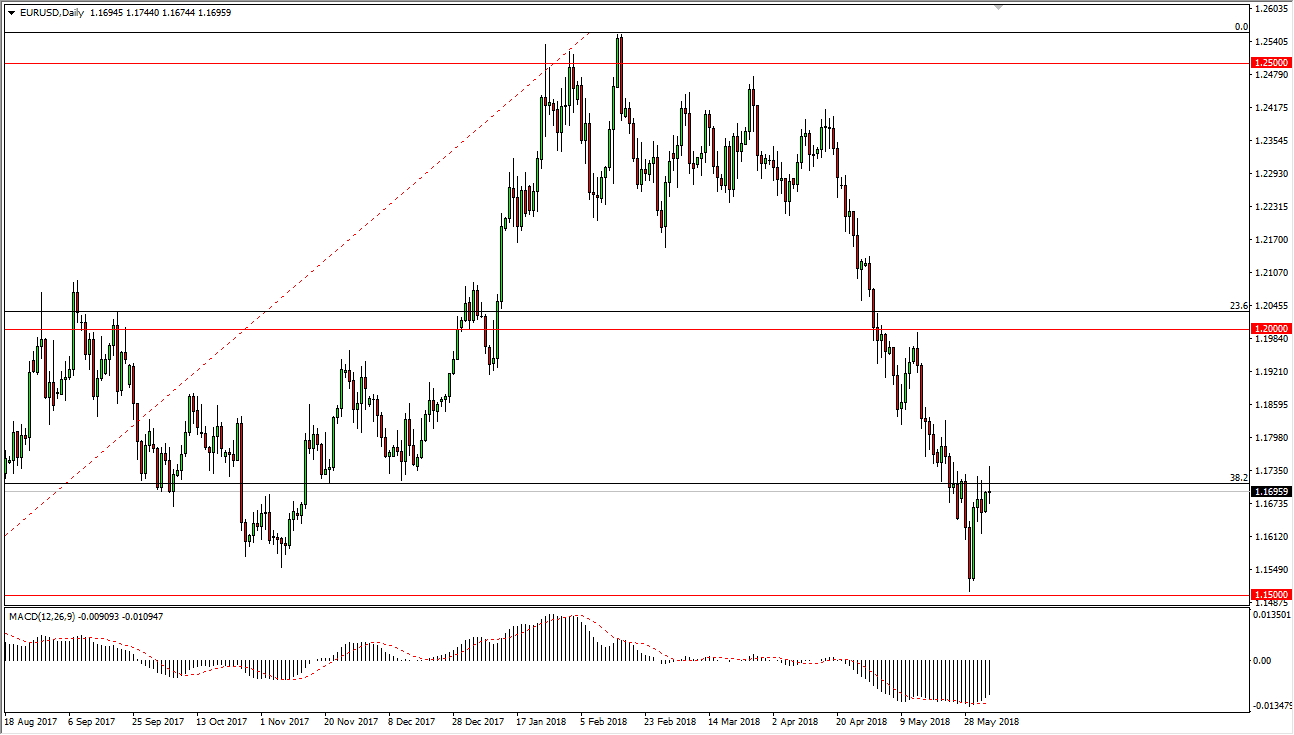

EUR/USD

The EUR/USD pair tried to rally during the trading session on Monday but gave back most of the gains to form a shooting star. Because of this, I think that we may see a bit of a pullback but when I look at the weekly chart, we have a massive hammer that has formed as we bounced from the 1.15 handle. I think it is only a matter time before the buyers jump into this market, perhaps taking advantage of the cheap pricing. However, if we break down below the 1.15 level, we could break down rather significantly. There is a ton of support at that level though, and I think that the situation in Italy will be the main driver of this market in one direction or another. If we can break above the top of the range for the day on Monday, then the market would be free to go much higher.

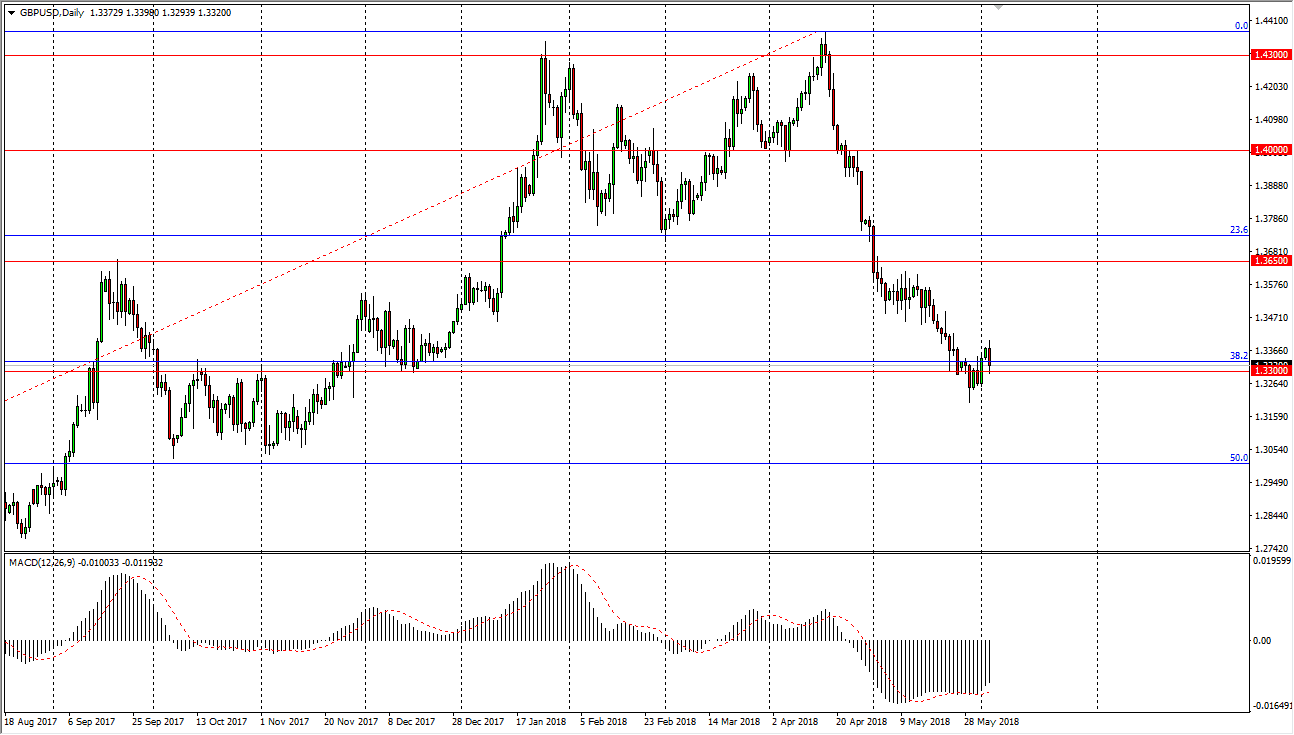

GBP/USD

The British pound has initially tried to rally during the trading session on Monday, but then rolled over to reach down towards the 1.33 handle. This should be an area of support though, so I think it’s only a matter of time before the buyers get involved and push higher based upon the hammer on the weekly chart. If we break down below the lows of the previous week, then the market probably drops rather significantly. I think that the 1.3650 level above is the target if we can rally, and of course continue to see quite a bit of situational call this when it comes to the idea of trade wars and the like. If we were to break down below, I think the 1.30 level will be the next target.