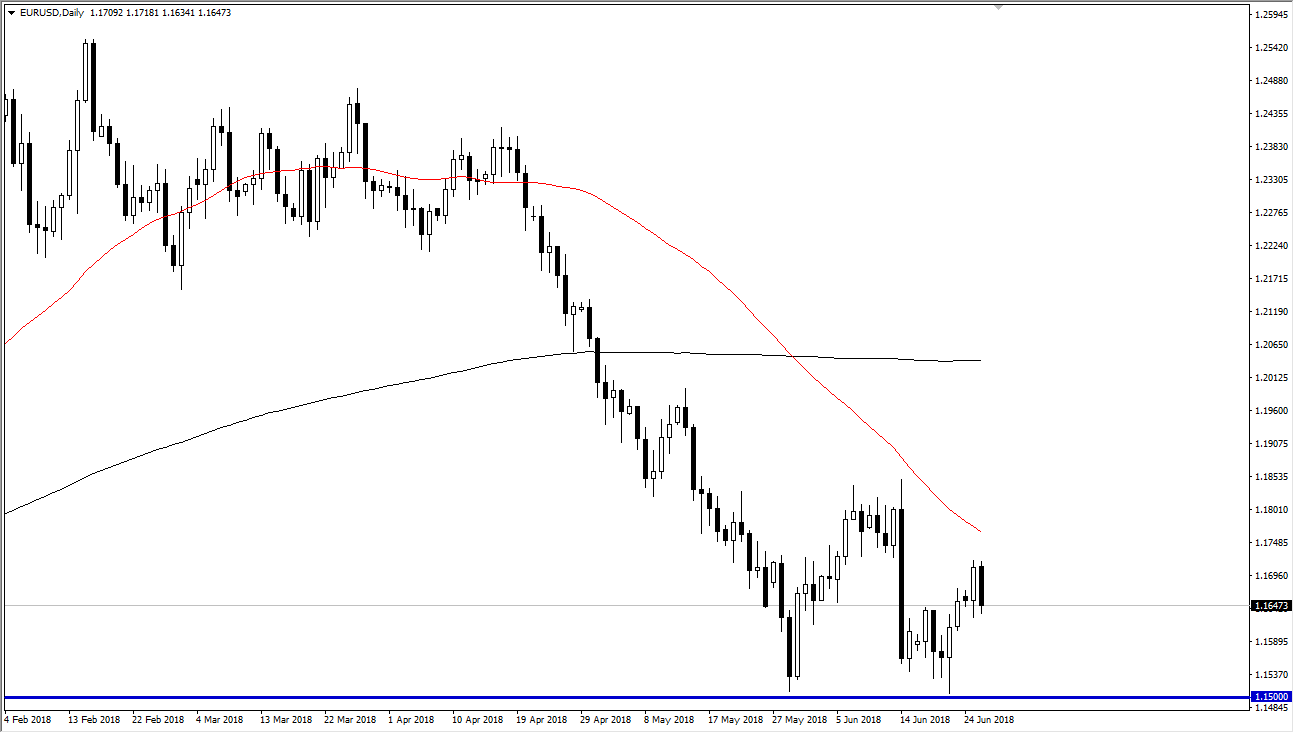

EUR/USD

The EUR/USD pair had a negative session during the day on Tuesday, as we rolled over and reached towards the bottom of the daily candle on Monday. However, there is a certain amount of support just below, and of course major support at the 1.15 handle. It is because of this that I am anticipating some type of bounce that we can take advantage of. Once we get that bounce, it’s time to start picking up the pair “on the cheap” again. Otherwise, if we were to break down below that level thanks could change rather drastically as the 1.15 level has been so important in the past. I think that the buyers will come back and try to drive towards the 1.1850 level, essentially forming a bit of a consolidation zone for traders to deal with. Longer-term, I would anticipate some type of recovery after the vicious selloff.

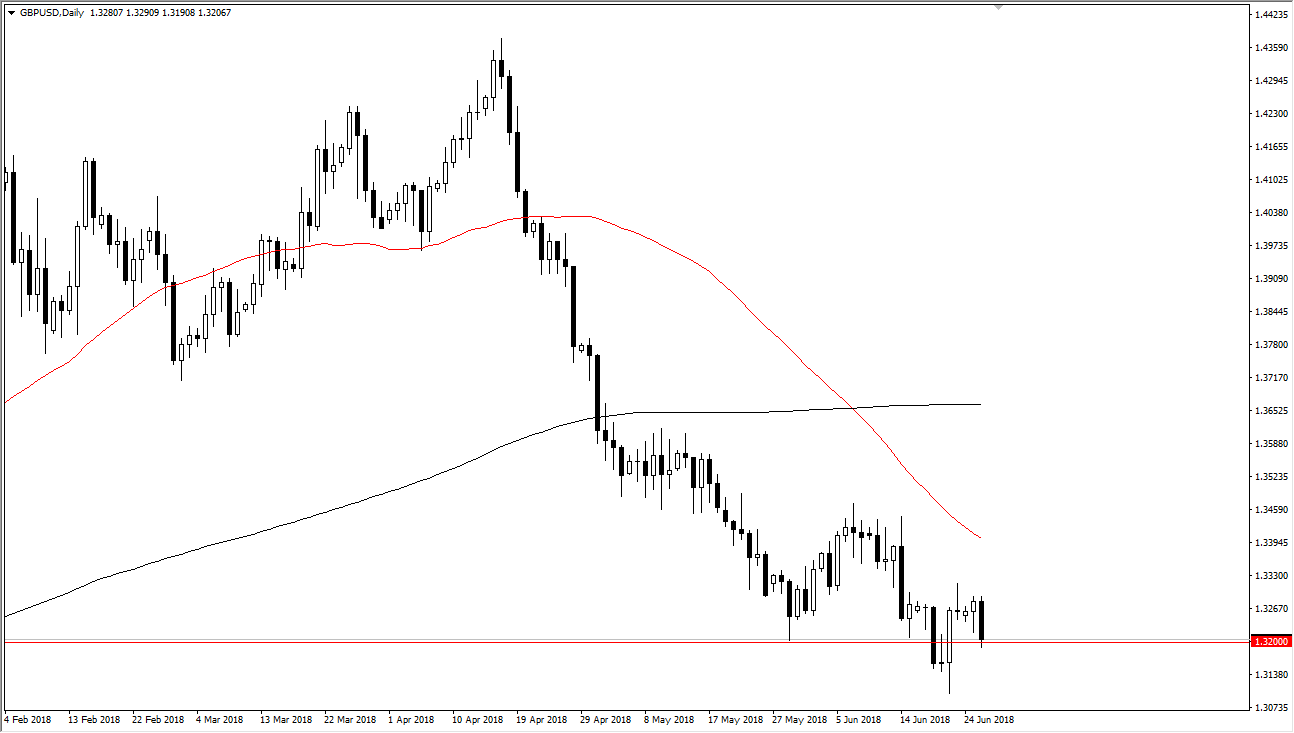

GBP/USD

The British pound has fallen during most of the day on Tuesday, reaching down towards the 1.32 handle. It looks as if we are ready to consolidate around this large, round, psychologically significant figure, so I think it’s only a matter of time before the buyers come back. However, if we were to break down below the lows of the last several sessions, then we could unwind towards 1.30 level after that. I think this market continues to be very noisy, and I think it’s very difficult to imagine a scenario where things can be easy. However, the Bank of England has just recently stated that they are more hawkish than people had anticipated, and that of course puts a little bit of upward pressure on the British pound in general. There are a lot of concerns right now around the world with global tariffs, but once things like that calm down this pair should be able to recover quite nicely.