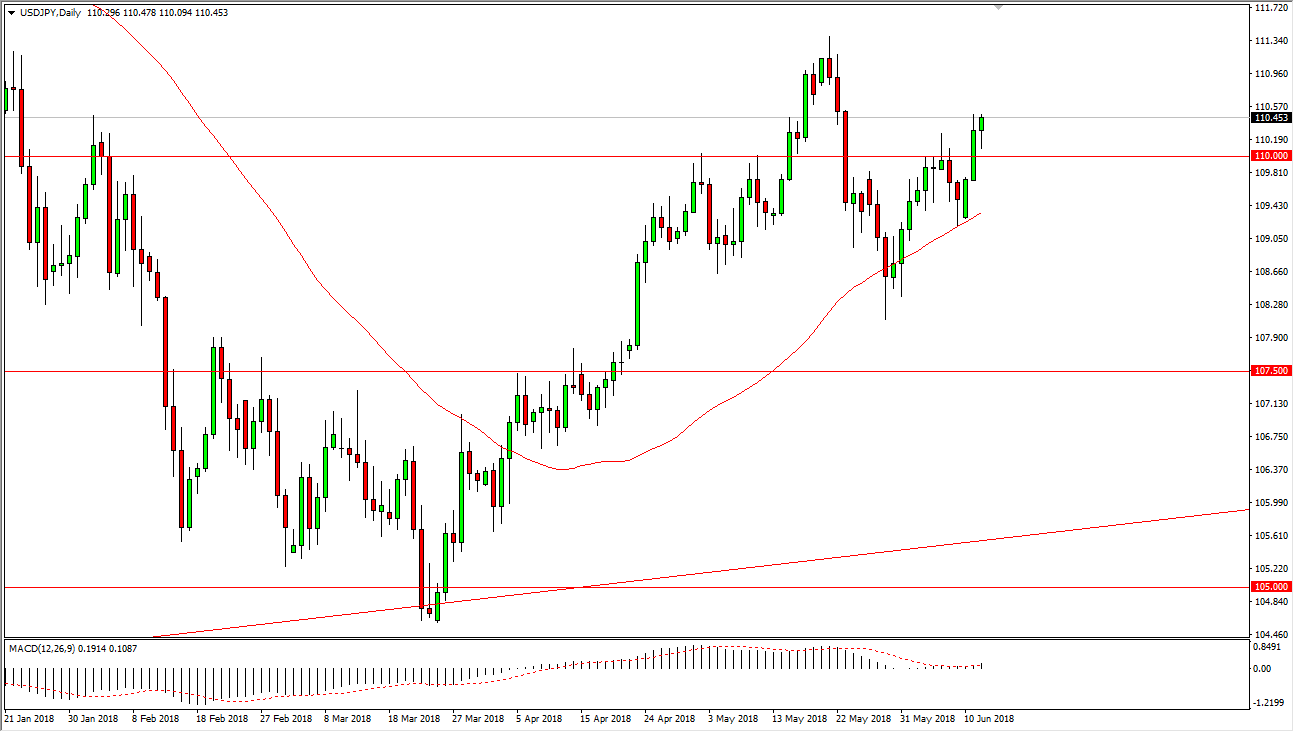

USD/JPY

The US dollar has initially pulled back during the trading session on Tuesday only to find support near the ¥110 level, which of course is a large come around, psychologically important number, and it coincided with Jerome Powell suggesting that he was going to have a press conference after each of the Federal Reserve meetings going forward. That has people anticipating that the Federal Reserve is going to lift interest rates rather quickly, and therefore it’s likely that traders are trying to anticipate this move ahead of time. I believe that market participants continue to try to go higher anyway based upon interest rate differential and possibly even risk appetite as this pair does tend to move with the overall risk appetite of global trade. At this point, I anticipate that there is a significant amount of support below at the ¥109 level.

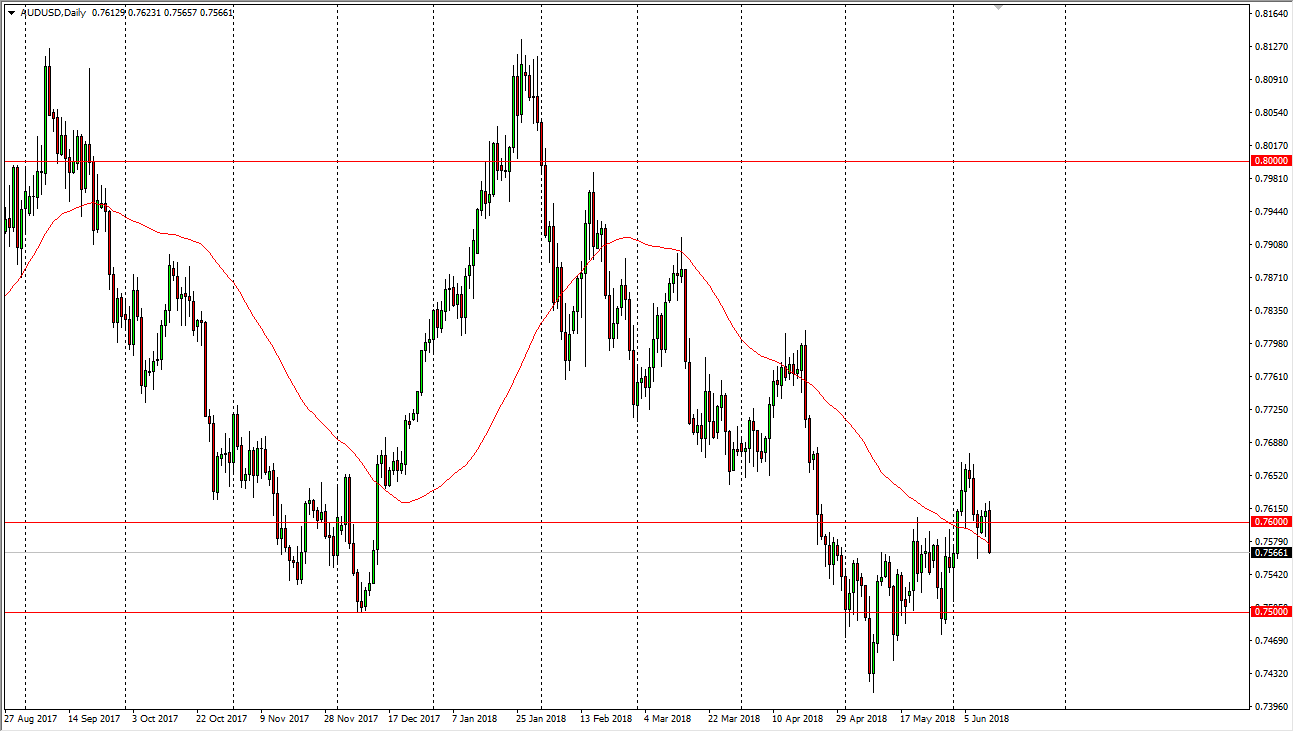

AUD/USD

The Australian dollar has fallen rather hard during trading on Tuesday, slicing through the 0.76 level. However, there is a lot of support below at the 0.75 handle, and I think this could be a short-term move more than anything else. I anticipate that we will continue to see a lot of noise, and this is probably a reaction to Jerome Powell suggesting that there were going to be a rapid pace to interest rate hikes. However, I think at this point it’s likely that we will continue to see a lot of noise, and I think that sooner or later the buyers will come back, but this knee-jerk reaction certainly has the market rolling over quite a bit during trading. I think that the weekly charts and all of the hammer is that have been forming around the 0.75 level suggests that value hunters should come back.