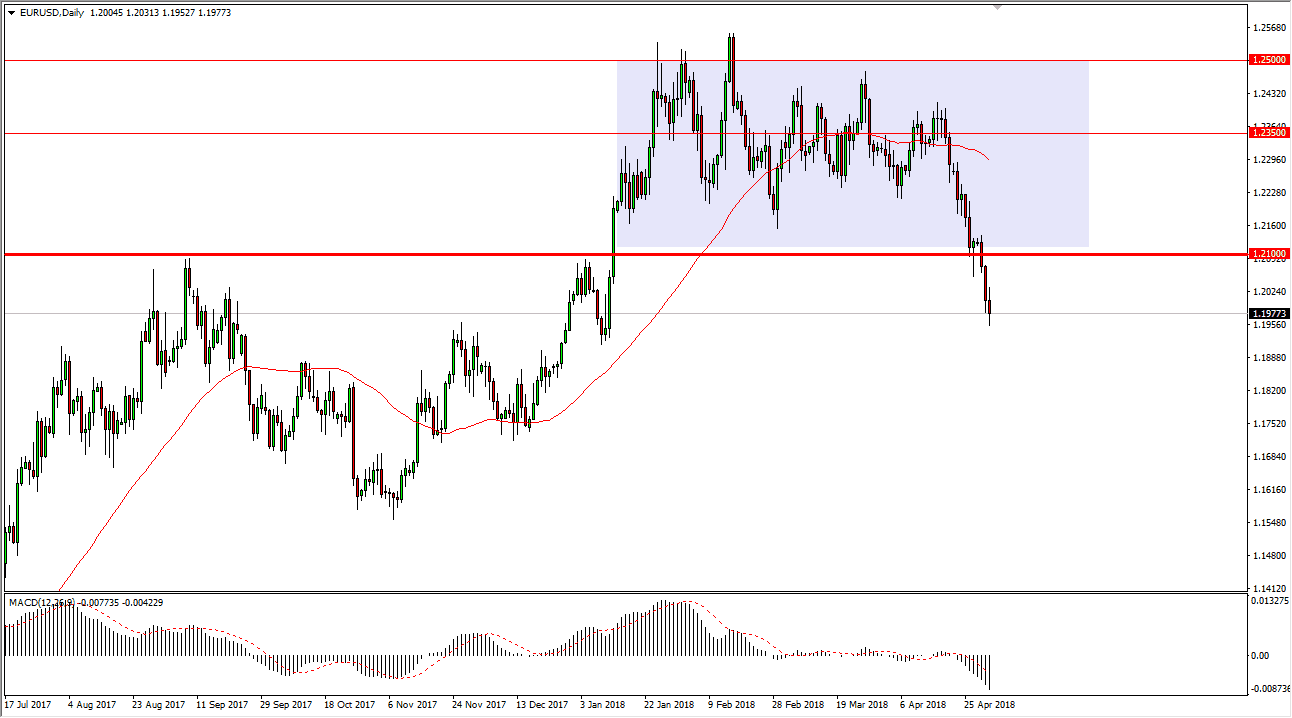

EUR/USD

The EUR/USD pair broke down a bit during the day on Wednesday but found support near the 1.1950 level as the FOMC statement came out relatively benign. The 1.21 level above should continue to be resistance as it was previous support, and I think that bounces that happen in this area will more than likely find a lot of selling pressure near that area. I believe in selling rallies as they occur, unless of course we can break above the 1.2150 level. If we break down below the bottom of the hammer like candle for the session, that probably allows this market to go down to the 1.18 level. However, I suspect that this is simply a function of traders looking to close out positions ahead of the vital jobs number coming out tomorrow.

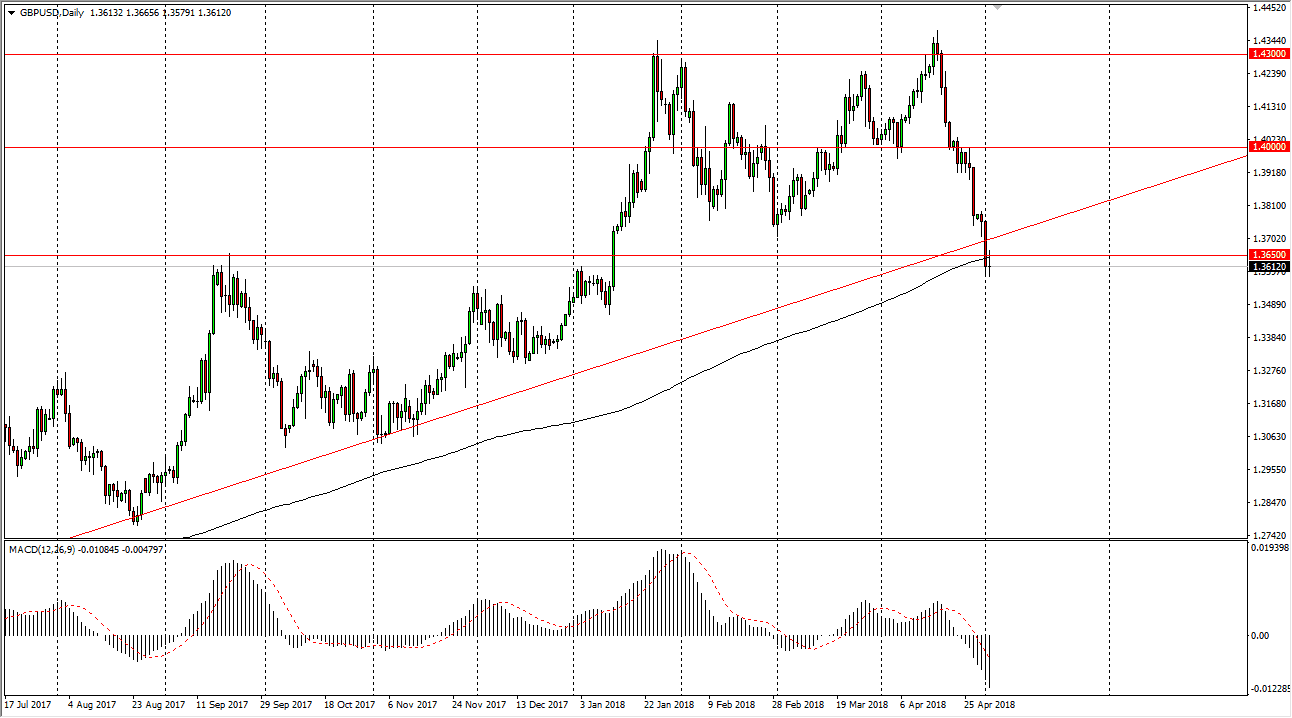

GBP/USD

The British pound has initially fell during the day on Wednesday but turned around to show signs of life again. We are testing the 1.3650 level as I record this video, and we are sitting right at the 200-day simple moving average. Considering that the last couple of candles have formed a bit of a short-term double bottom, if we can break down below the lows of both Wednesday and Tuesday, it’s a great sell signal. Otherwise, we could turn around and try to break above the top of the uptrend line, which would be a very bullish sign. However, I think that it’s very unlikely to be a situation where we get a significant move between now and the jobs number tomorrow. I anticipate that you are probably better off waiting until that announcement and the subsequent reaction to put money to work. However, if any of the previous mentioned areas get broken, that in and of itself can be a signal.