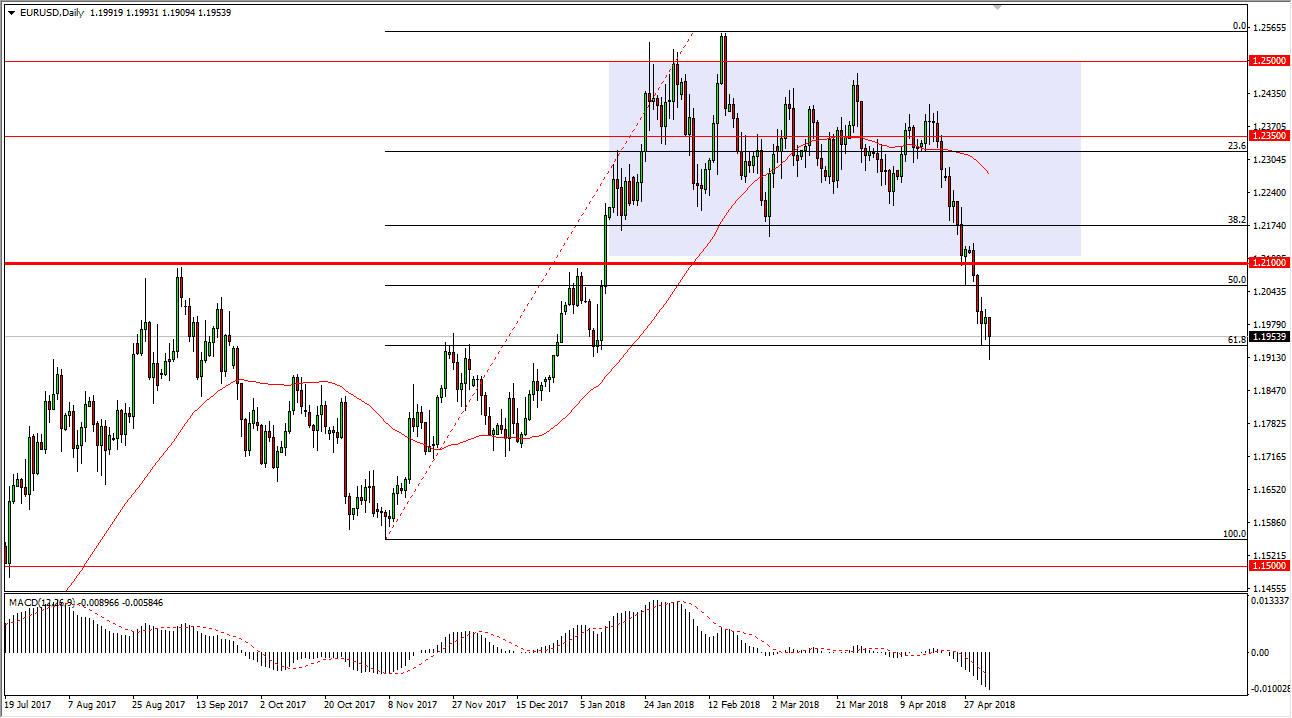

EUR/USD

The EUR/USD pair fell again during Friday trading, breaking down below the 1.1950 level. That of course is a negative sign, but we did recover a bit going into the weekend. I think that we could get a short-term rally, but I think that the 1.21 level will course continue to offer resistance as it was previous support. I think that any rally from this point should be a selling opportunity just waiting to happen. If we get some type of exhaustion, I would jump all over that. One thing that I would say about this is that the 61.8% Fibonacci retracement level has been reactive, but with interest rates rallying in the United States and the ECB likely to keep interest rates low for a longer amount of time, I think that this market will eventually try to break down. If it does, I think eventually we could be looking at the 1.15 level. If we break above the 1.2150 level, then we will probably try to retake the 1.25 handle.

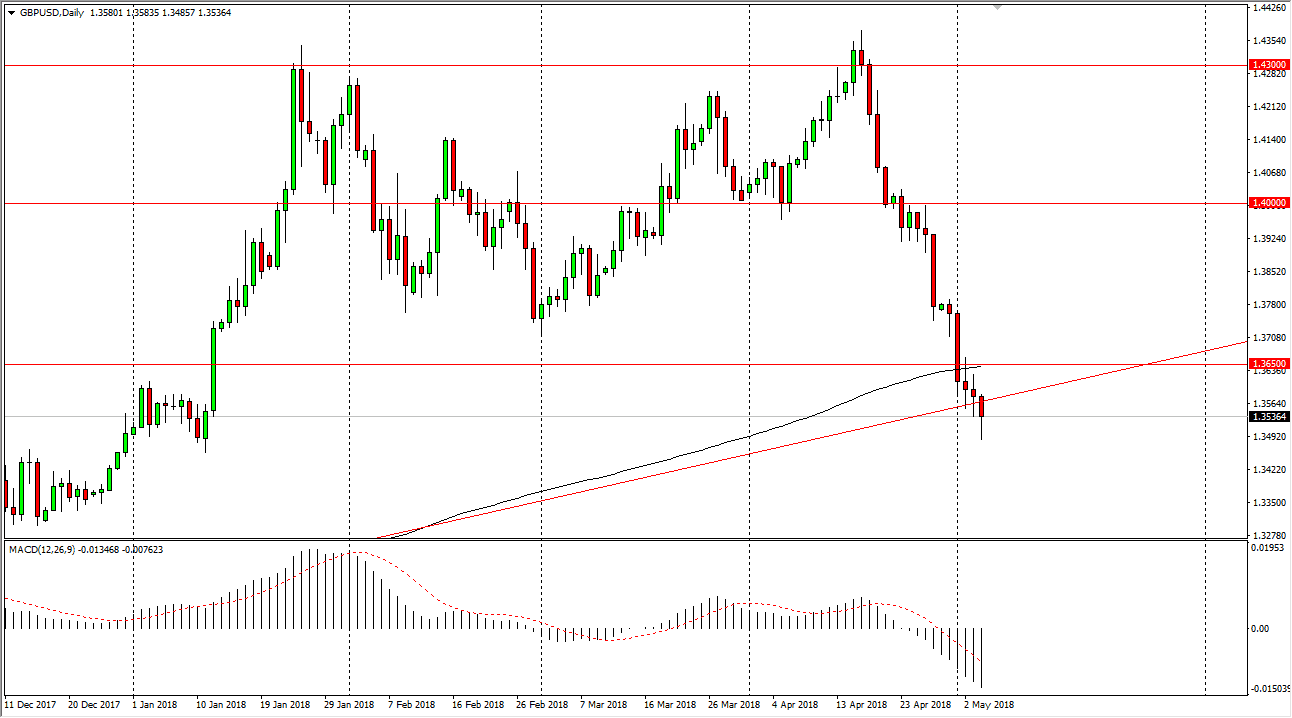

GBP/USD

The British pound fell during the trading session on Friday after the jobs number came out in America, as we have sliced through a major uptrend line. The question now is whether we can continue to keep the bearish pressure of. I think that the 1.3650 level would have to be overtaken on a daily close to start buying, and in the meantime I would look at short-term rallies as selling opportunities at the first signs of exhaustion. Otherwise, if we break down below the bottom of the candle for the trading session on Friday, then we should continue the downward pressure in this market, reaching down towards the 1.33 level, and then possibly the 1.3 level after that.