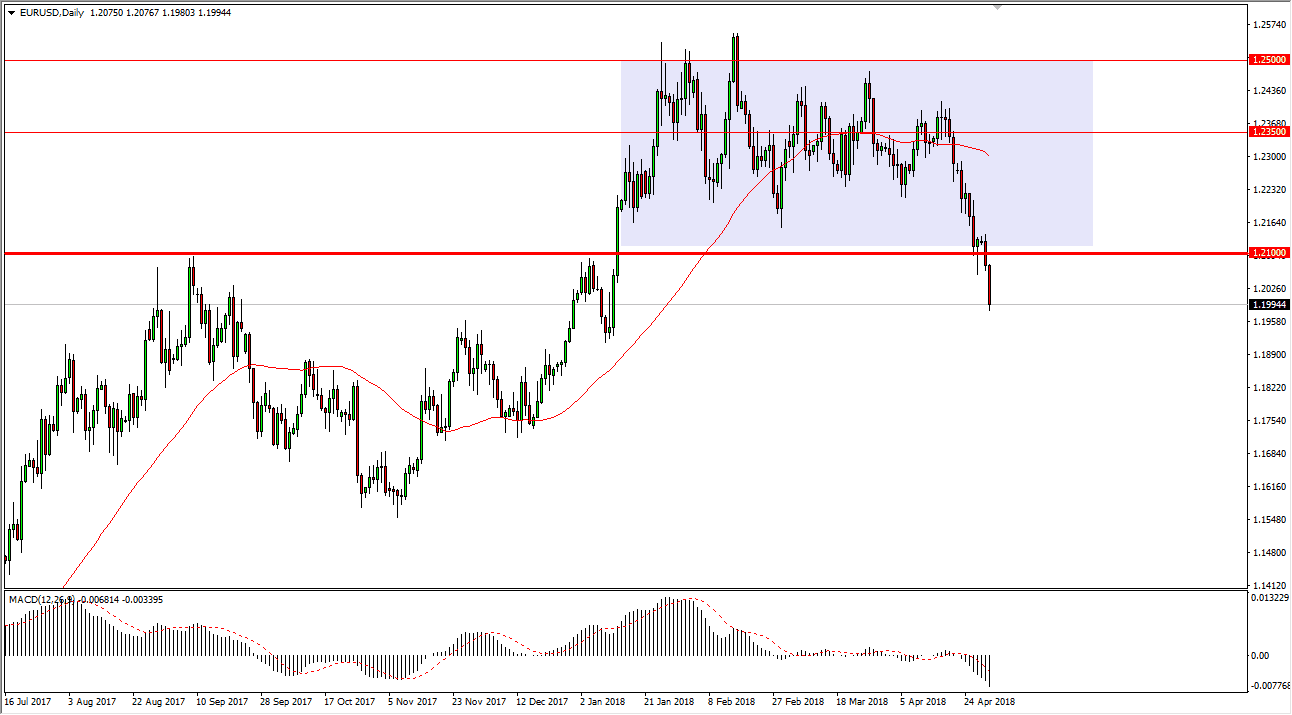

EUR/USD

The EUR/USD pair broke down during Tuesday trading, as we have sliced through the bottom of a hammer, that we formed several days ago. By doing so, we have tested the 1.20 level, which is where we currently find the market. If we break down below the bottom of the range for the session on Tuesday, the market then goes much lower. Rallies at this point should find plenty of resistance until the 1.2150 level. Any rally at this point should be an opportunity to sell at the first signs of exhaustion, but if we were to break above the 1.2150 level, the market could then go to the 1.23 level. This pair is reacting to the strengthening interest rates in the United States, and that of course is exacerbated by the ECB stepping away from perceived bullish attitudes.

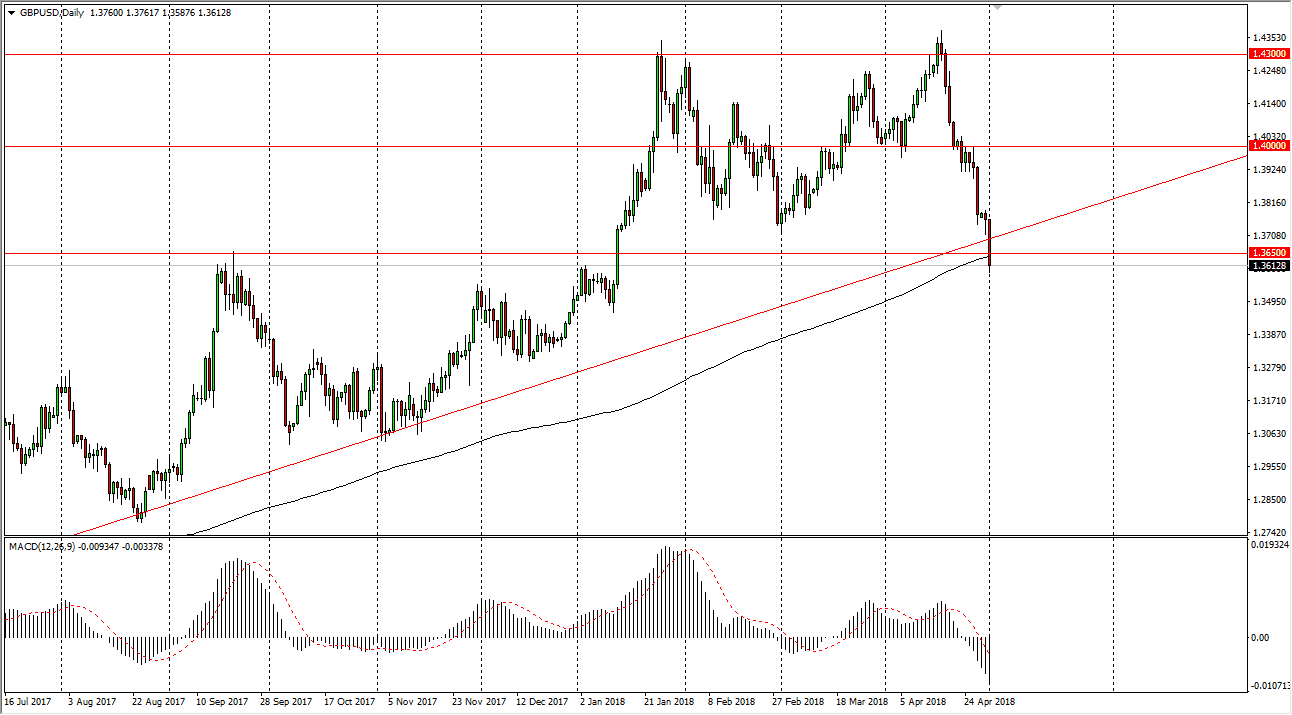

GBP/USD

the British pound has broken through the major trend line that I talked about yesterday, testing the 200 SMA. The 1.3650 level is supportive, but I think that if we can break down below the lows of the session on Tuesday, that sends this market much lower. This could have this pair going down to the 1.30 level longer term, but obviously will see the 1.35 level as support between here and there. If we rally, it’s not until we clear the 1.38 handle, then I think that the market could continue to go higher. Remember, the 200-day SMA is vital for longer-term traders, so it does not surprise me that we have bounced a bit towards the end of the day. I think the jobs number on Friday will give us a longer-term and definite direction in this pair. Ultimately, breaking through this trend line is a very negative sign.