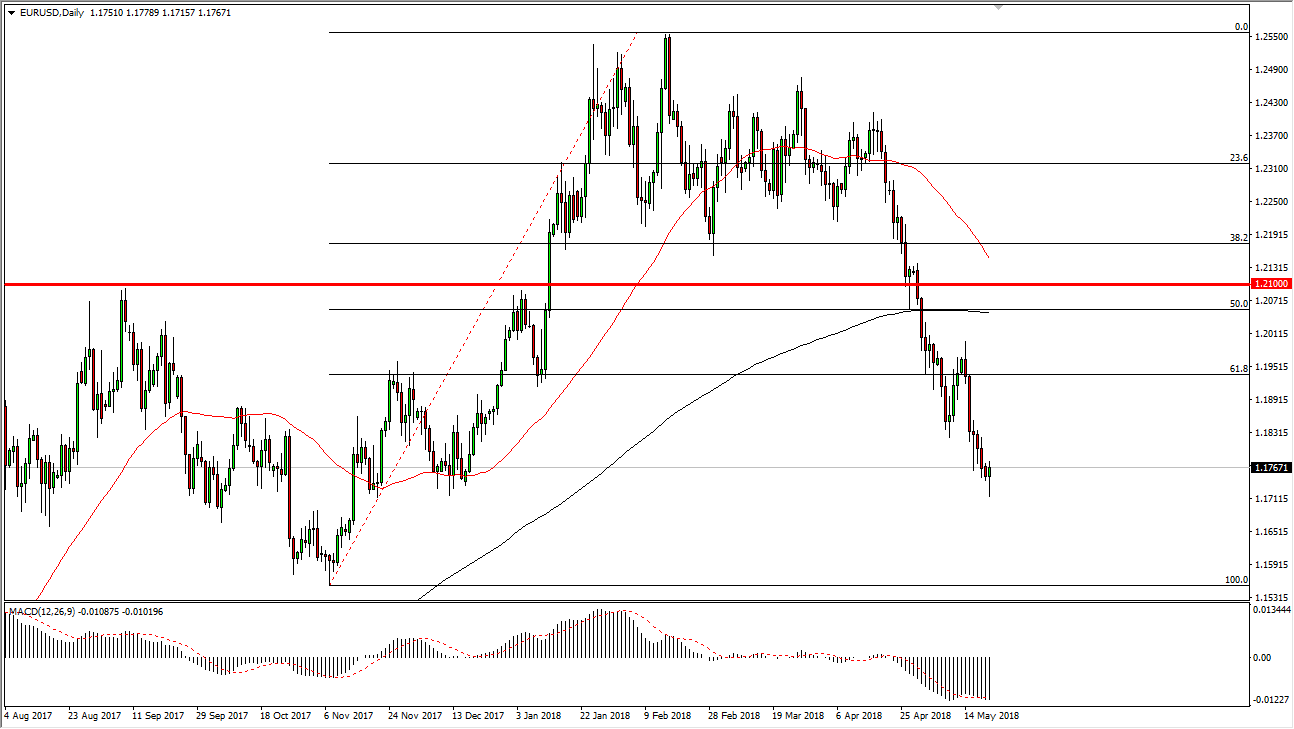

EUR/USD

The Euro fell against the Monday session as we have seen over the last couple of weeks but did turned around to form a hammer for the session. If we can break above the top of the range, that is technically a bullish signal, but I think it’s only a matter of time before the sellers get involved. At this point, I think that the market bouncing could send this market to higher levels, but at this point I think it would be more of a “dead cat bounce” than anything else. I would look to sell signs of exhaustion as soon as they appear, especially near the 1.1950 level. Otherwise, if we break down below the hammer for the session, that should be a very negative sign and could unwind the market down to the previous long-term below at the 1.1550 region. With the US interest rates rallying, it’s likely that we will continue to see more dollar pressure.

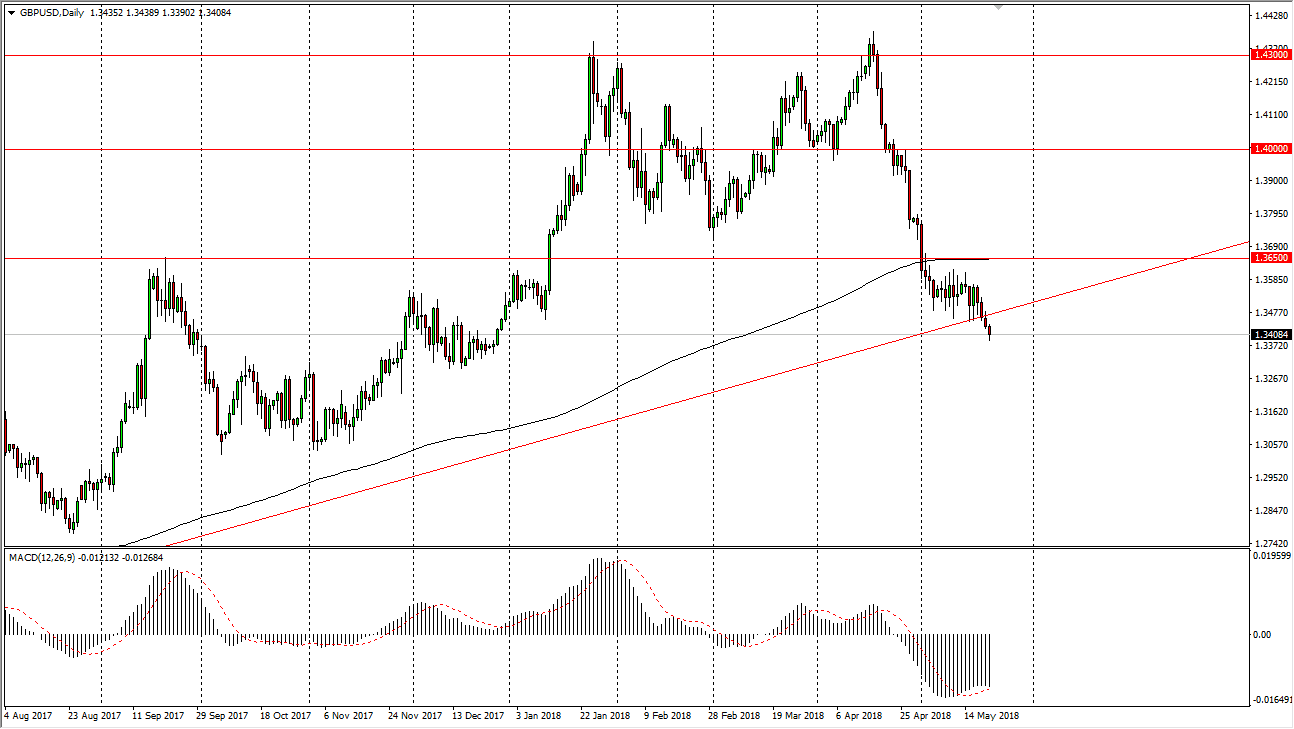

GBP/USD

The British pound has fallen a bit during the trading session on Monday but did see a little bit of support at the 1.34 level. I think that the market model has plenty of resistance above though, and I think that any short-term bounce should show an opportunity for sellers get involved as it would represent a bit of value in the US dollar. The previous uptrend line should now offer resistance, especially near the 1.35 handle. The alternate scenario of course is breaking down below the hammer for the session on Monday, both of which could send this market down to the 1.33 handle, and then eventually the 1.30 level after that. I don’t have any interest in buying this pair, at least not until we break above the 200-day moving average marked on the chart.