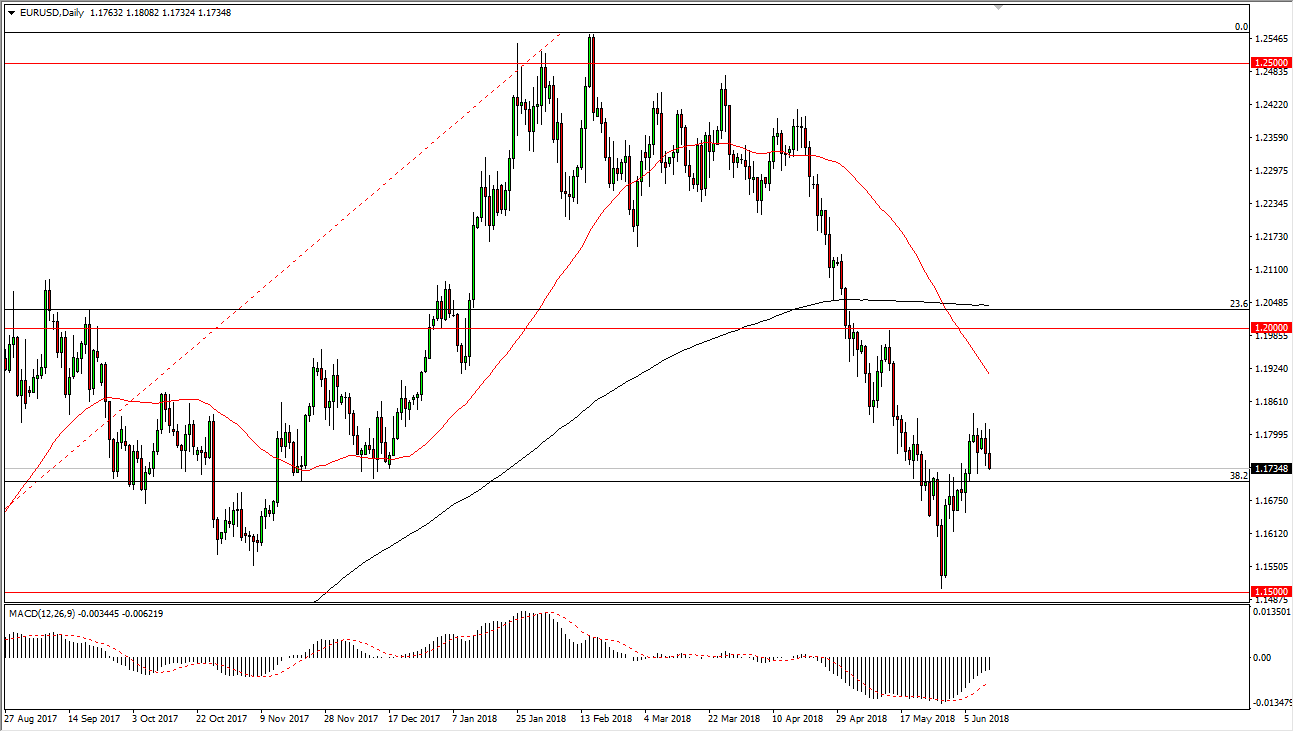

EUR/USD

The EUR/USD pair rallied a bit during the trading session on Tuesday, only to turn around near the 1.18 level. This was exacerbated as Jerome Powell has suggested that after each meeting with the Federal Reserve, he would like a press conference. People are anticipating that this means we are going to see interest rate hike rather quickly in the United States, and this of course has favored the US dollar. The 1.17 level underneath should be rather supportive, but if we can break down below there I think we make a return to the 1.15 level underneath, which has been massive support. I don’t think we break all the way down there, but clearly it looks as if the sellers are trying to make a stand. If we can break above the 1.1850 level, the market then is free to go to the 1.20 level. Beyond that, we have the ECB meeting today, and that of course can move the markets as well, especially if it looks like the European Central Bank is stepping away from quantitative easing. Expect a lot of noise today.

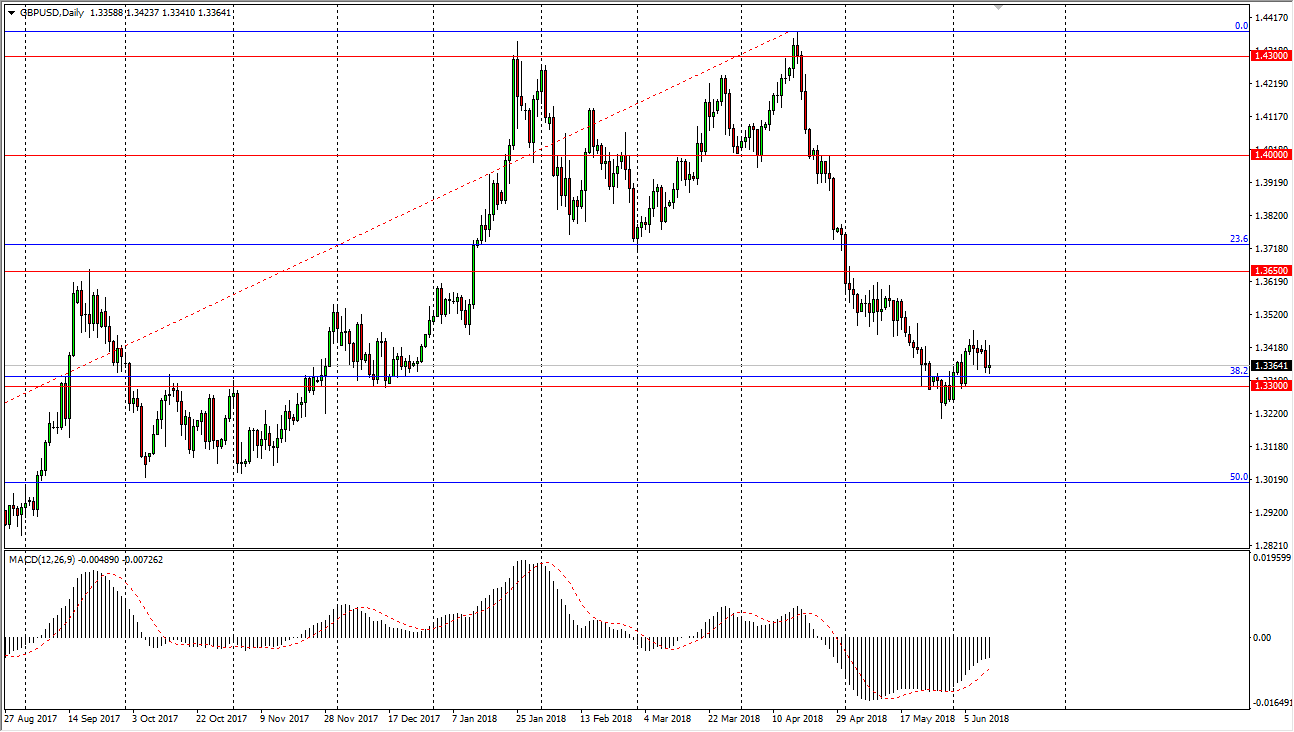

GBP/USD

Much like the EUR/USD pair, the market initially tried to rally during the day on Tuesday, but it did turn around as those words from Jerome Powell came out. Ultimately, I think that there is a significant amount of support at the 1.33 level, and if we break down below there we should go looking towards 1.3 to handle. A fresh, new low would send this market lower, down to the 1.30 level after that. Otherwise, I would anticipate seeing a bit of support at the 1.33 handle, an area that perhaps could be rather important on longer-term charts as well.