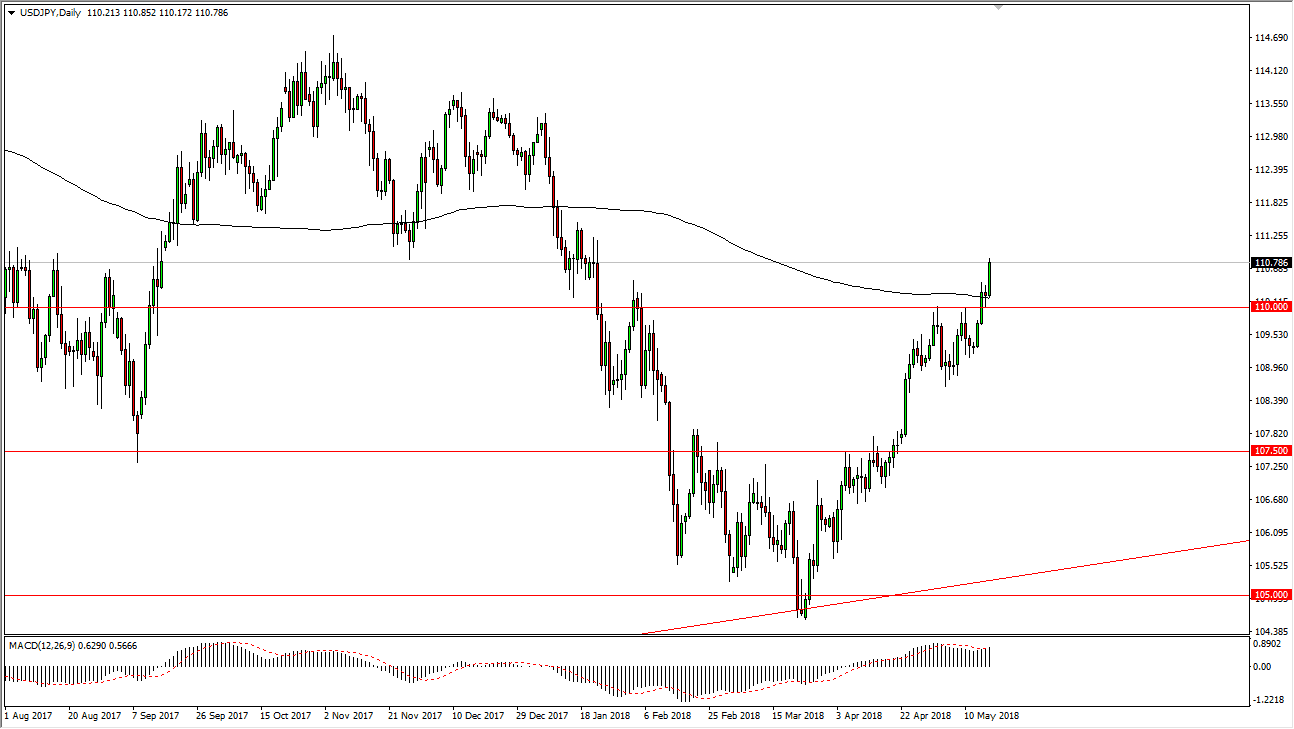

USD/JPY

The US dollar has rallied significantly during the trading session on Thursday, breaking above the 200-day moving average, clearing the ¥110 level. Because of this, it’s likely that the market is ready to change its overall attitude, as we have made a significant move higher. I think short-term pullbacks should continue to be buying opportunities, and that we should then go to the ¥112.50 level. I believe that pullbacks will continue to be buying opportunities down to at least the ¥109 level, and I think that the market will continue to find buyers every time we offer “value” in this pair. If we break down below the ¥109 level, that could unwind this market down to the ¥107.50 level. Remember that this pair is highly sensitive to the 10-year treasury markets, and as those interest rates rise, it’s likely that this pair will continue to go much higher.

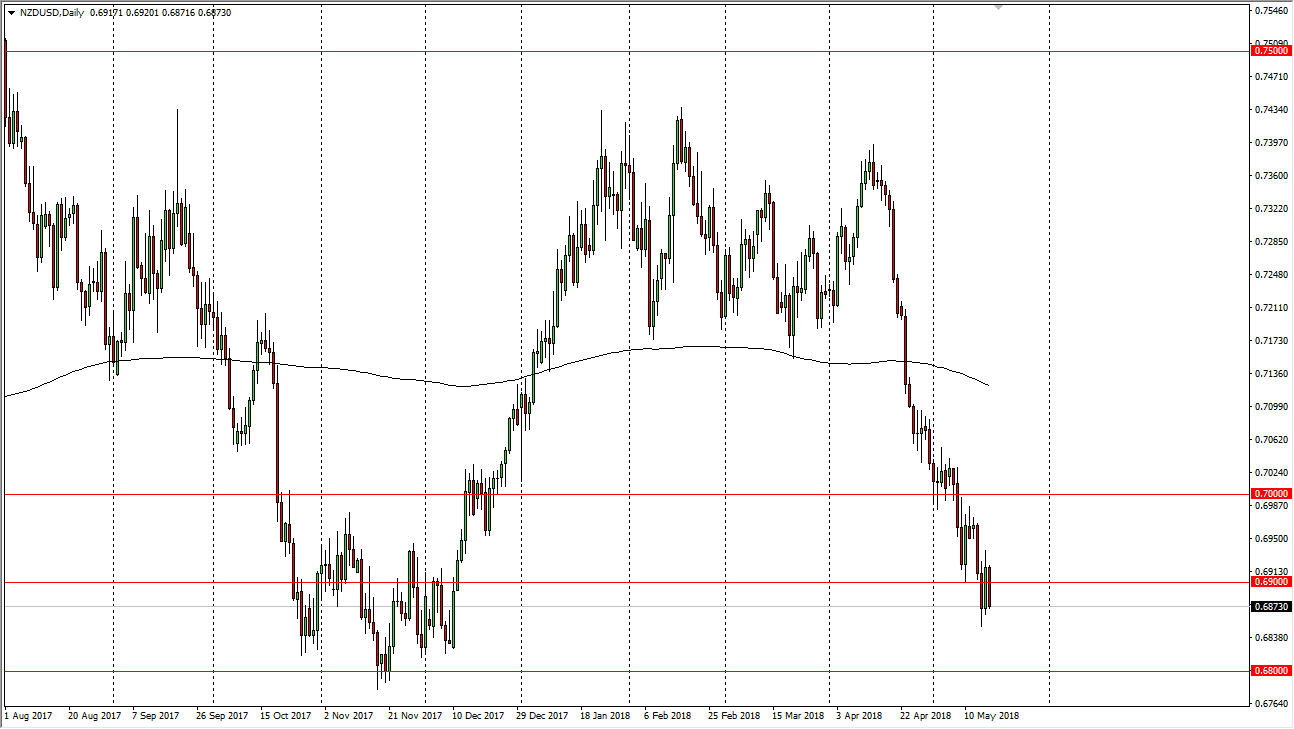

NZD/USD

The New Zealand dollar has broken down significantly during the trading session on Thursday, slicing through the 0.69 handle. It looks likely that we are going to continue to go lower, perhaps reaching to the 0.68 level. I think that every time we rally, sellers will come back, but we are bit overextended. I recognize that the 0.68 level underneath is the bottom of a long-term consolidation area, and that is a very important support level. If we were to break down below there, the New Zealand dollar would fall apart. I would anticipate some type of bounce from there though, because quite frankly we have fallen straight off of a cliff. I suspect that the 0.70 level will offer a bit of a “ceiling” in the market.