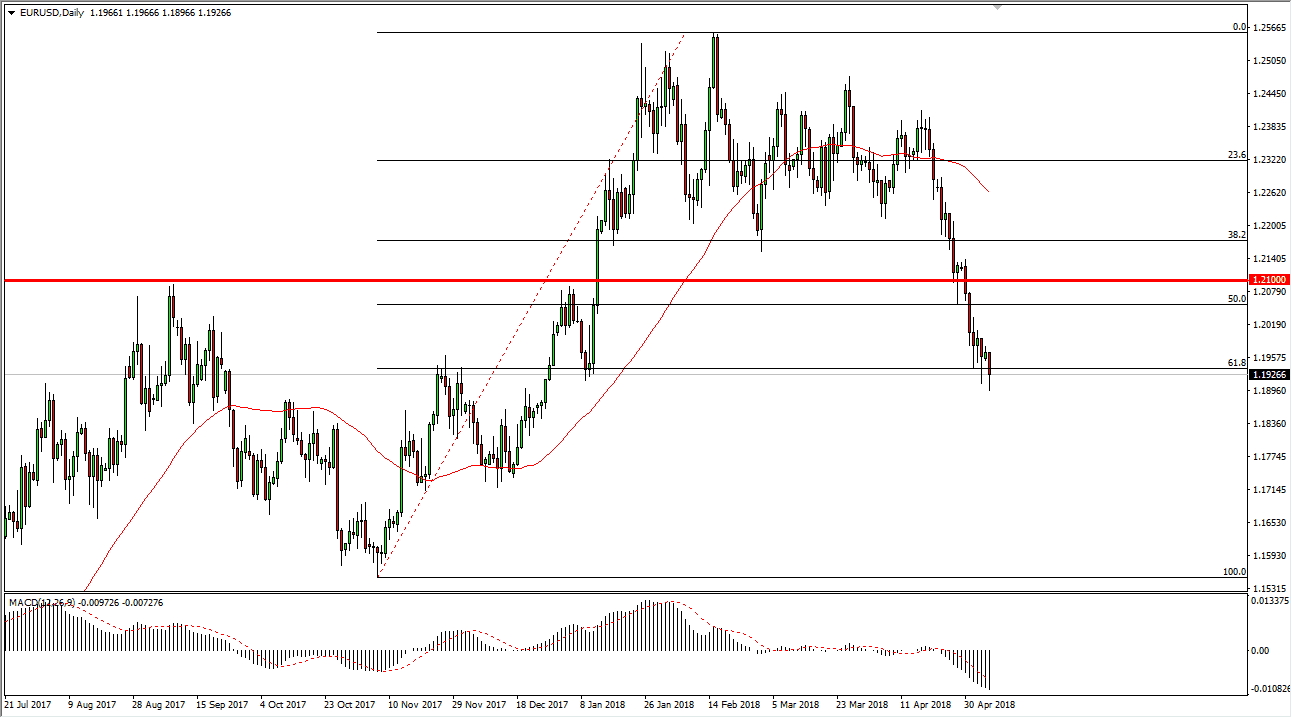

EUR/USD

The Euro fell again on Monday, as the US dollar continues to show strength in the Forex markets, with higher interest rates coming in and of course better economic indicators coming out of America. It looks as if the ECB is going to step away from normalizing monetary policy anytime soon, and this should continue to put bearish pressure on this pair through the summer. Currently, it looks as if we may be a bit oversold, so perhaps a bounce is necessary. However, I suspect that the 1.21 level will be significant resistance so I’m looking for shorting opportunities after slight bounces. Longer-term, I suspect that we will probably go looking towards the 1.15 handle, now that we have pierced the 61.8% Fibonacci retracement level several times. Typically, Mark so move in one direction forever and we most certainly are due for some type of correction.

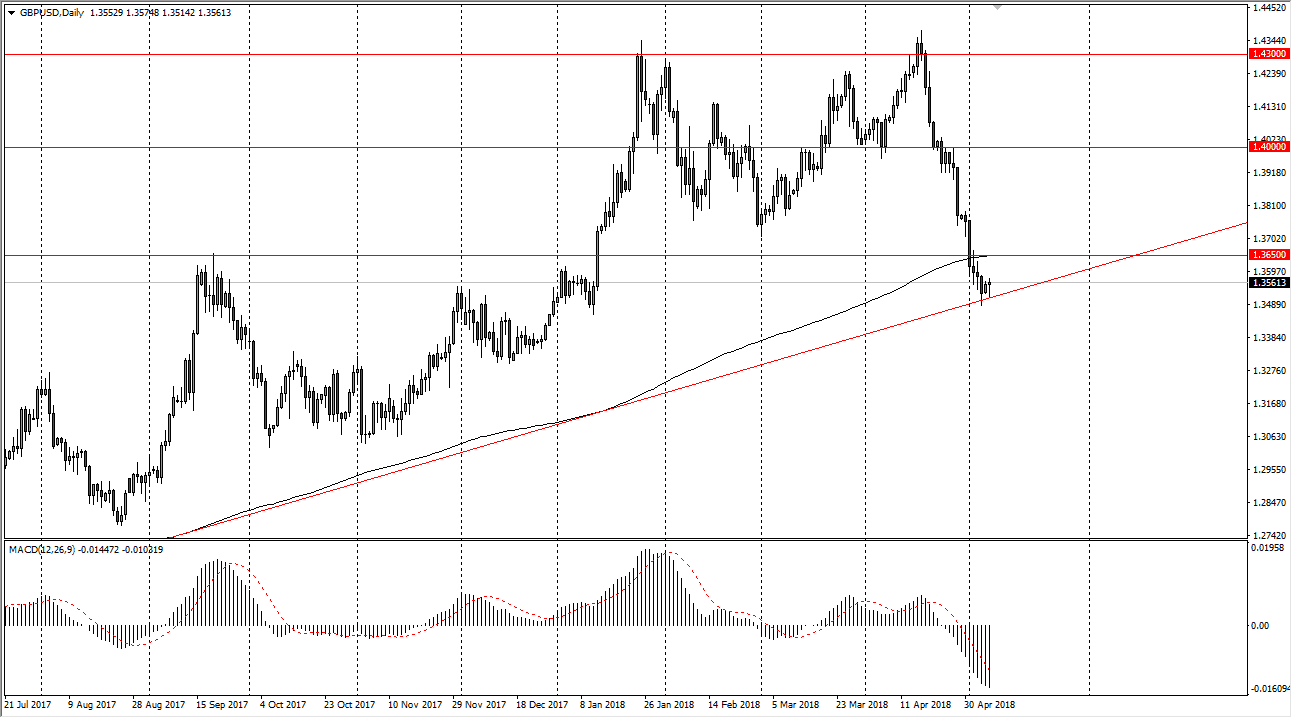

GBP/USD

The British pound fell initially during the day but found enough support at the uptrend line to turn things around. However, even though we had formed a hammer I suspect there is a lot of bearish pressure above, especially near the 1.3650 level. I would be a seller at the first signs of exhaustion in that region, or perhaps a breakdown below the lows of Friday. It's worth noting that the 200-day moving average is at the 1.3650 level, so I think it's only a matter of time before sellers will come in and start pushing lower in that general vicinity. The 200-day moving average doesn't get broken very often, but when it does it tends to be a big deal. Because of this, I expect we may get a short-term reprieve for the British pound, only to see the sellers come back.