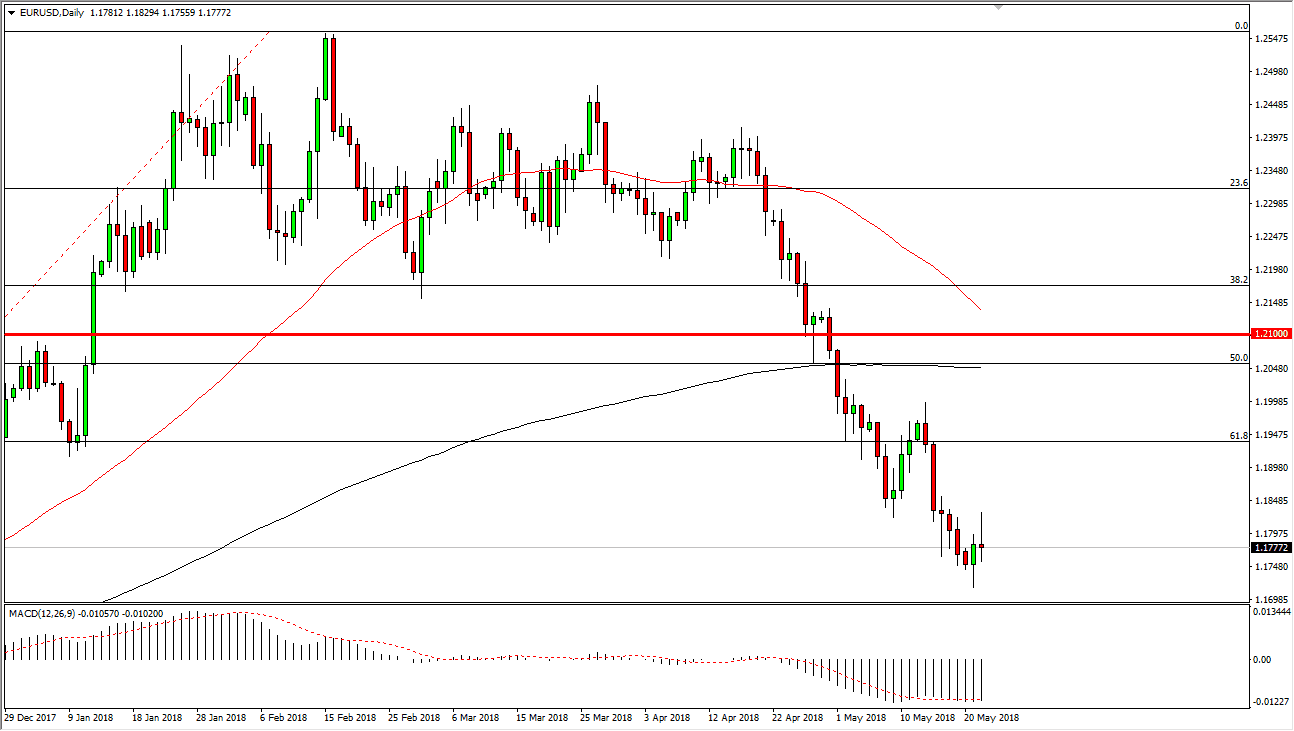

EUR/USD

The EUR/USD pair initially rallied during Tuesday but rolled over the form a huge shooting star. This shows just how negative this market is, as every time we form a hammer, it seems that it fails the next day. There is simply no buying this pair, and every time we rally one would think that the sellers will be very interested. We are well below the 200-day moving average, and the 50-day moving average is getting close to crossing it as well, which is an even more negative sign. I believe that the market is going to go looking towards 1.15 level underneath, which has been important in the past. Ultimately, I feel that this market will continue to find reasons to go lower, not the least of which is going to be interest rates rising in the United States, and of course the bond troubles in Italy.

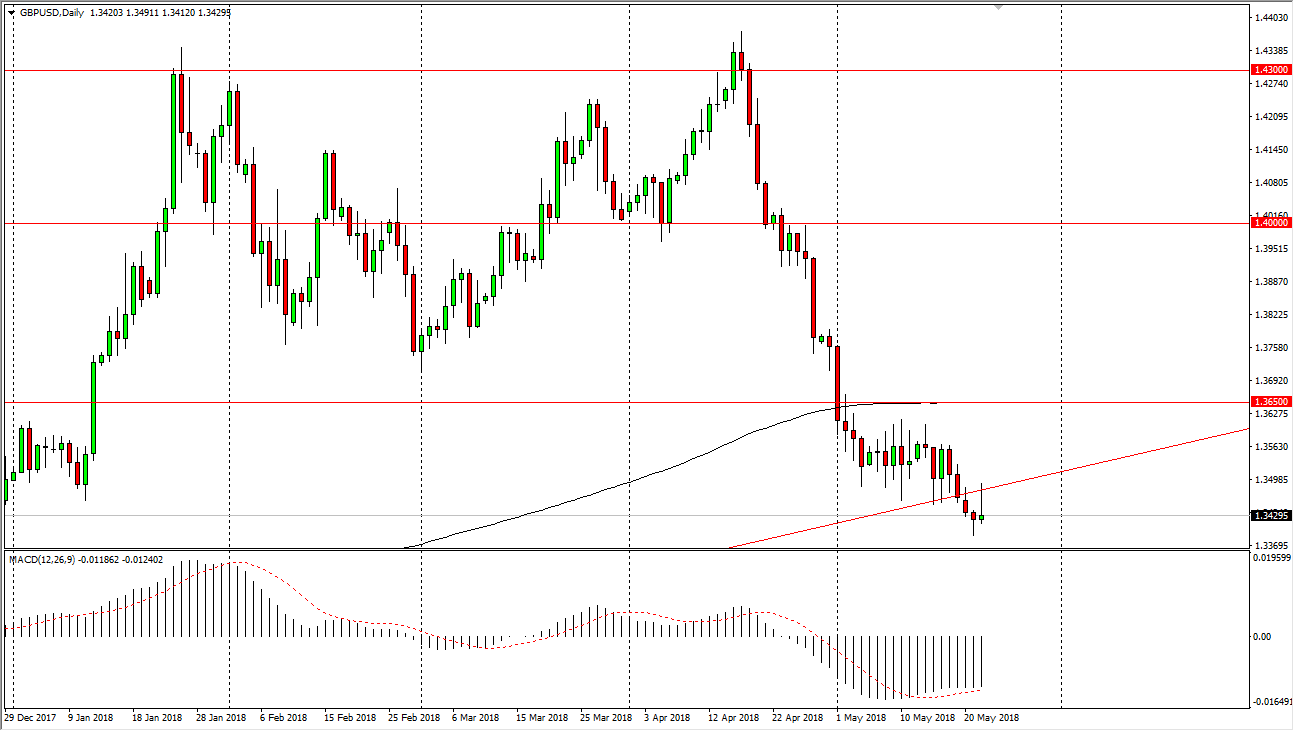

GBP/USD

The British pound also tried to rally during the day but failed at the previous uptrend line, forming the shooting star. This is a very negative sign and I think we will eventually go much lower in this market. I believe that the US interest rates will continue to rise, and that will continue to put a lot of bearish pressure on this market. Ultimately, I think we will probably break towards the 1.33 handle, and then eventually the 1.30 level. I’m not interested in buying until we break above the 200-day moving average, closer to the 1.3650 level, something that doesn’t look very likely after the Tuesday session failing so drastically. I don’t necessarily think we are going to melt down, but certainly there is a bias to the downside in this pair as the last couple of months have been rather negative.