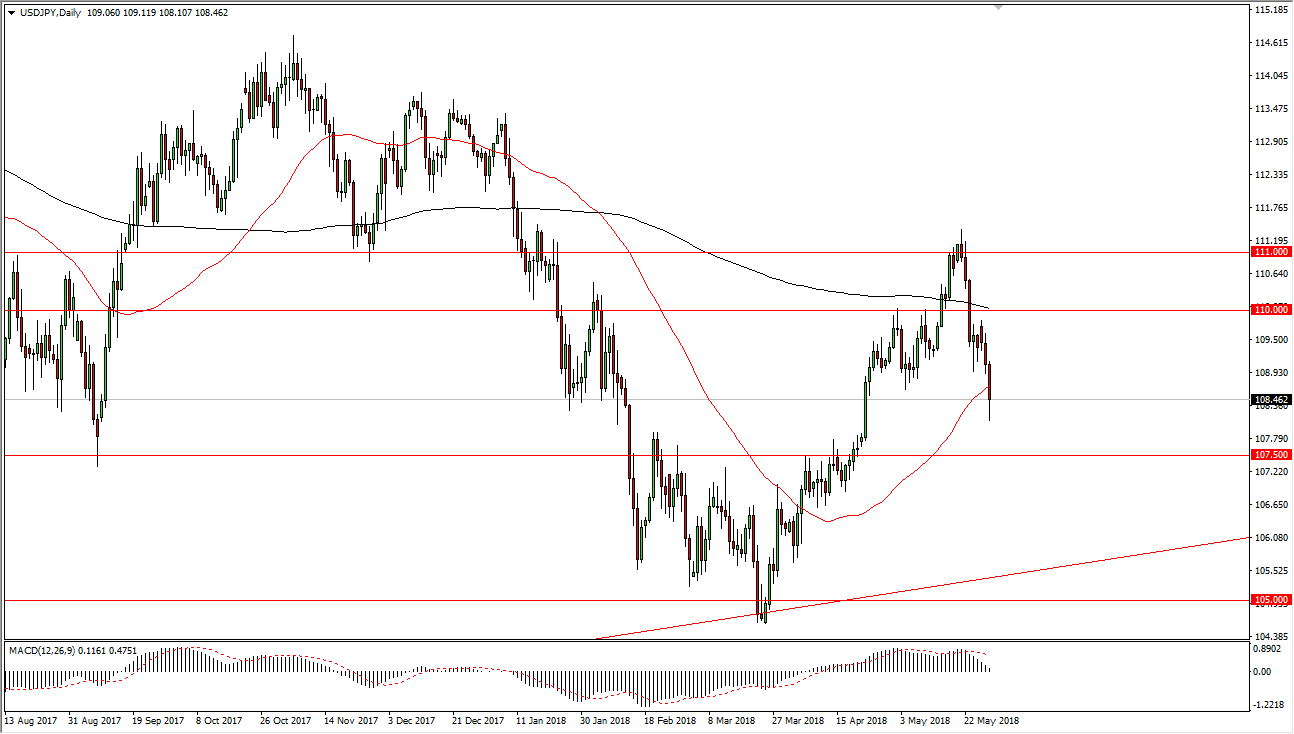

USD/JPY

The US dollar broke down during the course of the session on Tuesday, reaching below the 50 day moving average. The ¥107.50 level underneath continues to be supportive in my estimation though, so I think it’s only a matter of time before we find value. I think that if you are cautious, you can find an opportunity to go long in this market. I believe that the 107.50 level will attract a lot of attention, as well as the uptrend line underneath. Longer-term, I do believe that we go higher, especially considering that we have higher interest rates coming in the United States. I believe that most of the selling during the day on Tuesday was probably due to fears coming out of Italy more than anything else. Overall, I think it’s only a matter time before we go higher, so I’m going to be patiently waiting on the sidelines for an opportunity to go long.

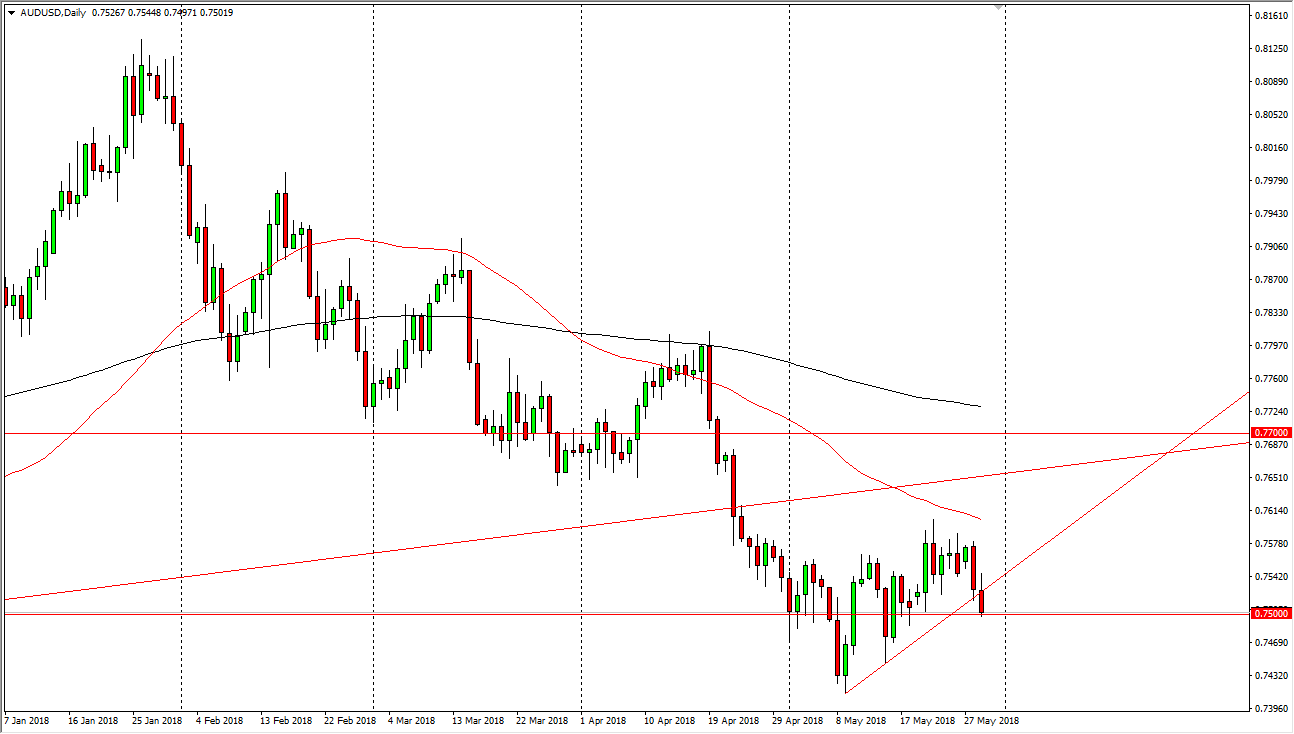

AUD/USD

The Australian dollar broke down against the US dollar during the day, reaching towards the 0.75 level to find support. I think that the market breaking below that level is a nice selling opportunity, as we should continue to go lower again. The short-term uptrend line being broken to the downside is a negative sign, but I think that we need to clear the 0.75 level to be a little bit more comfortable shorting this market, and if we continue to get a lot of fear coming out of Italy, this pair could continue to go lower. If interest rates in the United States continue to rise, I believe that will also drive this market lower. I don’t have any interest in buying the Australian dollar, I think we do continue to go much lower as recently we have broken through a longer-term uptrend line near the 0.76 handle.