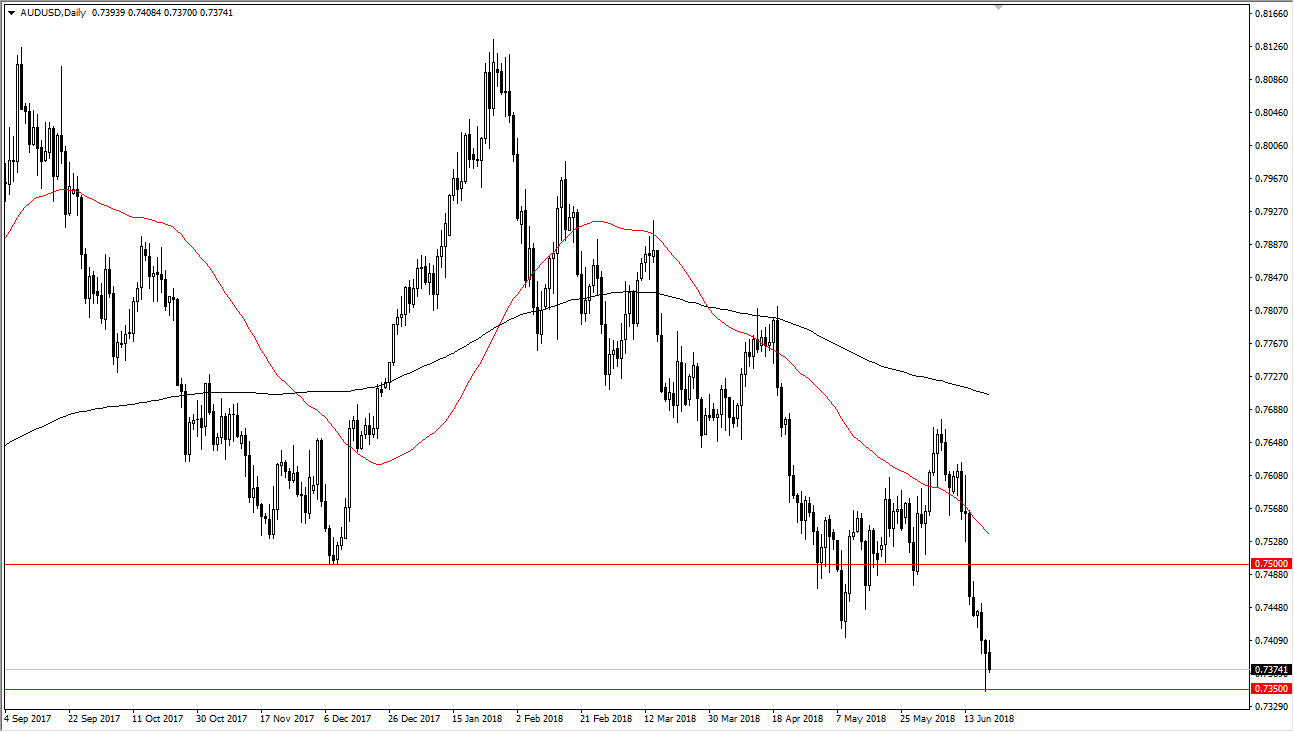

AUD/USD

The Australian dollar has initially tried to rally during the session on Wednesday but found enough resistance above to turn around and fall towards the 0.7350 level. That’s an area that offered a significant amount of support as we ended up forming a hammer on Tuesday, but I think that if we break down below there it could have the Australian dollar unwinding rather drastically. On the other hand, if we were to break above the top of the candle for the session on Wednesday, then the market could go looking towards the 0.75 level above. This pair will be very sensitive to the overall attitude of risk appetite, which of course is moving back and forth due to toxic trade tariffs and the like.

Beyond that, pay attention to the Gold markets, as they tend to have a significant amount of influence on the Aussie dollar in general, and of course the US dollar.