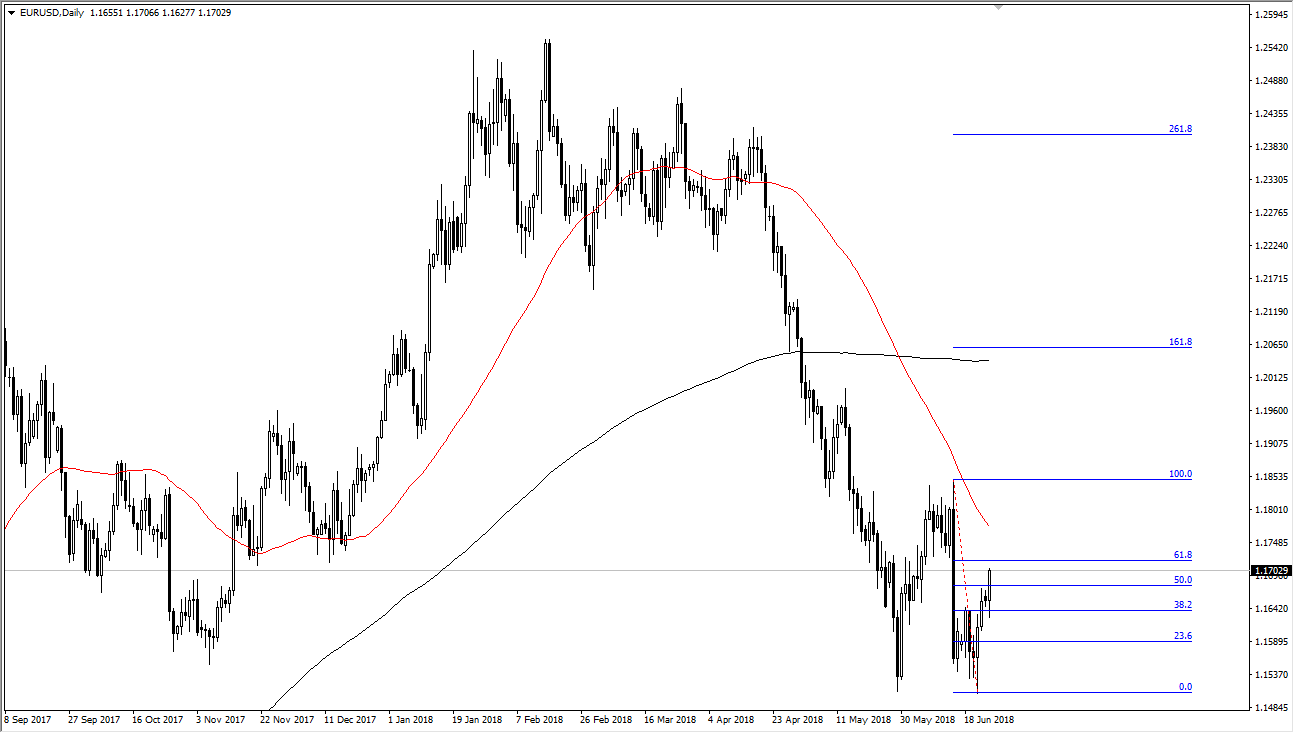

EUR/USD

The Euro initially pulled back during the day on Monday but turned around to form a very bullish candle as we recovered. You can see that I have the Fibonacci Retracement Tool drawn on the chart from the most recent sell off, and we have busted through the 50% level. Now that we have cleared that, and the 1.17 level, it’s likely that we will go to the 61.8% Fibonacci retracement level, which as you can see had previously had resistance before the breakdown. I think once we break above there, we will wipe out the selloff after the ECB statement. Once we cleared that level, then the market is free to go much higher. For what it’s worth though, I think that more likely we will see overall consolidation between the 1.1850 level above, and the vital 1.15 level underneath. The US dollar is being punished to some extent due to the trade concerned.

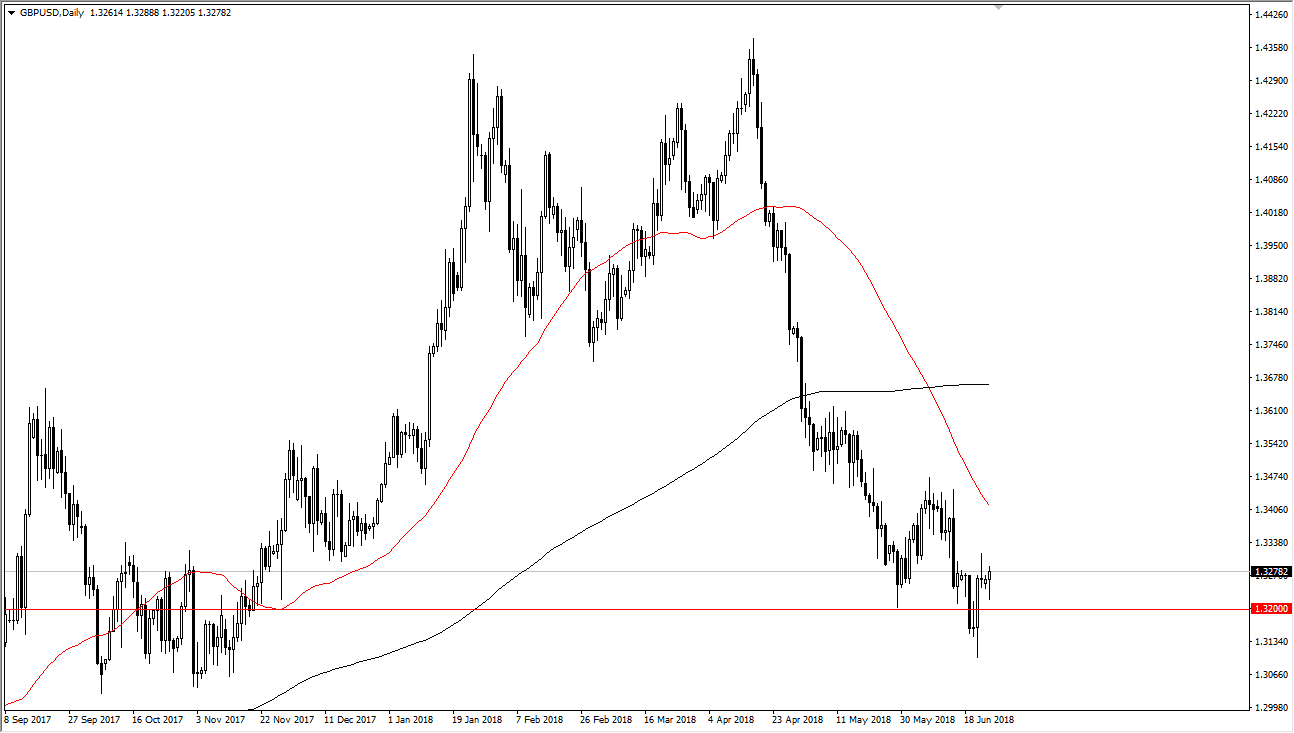

GBP/USD

The British pound pulled back a little bit during the trading session on Monday but turned around and showed signs of support at the 1.32 level underneath. I think that the market could very well bounce a bit from here, perhaps reaching towards 1.3450 level. On the weekly chart, we had formed a massive hammer from last week, so I think there is a certain amount of bullish pressure just waiting to be released. The question now is whether we can hang onto the gains and continue to go higher? I think it’s a little early to tell that, but we certainly have seen a change in the short term attitude of the British pound due to the Bank of England suggesting it was much more hawkish than anticipated during the statement last week.