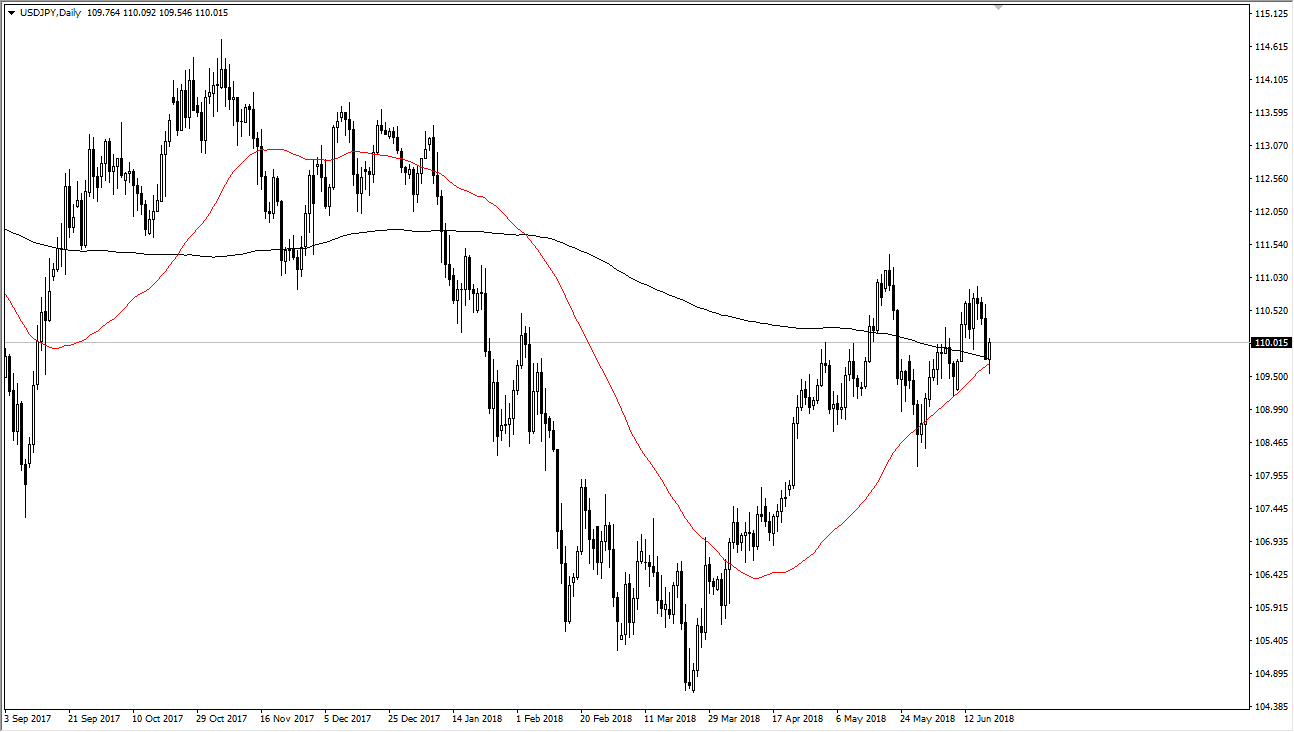

USD/JPY

The US dollar initially fell against the Japanese yen as it was announced that there were an additional $200 billion of tariffs being planned against the Chinese by the Americans. However, we turned around to form a bullish candle, right at the dissection of the 50 day SMA and the 200 day SMA. That would make for a “golden cross” on the chart and could send longer-term buyers into the market as well. The shape of the candle is a hammer, so that doesn’t bode well. However, I anticipate that we are more likely than not the sea choppiness and consolidation more than anything else, at least until we get some type of resolution to the issues between the Chinese and the Americans.

I believe that the ¥110 level is essentially a magnet for price, which is where we are at as I record this video. If we can break above the ¥111 level, that would be a very bullish sign just as a break down below the ¥109 level would be very negative.

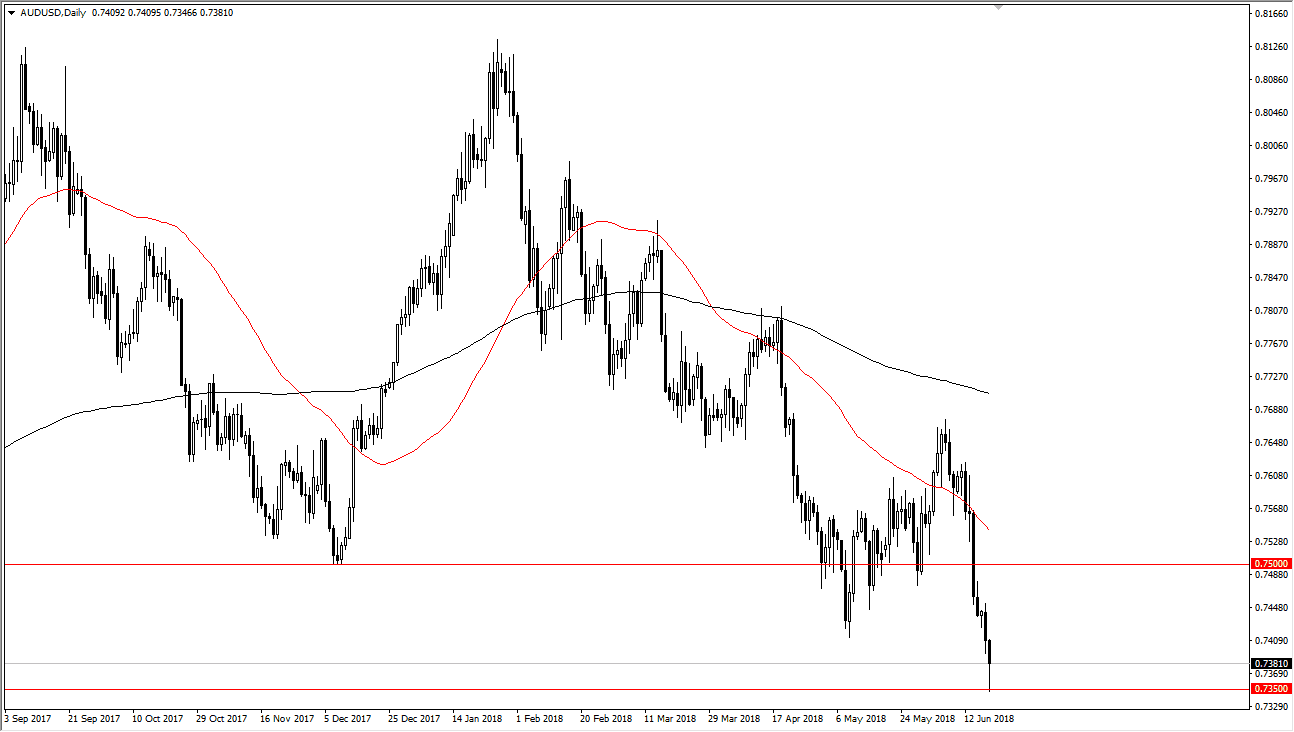

AUD/USD

The Australian dollar fell rather significantly during the day but found a major support level in the form of the 0.7350 level, an area that has been supportive on longer-term charts in the past. We bounced enough to form a bit of a hammer, and I think that a bounce is probably overdue. However, I don’t think that the market is going to have an easy time of getting above the 0.75 handle. Because of this, this may be a “sell the rallies” type of bounce coming. Keep in mind that if we break down below the 0.7350 level, that is a very significant technical break of market structure, sending sellers into overdrive at that point.