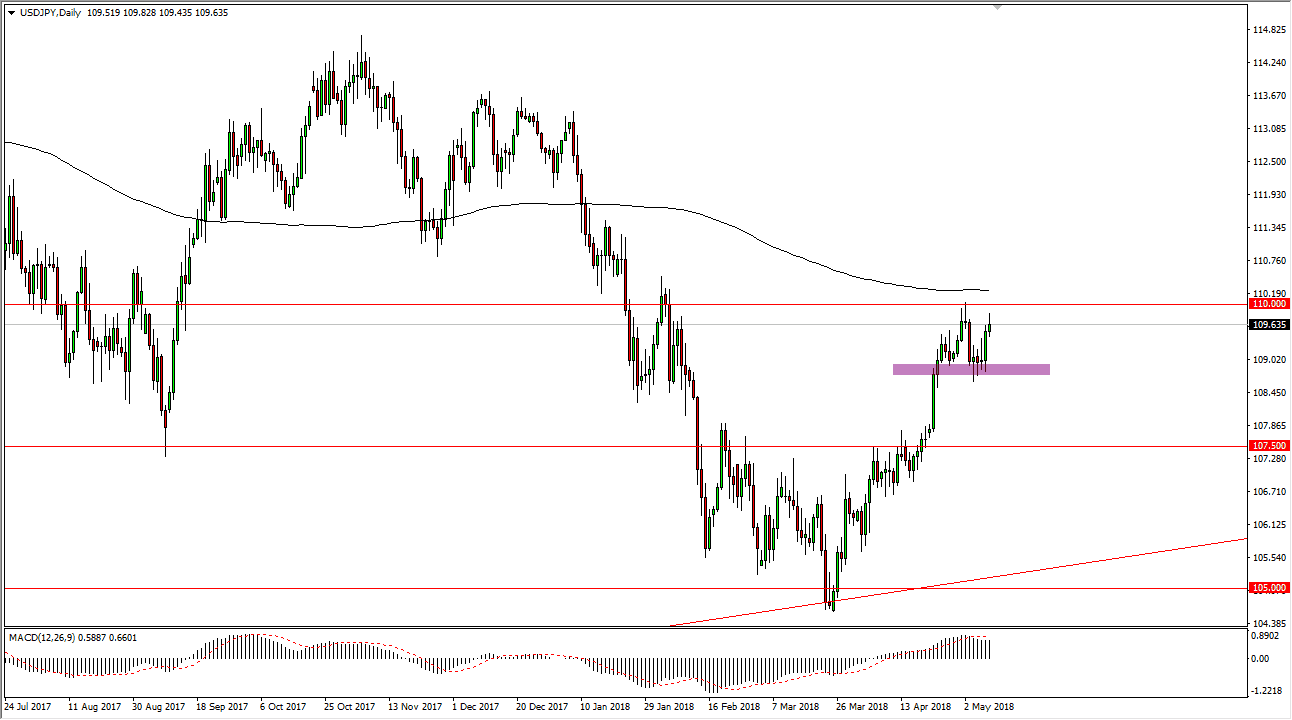

USD/JPY

The US dollar has initially rallied during the session on Wednesday but failed to break above the ¥110 level again. That of course is an area that has been important more than once, and we have the 200-day simple moving average just above that level. Because of this, I think it’s only a matter of time before we roll over again, and I think that breaking above there would be a very bullish sign. Looking at this chart, and the fact that we formed a bit of a shooting star during the day on Wednesday, and that of course gives us an idea that we may pull back. I think we are trying to build up enough momentum to break out, and that may take several attempts. Expect a lot of volatility, but the 109 level being a bit supportive. Beyond that, the 107.50 level is massive support.

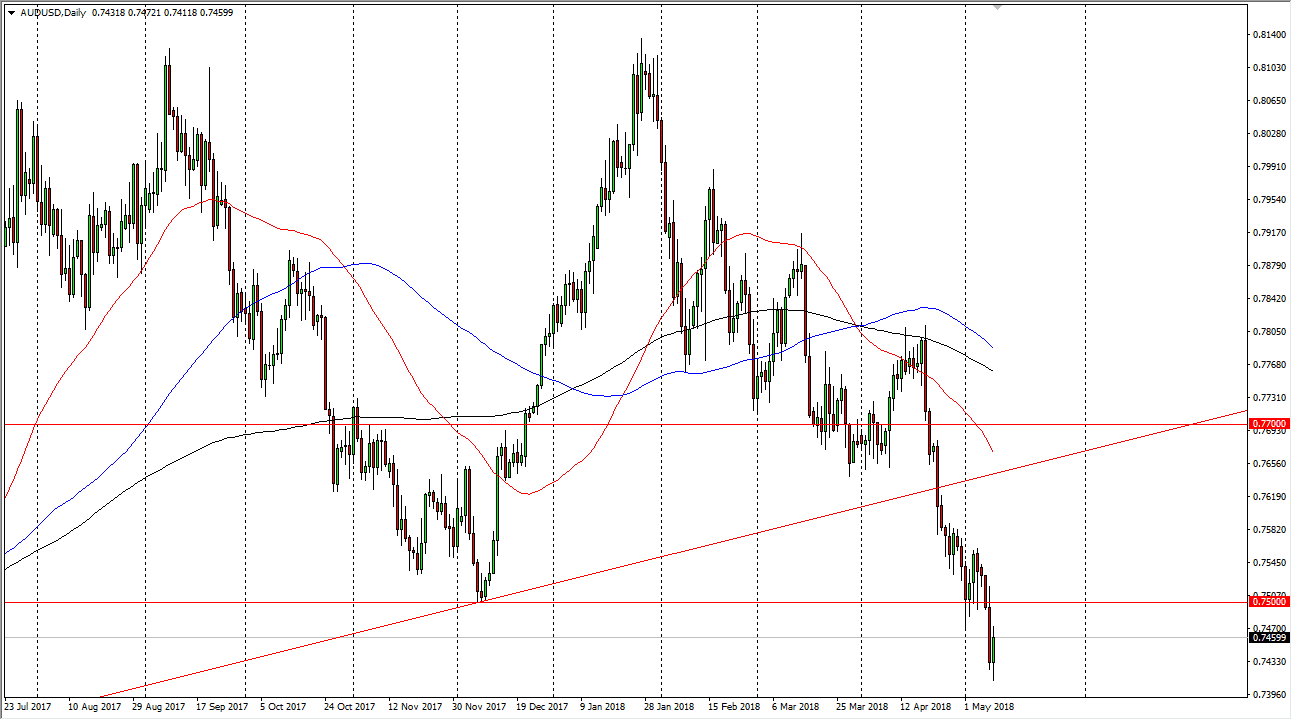

AUD/USD

The Australian dollar has initially falling during the day on Wednesday, but then rallied again to reach towards the 0.7475 handle. I think the 0.75 level above is going to be resistance, mainly because it was so important in the way of support in the past. I believe that the recent breakdown through an uptrend line of course is a sign that we are going to struggle going forward, and I do believe that the summer is going to be very positive for the US dollar in general. I think that the market will unwind towards the 0.7250 level, possibly the 0.70 level after that. If we were to break above the 0.77 handle, we would then probably turn things around completely. I don’t think that happens anytime soon though, and I believe that rallies continue to offer selling opportunities.