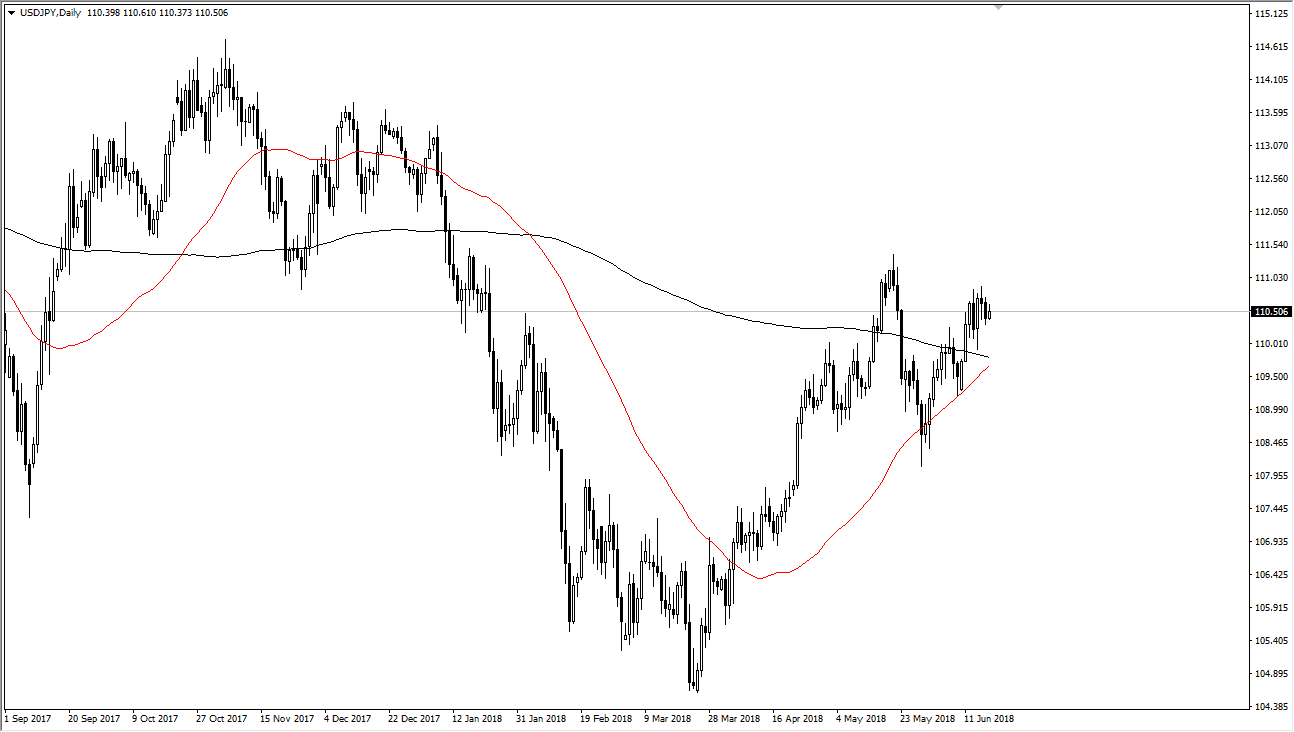

USD/JPY

The US dollar has rallied slightly during trading on Monday as the world awaits several central bank meetings this week, and of course the results of the tit-for-tat tariffs that keep continuing to be headlines coming out of both Beijing and Washington. When looking at the technical indicators, the 200 day moving average, pictured in black on the chart, is ready to be crossed by the 50 day moving average, pictured in red. This is a very bullish cross and should fire off technical trading systems to start buying. However, there is a significant amount of consolidation in this general vicinity, so at this point I think that the market will continue to react to the large, round, psychologically significant figure of ¥110. If things do calm down between the Chinese and the Americans, it’s likely that this pair will rally rather significantly.

