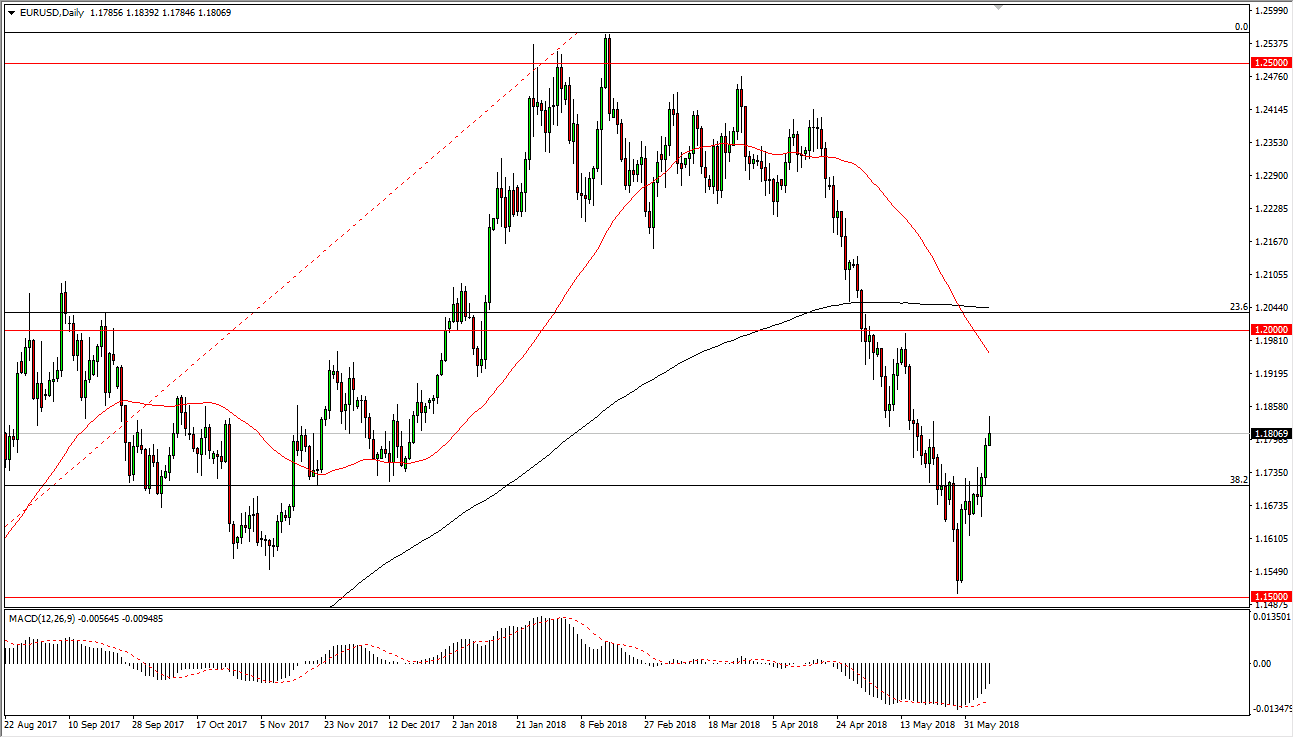

EUR/USD

The Euro rallied a bit during the trading session on Thursday but found enough resistance at the 1.1850 level to cause some issues and pull back a bit. I think if we break down below the lows of the session on Thursday, the market will probably roll over in continue to go lower. Ultimately, this is a market that bounced quite nicely after being oversold, so I think that at this point it makes sense that we find ourselves in this area. Ultimately, if we can break above the top of the shooting star, that would free the market to go higher. If we break down from here, then I think the market probably goes looking towards 1.17 level underneath. Overall, I think that this is a bit of a binary setup, meaning that if we broke above the top of the candle, and it’s a short-term buying opportunity. Otherwise, if we break down below the bottom of the candle, then I would be a seller.

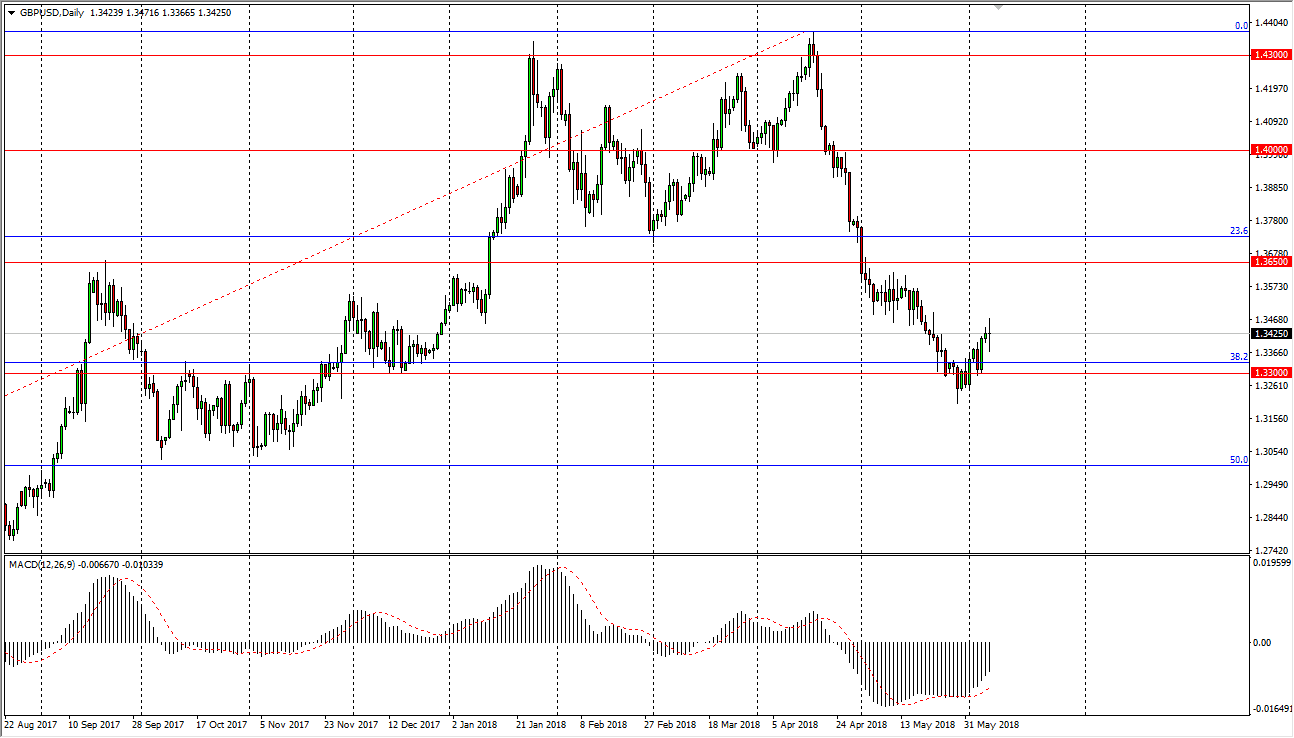

GBP/USD

The British pound went back and forth during the trading session on Thursday, perhaps in reaction to word getting out that the United Kingdom was going to leave the custom union as well as the European Union. Overall, I think that the market is going to continue to be very choppy, and of course very difficult. I think that the 1.3650 level above will be a bit of a “ceiling”, while the 1.33 level underneath should be supportive. If we make a fresh, new low, then the market will unwind to the 1.30 level. If we break out to the upside, I would anticipate seeing a lot of selling pressure near the 1.3650 level.