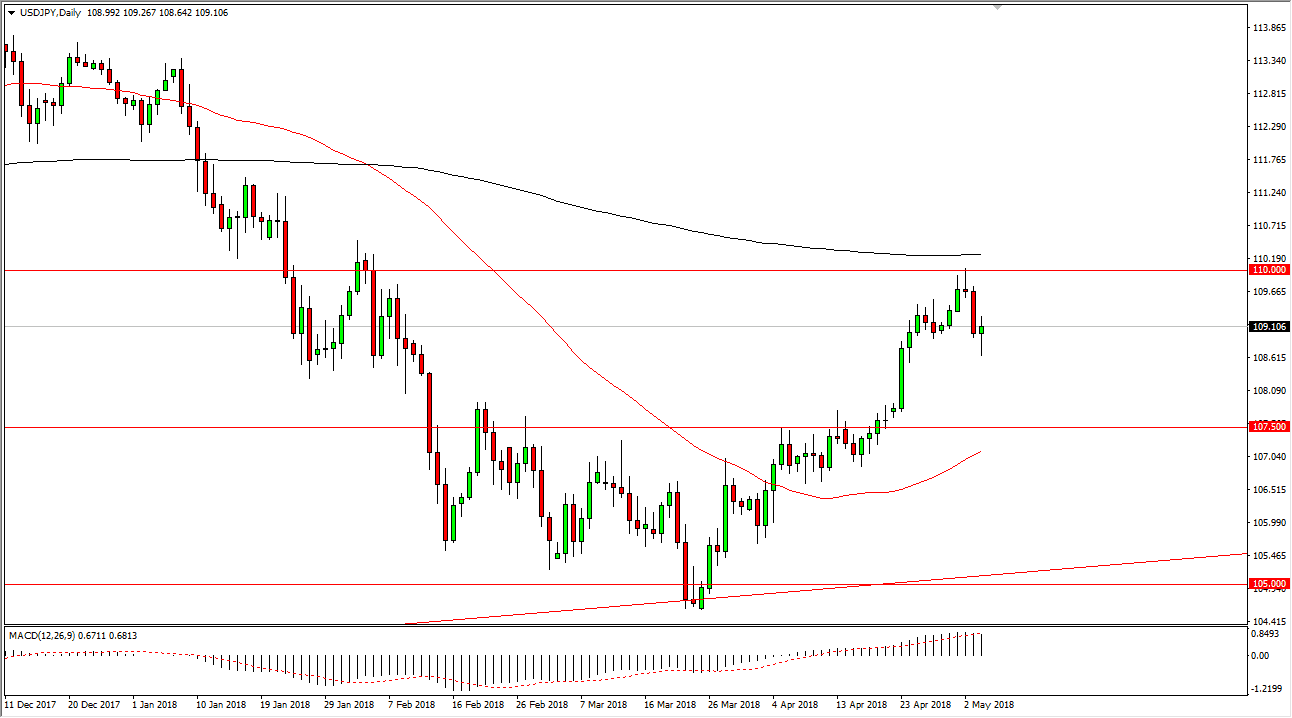

USD/JPY

The US dollar fell initially against the Japanese yen during training on Friday as the jobs report came out and rocked the market as per usual. However, by the time it was all said and done we ended up forming a bit of a hammer. The hammer of course is a bullish sign, so I think that we will probably try to get to the 110-level given enough time. However, I would be remiss if I didn’t point out that the weekly candle was a shooting star, so it’s possible that we continue to fall a bit from here. Even if we do, I think that is only an opportunity to pick up value at lower levels. I think the 107.50 level is significant support, as it was previous resistance. Ultimately, I think we are simply trying to build up the necessary momentum to have the larger move to the upside.

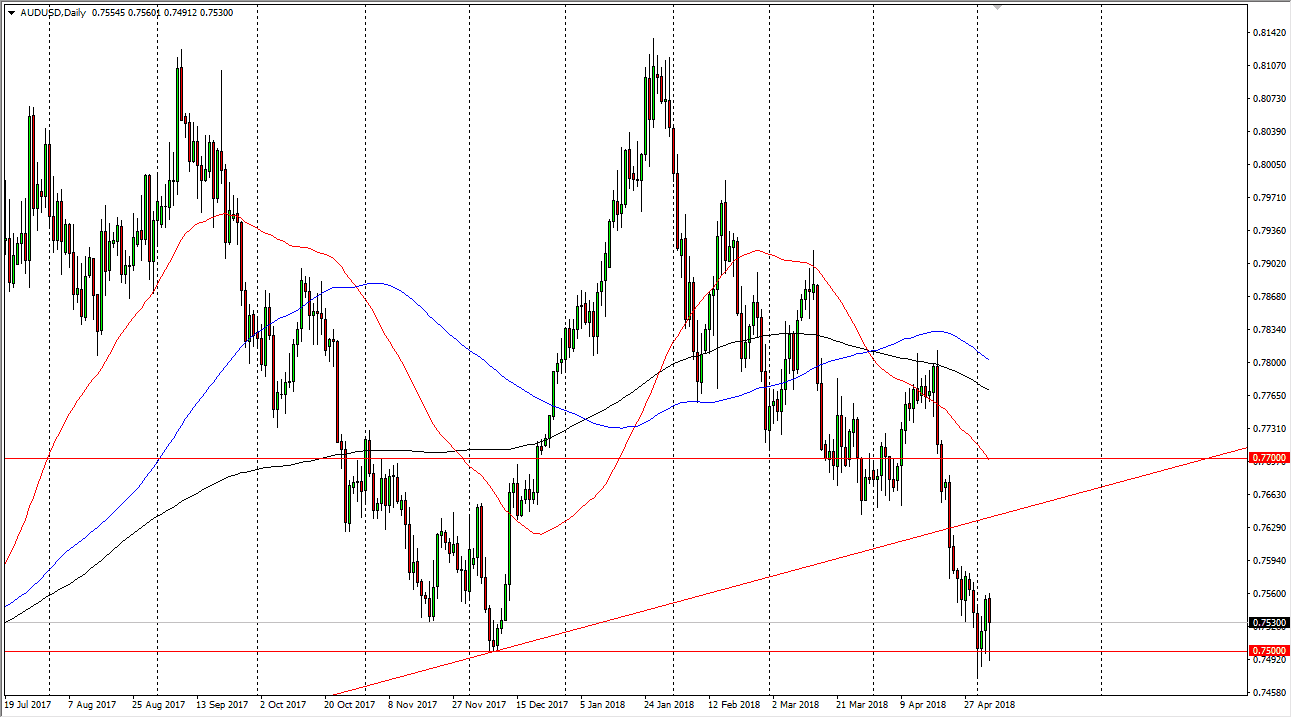

AUD/USD

The Australian dollar has been very noisy during the trading session on Friday, bouncing from the 0.75 handle. This is an area that is of course a large, round, psychologically significant number. I think that if we bounce from here though, we will probably have a significant amount of resistance at the previous uptrend line. I think that the market breaking above there would be a good sign, but it’s not until we clear the 0.77 level that I’m interested in buying. If we break down below the lows from a few sessions ago, then I think the market unwinds to the 0.7350 level. That of course is a support level based upon longer-term technicals, so it’ll be interesting to see what happens there. Pay attention to interest rate markets in America, if they continue to offer more yield, that will put downward pressure on this market.