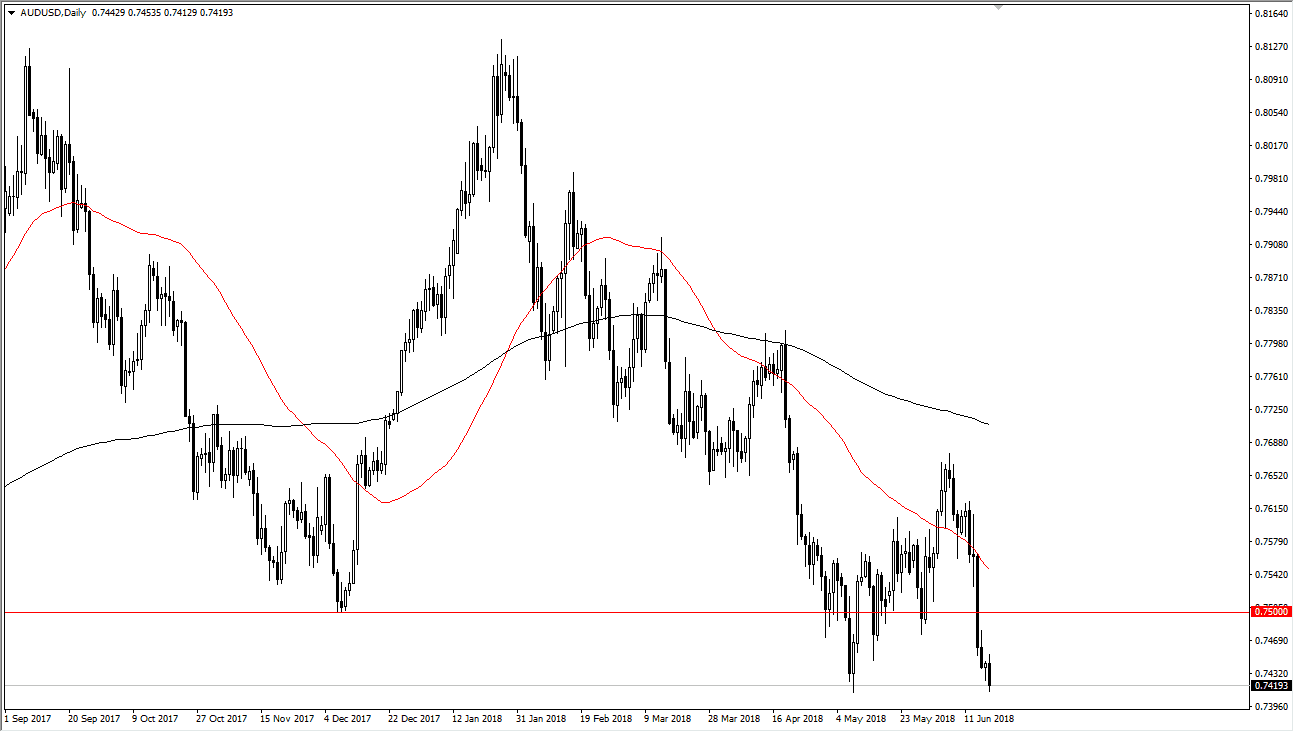

AUD/USD

The Australian dollar continues to fall, breaking through the bottom of the hammer from the Friday session. Ultimately, the market looks as if it is ready to break through the 0.74 handle, perhaps unwinding down to the 0.7350 level which has been important in the past. Rallies at this point should continue to be resistive in nature, and therefore opportunities to sell yet again. The trend is most certainly to the downside, and as long as we have problems with tariffs around the world, it’s possible that the pair will continue to struggle as the Australian dollar is so highly sensitive to trade between the United States and China. This is because Australia is a major provider of hard commodities to the Chinese, but at this point I think it’s obvious that there is a lot of concern around the world, and that should continue to favor the US dollar in general as people rush into treasuries.