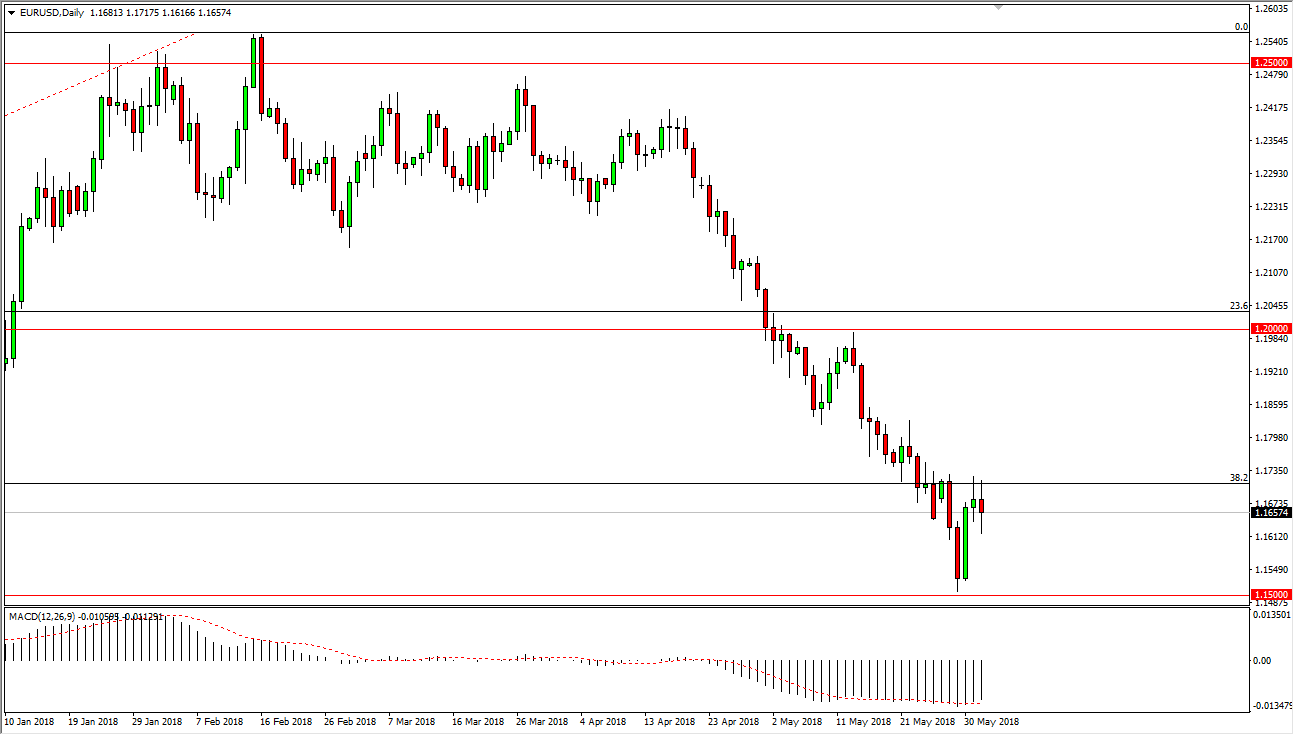

EUR/USD

The EUR/USD pair was very noisy on Friday as you would anticipate, as we had the Nonfarm Payroll announcement coming out. The market continues to be very noisy in general, and as you can see we ended up forming a somewhat neutral candle. What’s interesting is that we tested the top of the shooting star from Thursday session which was very negative. Ultimately, what I look at the charts 24 hours ago, I thought we would reattempt the 1.15 level again. However, now that we have closed the week, we ended up forming a hammer. In other words, I think it’s only a matter time before we rally. If we can break above the top of the shooting star from the Thursday session, at that point I’m looking for this market to rally somewhat significantly. However, if we break down below the bottom of the candle for the Freddie session, we may in fact return to the 1.15 level underneath. Breaking down doesn’t seem as likely as it did just a few days ago.

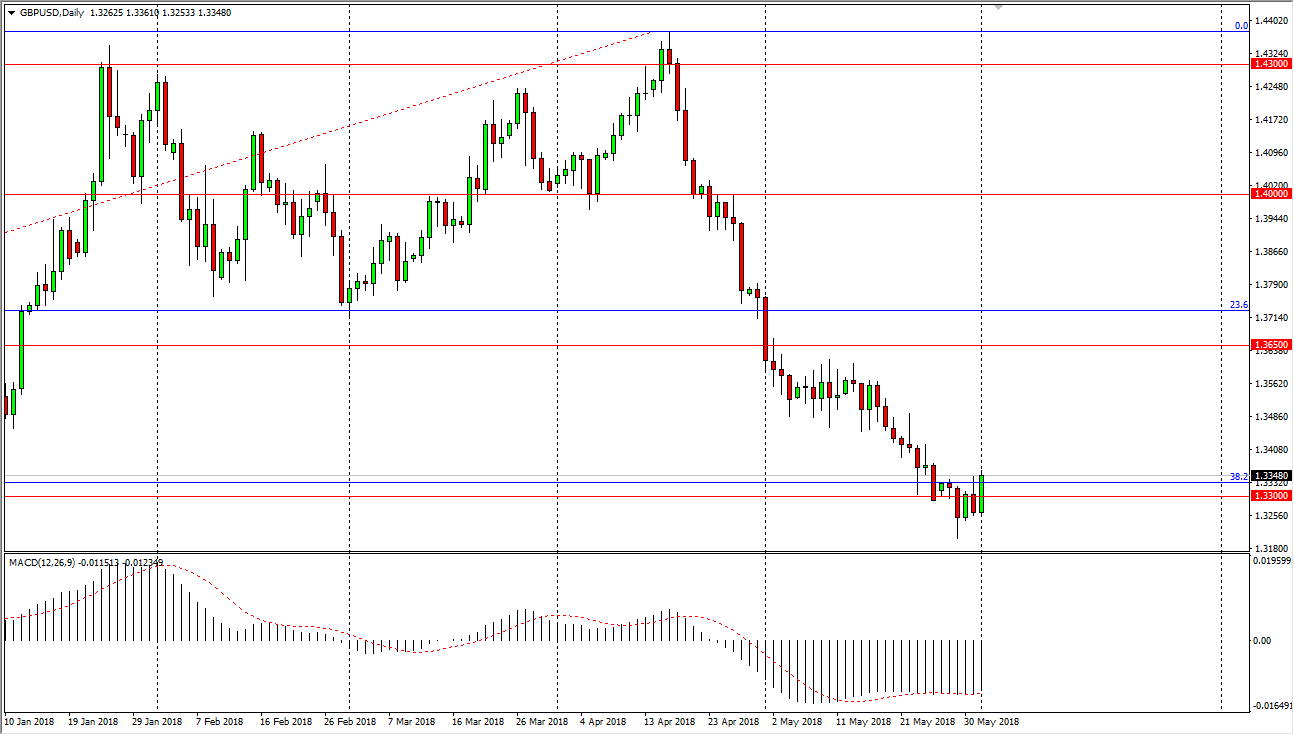

GBP/USD

The British pound rallied significantly during the day on Friday, breaking towards the top of the range for the Thursday session. I think if we can break above the top of the range for the session on Friday, it’s likely that the market would continue to go higher. The weekly candle formed was a hammer, and the hammer of course is a very bullish sign. So I think it’s only a matter time before we rally, and I think the market is going to turn around again. The fact that we have turned around so drastically after the jobs are on Friday suggests to me we are going to get a bit of a “risk on” rally.