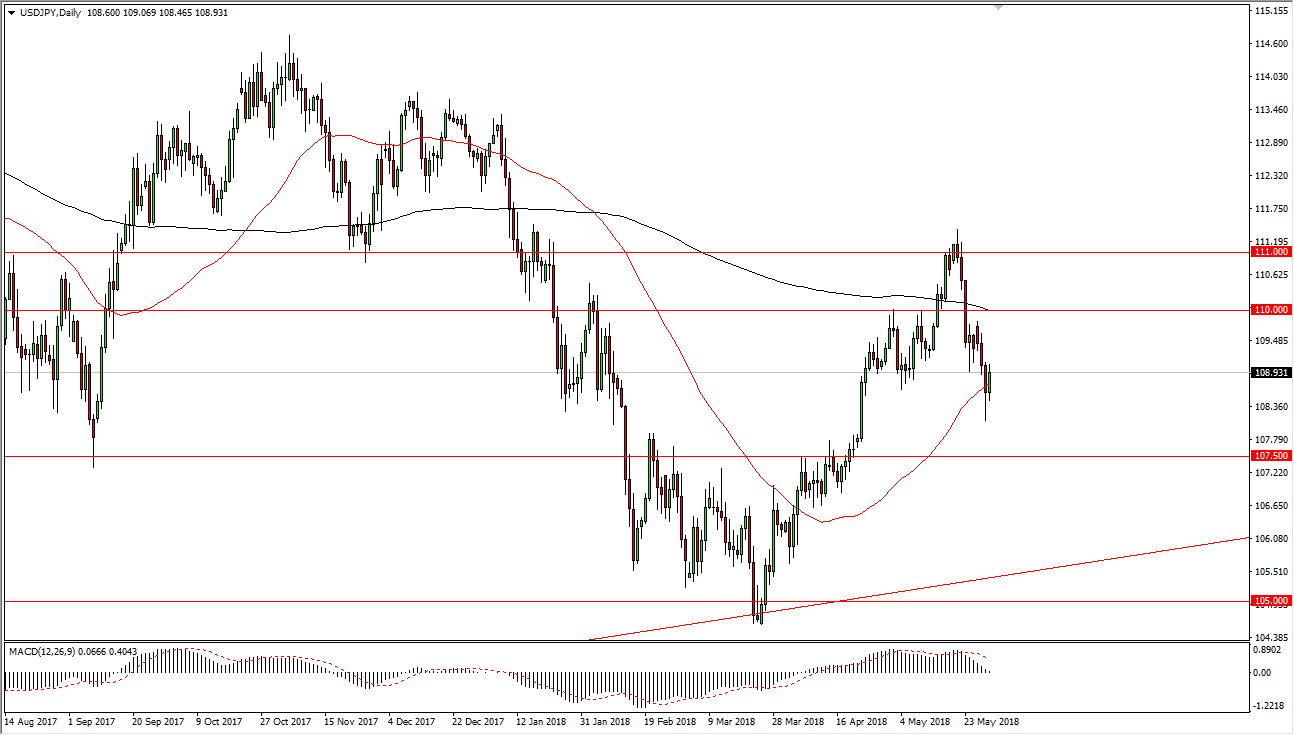

USD/JPY

The US dollar has rallied slightly during the trading session on Wednesday as risk appetite increased again. The Italians look a little less likely to have another election, at least that’s how the market is taking it. Because of this, it’s likely that more risk will be taken. That typically sends this market higher, but I recognize that the ¥109 level is going to offer short-term resistance barrier. I think that eventually we do go higher though, and I think that the “floor” of the market is closer to the 107.50 young level. The 200 day moving average is just above, and we did break down below again, but I think this is typical of this pair as it tries to build up enough momentum to change the trend. It typically means a lot of volatility, but I do think that the buyers are going to jump in and push this market given enough time.

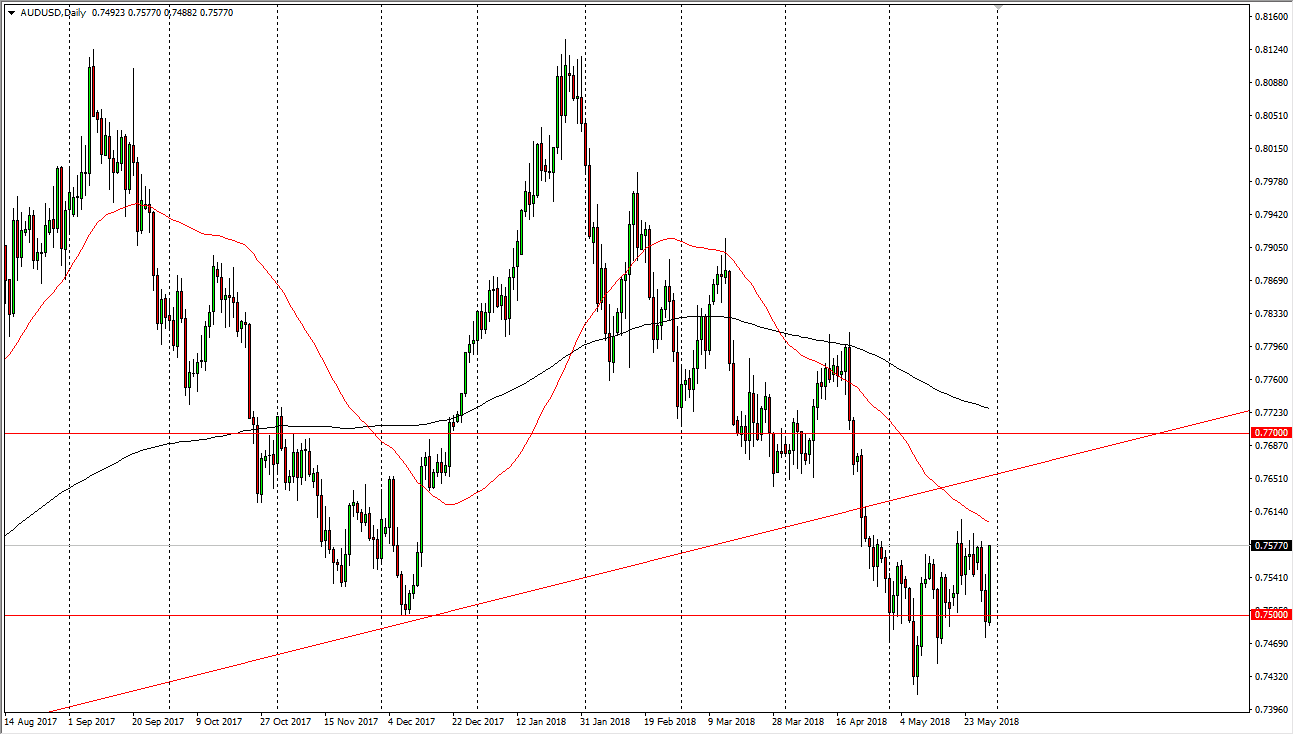

AUD/USD

The Australian dollar has exploded to the upside during the trading session on Wednesday, reaching towards the 0.76 region. The market is currently consolidating, and I think that there is a significant amount of resistance above at the 0.77 handle based upon the previous structure and of course the uptrend line. The uptrend line that we break down below should now be resistance, and I think that signs of exhaustion is right around the corner. I think that eventually we will go looking towards the 0.7350 level, and perhaps even go lower than that. I don’t have any interest in buying this pair, I think that it’s only a matter time before interest rates continue to rise in the United States, and that should send this market lower overall. Pay attention to gold, it will have its usual influence on this pair as well.