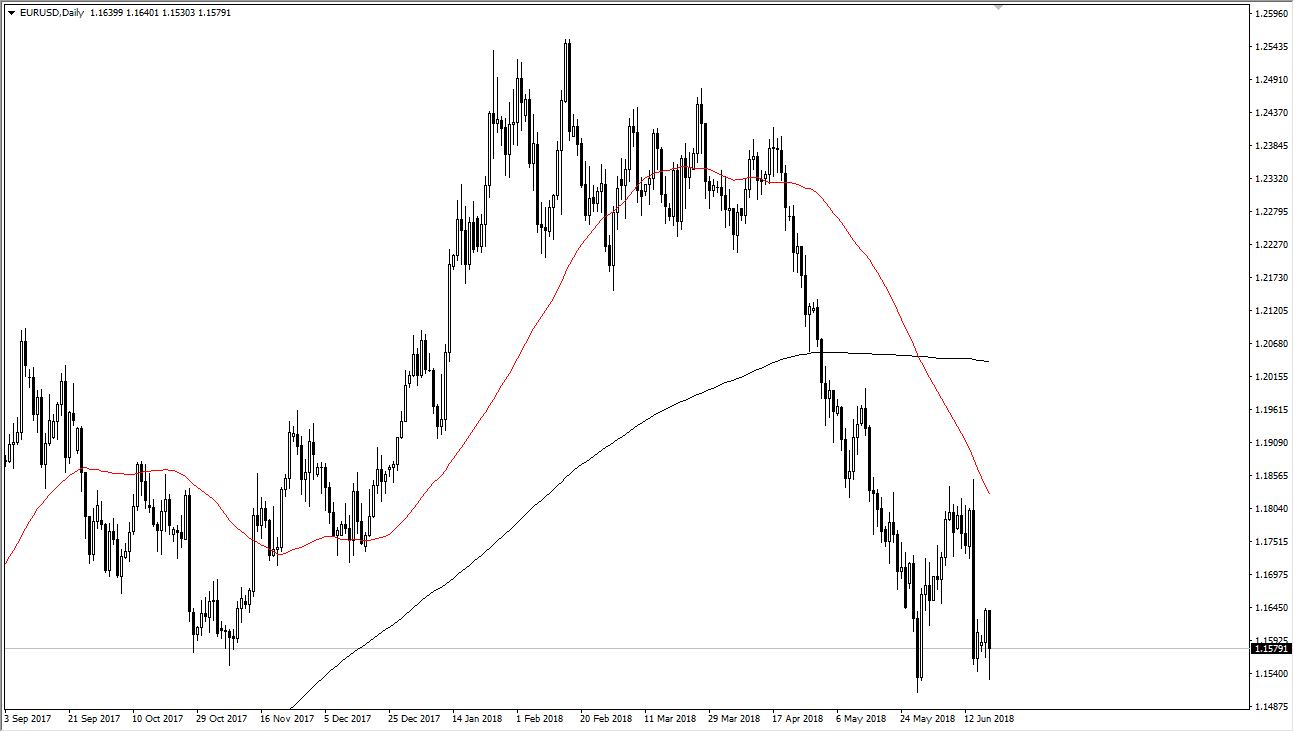

EUR/USD

The Euro fell during much of the session on Tuesday, as global concerns continue to elevate after the United States has slapped more trade tariffs against China, and of course the Euro is especially susceptible to the noise coming out of the German political sphere. Uncertainty is almost always negative for currency, and as people are beginning to question whether Angela Markel will be around, that of course has a bit of negativity weighing upon the common currency as well.

Beyond that, we have been in a negative tone for some time. However, interestingly enough we did not break down to a fresh, new low, and I think that is what we are going to see going forward: massive support near the 1.15 level. That’s an area that will be very difficult to break down, so I suspect that there will be value hunters in that region. However, that is a short-term “smash and grab” trade more than anything else. We have recently made a “death cross” on the chart, so I think the sellers will continue to be very aggressive on rallies. I would prefer to fade rallies and to try to pick the bottom.

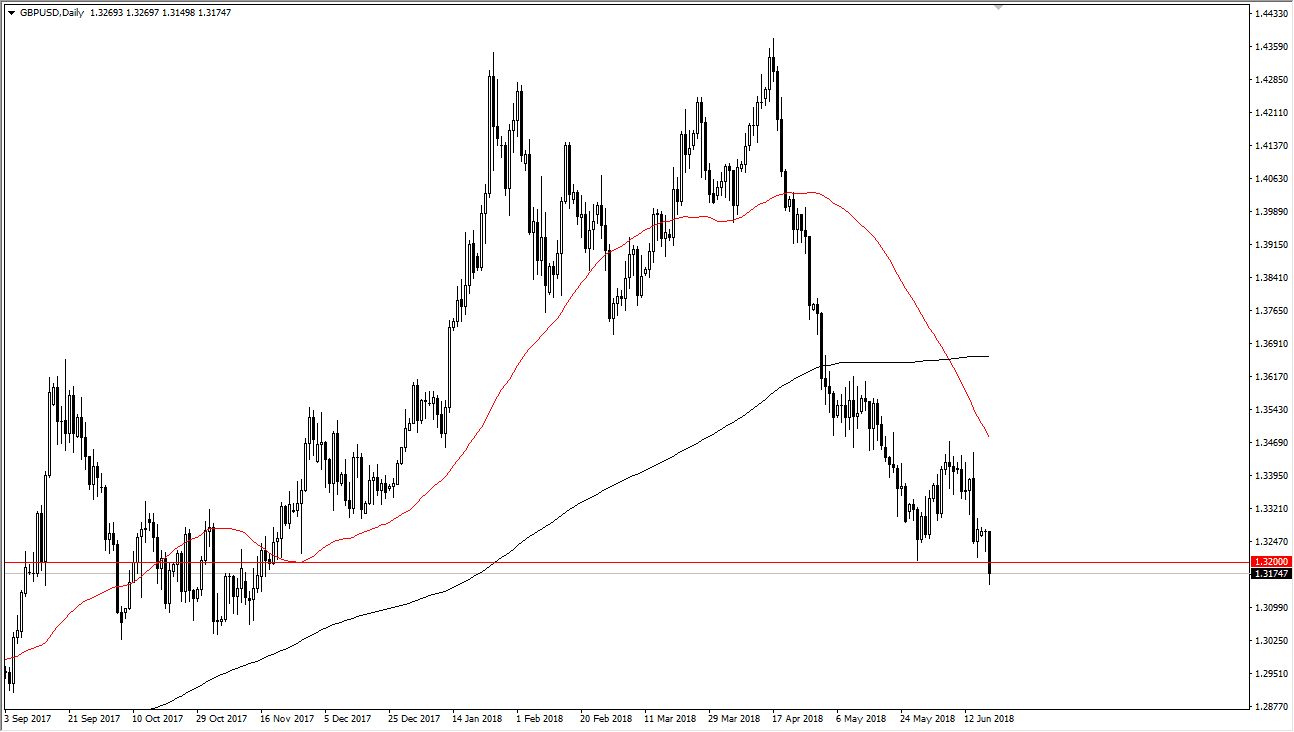

GBP/USD

The British pound also fell during the day, making a fresh, new low to the impulsive move lower. The 1.32 level was broken, but there is probably a significant amount of support in this general vicinity, so I think we are looking at more consolidation with a downward slant than anything else. Obviously, this market is influenced by less than stellar British economic numbers coming out, as well as the risk appetite situation around the world, so keep that in mind. I believe that rallies are to be sold unless we were to break above the 1.35 handle.