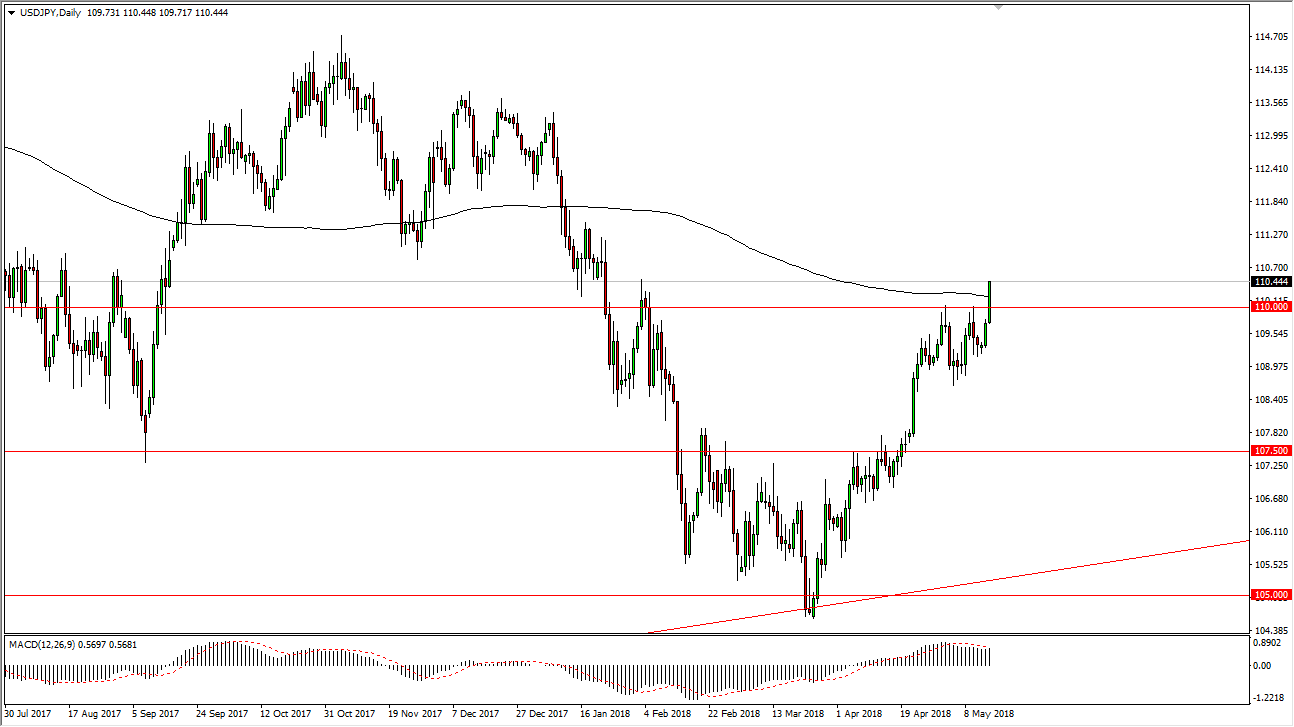

USD/JPY

The US dollar has rallied significantly during the day on Tuesday, breaking above the psychologically important ¥110 level. The 200-day moving average is just above, and we have cleared that level, so I think at this point the US dollar is going to continue to go higher. I like buying pullbacks, and I believe that the 109-level underneath is the bottom of a support “zone” that should continue to lift this market. With the 10-year interest rate climbing above the 3.06% level, it looks as if interest rates in America are about to break out significantly. Because of this, it makes sense that this pair would continue to climb, as it is highly correlated to what’s going on in the 10-year note markets. I suspect that people will continue look at dips as potential value to take advantage of a situation that has seen US dollar strength everywhere.

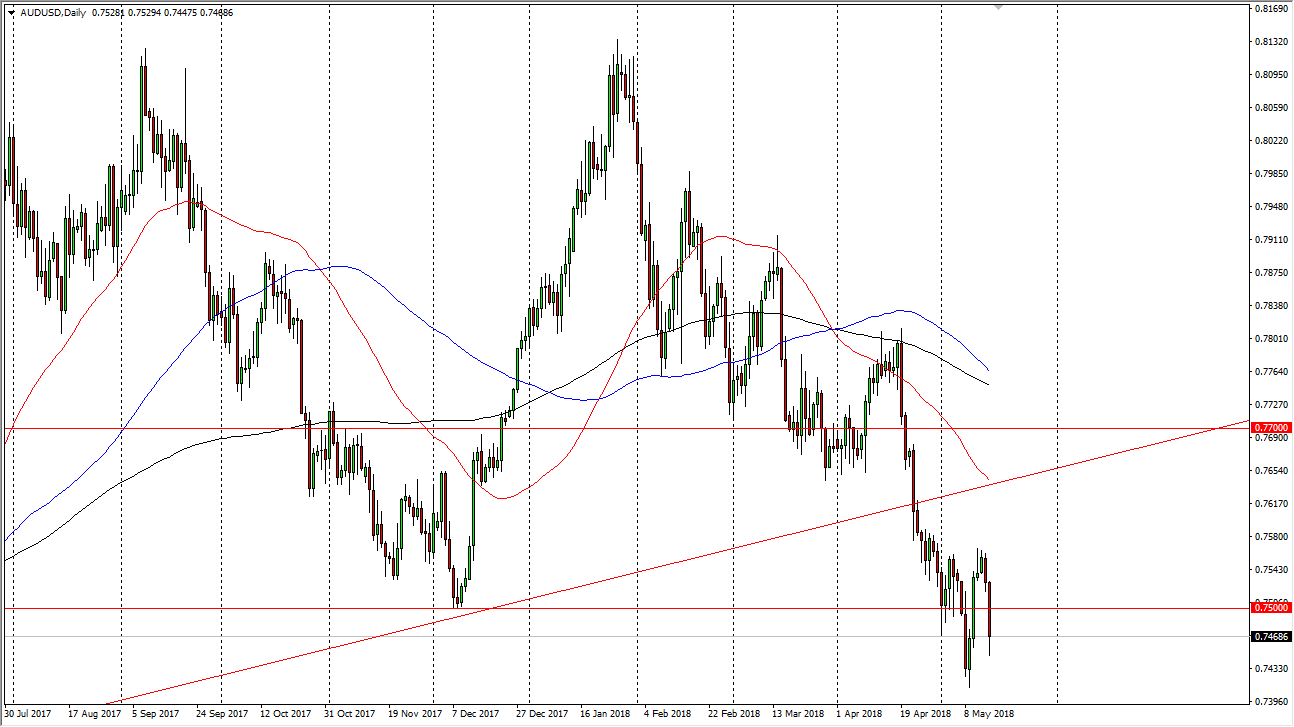

AUD/USD

The Australian dollar has broken down significantly during the day on Tuesday, slicing through the 0.75 handle. The market continues the bounce around this area, but most certainly was very negative during the day. I think that eventually this market could break down and if we get a fresh, new low, the market will break down rather significantly. Otherwise, I would anticipate seeing quite a bit of volatility and choppiness in this general vicinity, but that doesn’t mean that we get the “all clear” to start buying. Just because we show signs of stability could mean that we are showing signs of the market trying to digest the news. It’s not until we break above the previous uptrend line, extensively the 0.7650 level that I would be a buyer. Ultimately, I think that paying attention to the US dollar is the best way to go, as this market has more to do with greenback strengthen anything else.