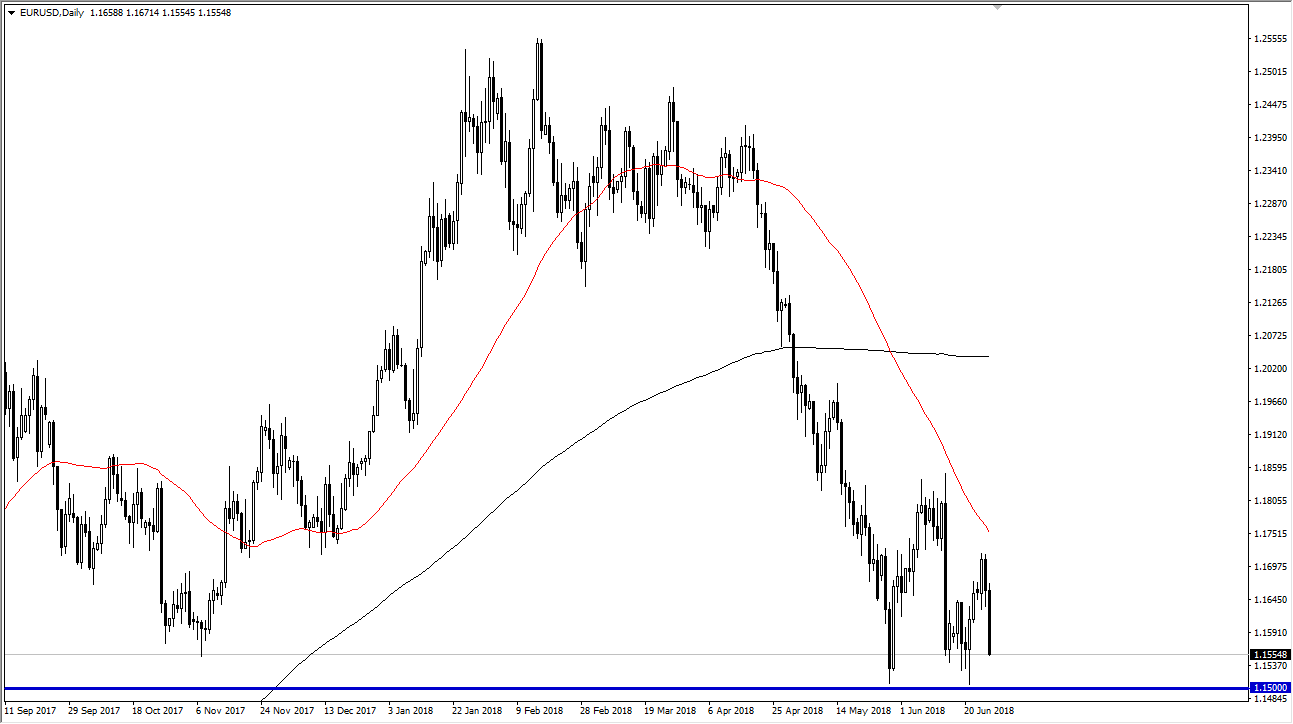

EUR/USD

The EUR/USD pair fell significantly during the trading session on Wednesday, reaching below the 1.16 level again, threatening to test the 1.15 handle. At this point, I think it’s rather simple: if we break down below the 1.15 level significantly, it’s going to drive the Euro much lower. Essentially, the 1.15 level must hold to keep the market participants involved in the upside. It certainly seems to be a bit of a “risk off” situation, and that of course favors the US dollar overall as we have plenty of political issues going on in the European Union. If we can hold the 1.15 level, it’s likely that we could eventually bounce. This is a crucial area that I cannot stress enough as being important. The next couple of days will be crucial, but certainly Wednesday is a very negative sign.

GBP/USD

The British pound has broken down significantly during the trading session on Wednesday as well, reaching towards the 1.31 level. If we can break down below the lows of last week, the market could go down to the 1.30 level, possibly even lower than that. This is most certainly a very negative looking market, and I think that rallies will be shorted on short-term charts. We simply must hold the 1.30 level, because if we don’t the trapdoor opens, and we go much lower. In the short term, I would not be overly surprised to see some type of consolidation, but the candle that formed during the day on Wednesday was negative enough to have me a bit concerned for the British pound again. This collapse has been brutal, and I think at this point we are looking very much like a “risk off” market overall.