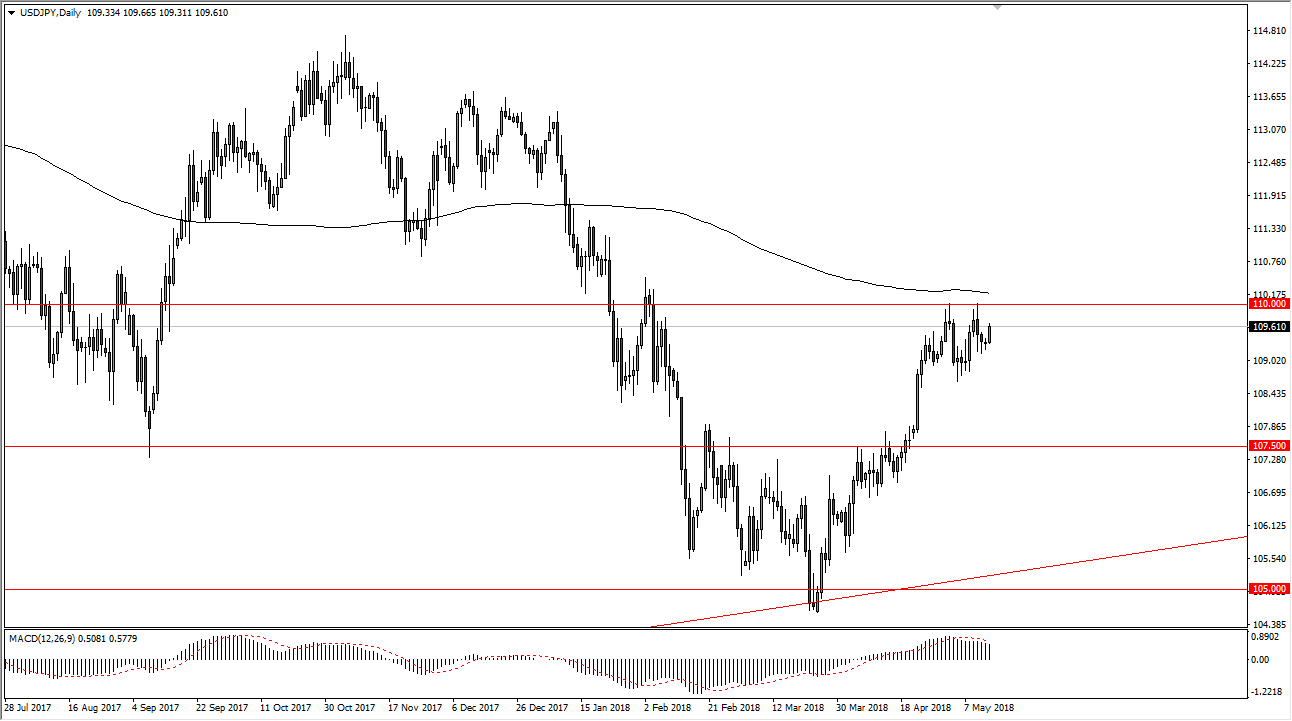

USD/JPY

The US dollar has rallied against the Japanese yen against the trading session on Monday, reaching towards the ¥110 level. I think that if we break above that level, we need to deal with the 200-day SMA, which of course is a psychologically and technically important level. In the meantime, I anticipate that short-term pullbacks should be buying opportunities and could build up enough momentum to finally break out. The ¥109 level underneath has offered support, but I think there’s even more support closer to the ¥107.50 level. Ultimately, I believe that this market is trying to build up the necessary momentum to go higher, especially considering there is such a massive divergence between the interest rate outlook for both countries. I continue to look at short-term dips as being buying opportunities.

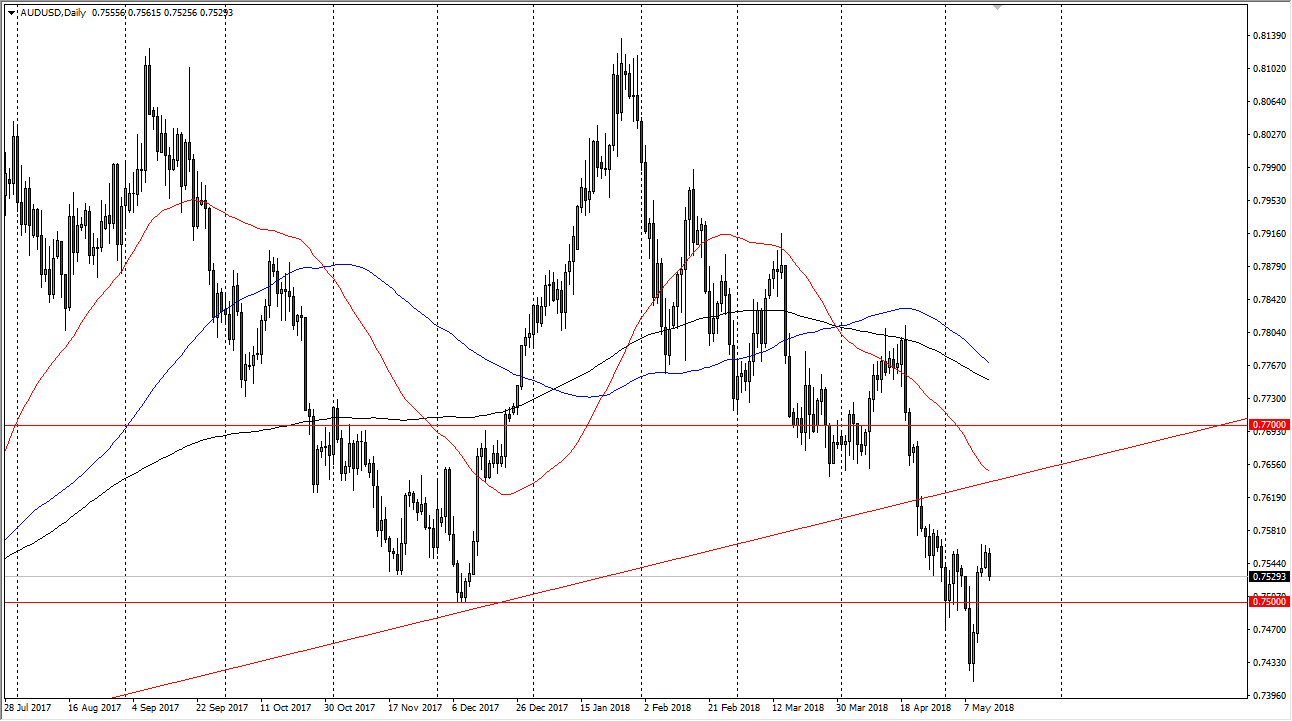

AUD/USD

The Australian dollar has formed a bearish candle for the session on Monday, after forming a very bearish candle on Friday. However, we had formed a hammer on the weekly chart, so I think at this point there is probably some consolidation to be found in this area. If we make a fresh, new low, then I believe that the Aussie goes much lower. I don’t have any interest in buying this pair, at least not longer-term, because I recognize that there’s the previous uptrend line that has been broken through, and of course the 0.77 level which has been massive resistance. I believe it’s only a matter time before you break down to the 0.70 handle based upon that move, and therefore I will be paying a lot of attention to this market. With this type of negativity, I believe that we will continue to see sellers jump in on signs of exhaustion. If we break above the 0.77 handle, the market could go much higher.