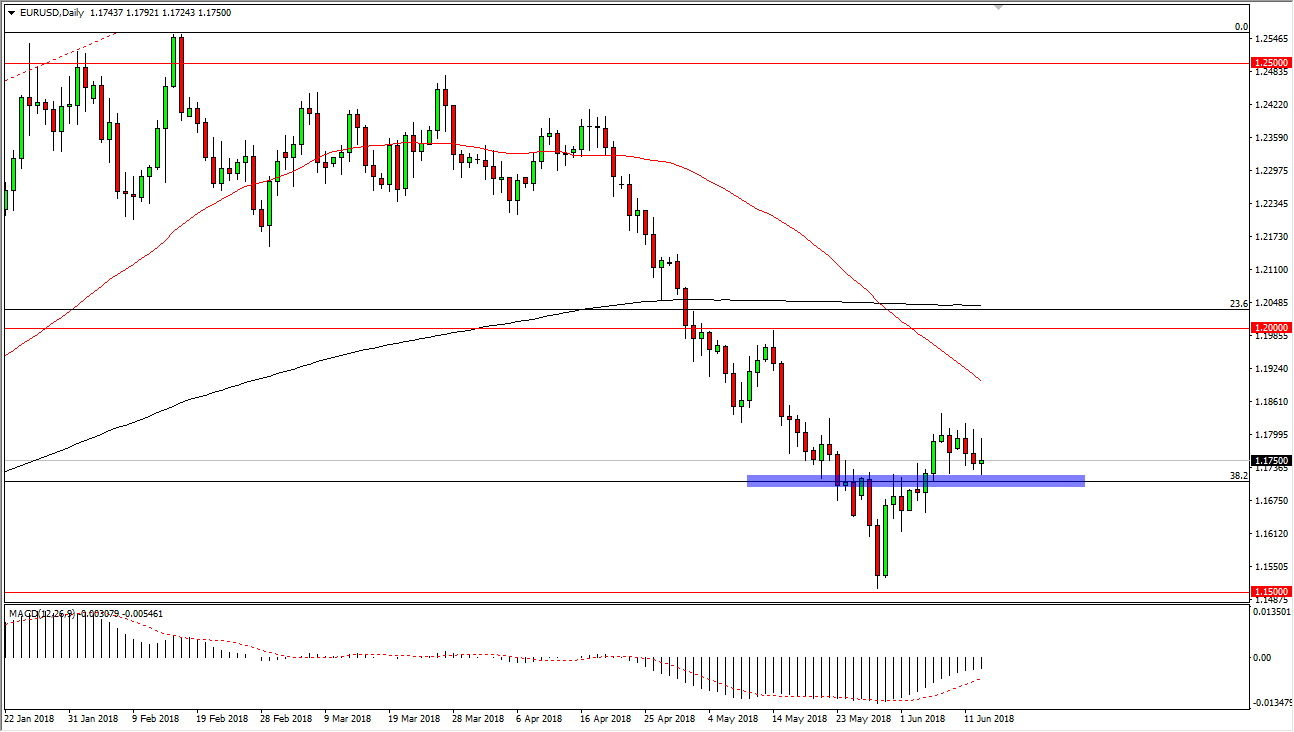

EUR/USD

The EUR/USD pair had a volatile session during the day on Wednesday as you would expect, with the FOMC Statement coming out during the day. However, today we also have the European Central Bank coming out with the statement, so it’s likely that we will continue to see a lot of volatility. If the European Central Bank suggests that they are getting away from the quantitative easing, even if they are tapering ever so slightly, that could be reason enough to send this market much higher. I see a lot of resistance above though, so at this point I think that we are probably looking at more consolidation than anything else as the 1.17 level underneath offers a lot of support. Market participants continue to be very jittery, but at this point I think we show a lack of commitment, so therefore I believe it’s going to be a short-term range bound trading more than anything else.

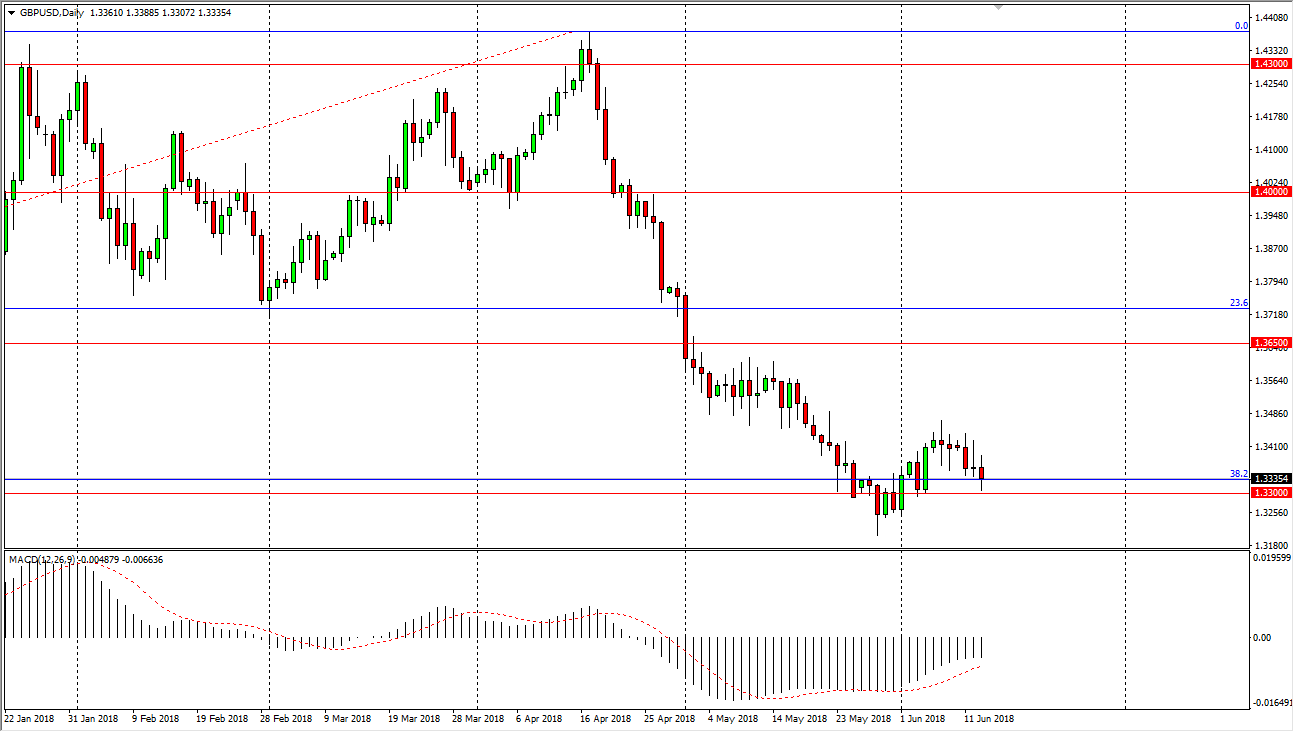

GBP/USD

The British pound of course was noisy as well, testing the 1.33 level for support. We found it there, bounce significantly, and then ended up sending the market back to a relatively neutral stance. I think that we could go higher, but there is so much in the way of noise above it’s going to be a difficult trade to take. The 1.33 level has been massive support, and if we break down below there, we could go to the 1.32 level. If we make a fresh, new low, then the pair can unwind towards the 1.30 level. I think that the market rallying and breaking above the little bits and pieces of resistance on the daily charts could send this market towards the 1.3550 level next, and that eventually the 1.3650 level.