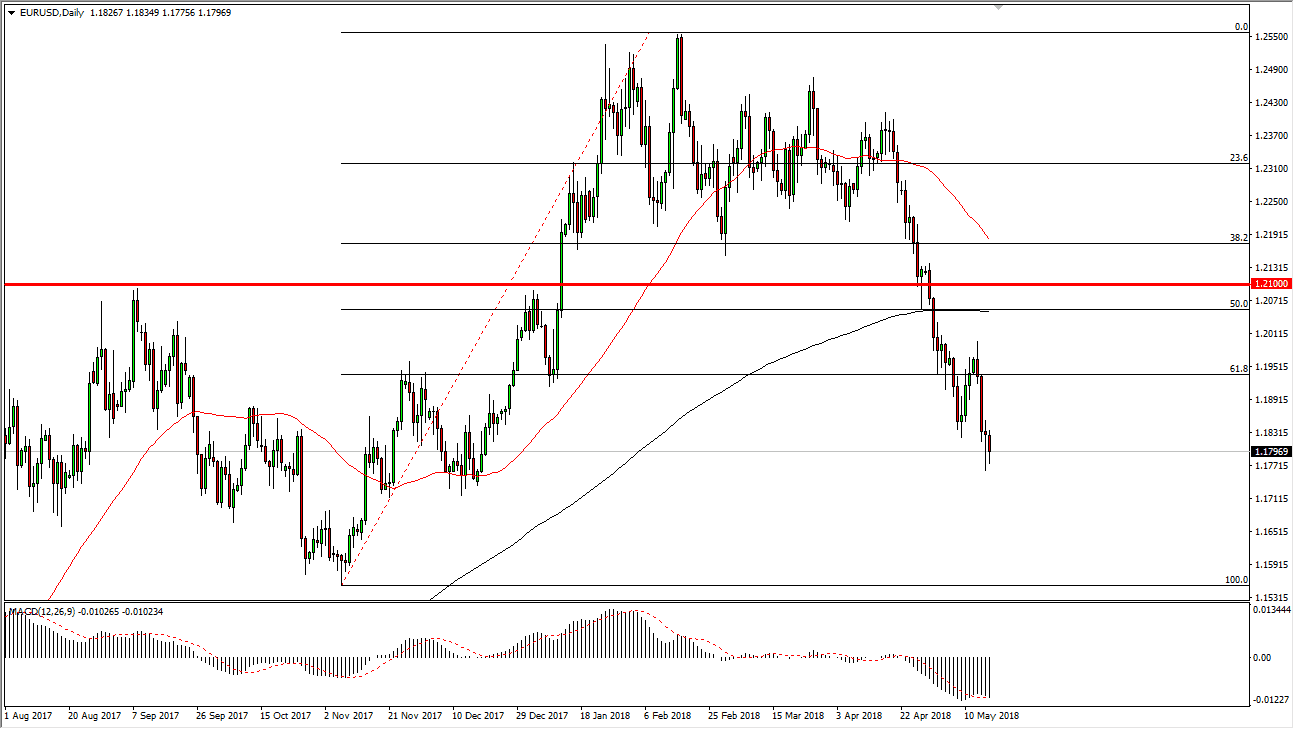

EUR/USD

The EUR/USD pair has fallen during trading on Thursday, reaching towards the bottom of the hammer from the Wednesday session. If we can break down below the bottom of the hammer from the trading session on Wednesday, that would open the floodgates too much lower levels. I think short-term rallies will continue to be selling opportunities, and I believe that the 1.20 level above is massive resistance, as well as the 1.21 handle which has been massive resistance in the past. I believe it’s only a matter of time before sellers come back, as the interest rates in the United States are most certainly going higher, while the European Central Bank is nowhere near stepping away from quantitative easing. I think that this market is eventually going to unwind to the 1.15 level underneath. Based upon longer-term charts, it makes a lot of sense to attempt that move.

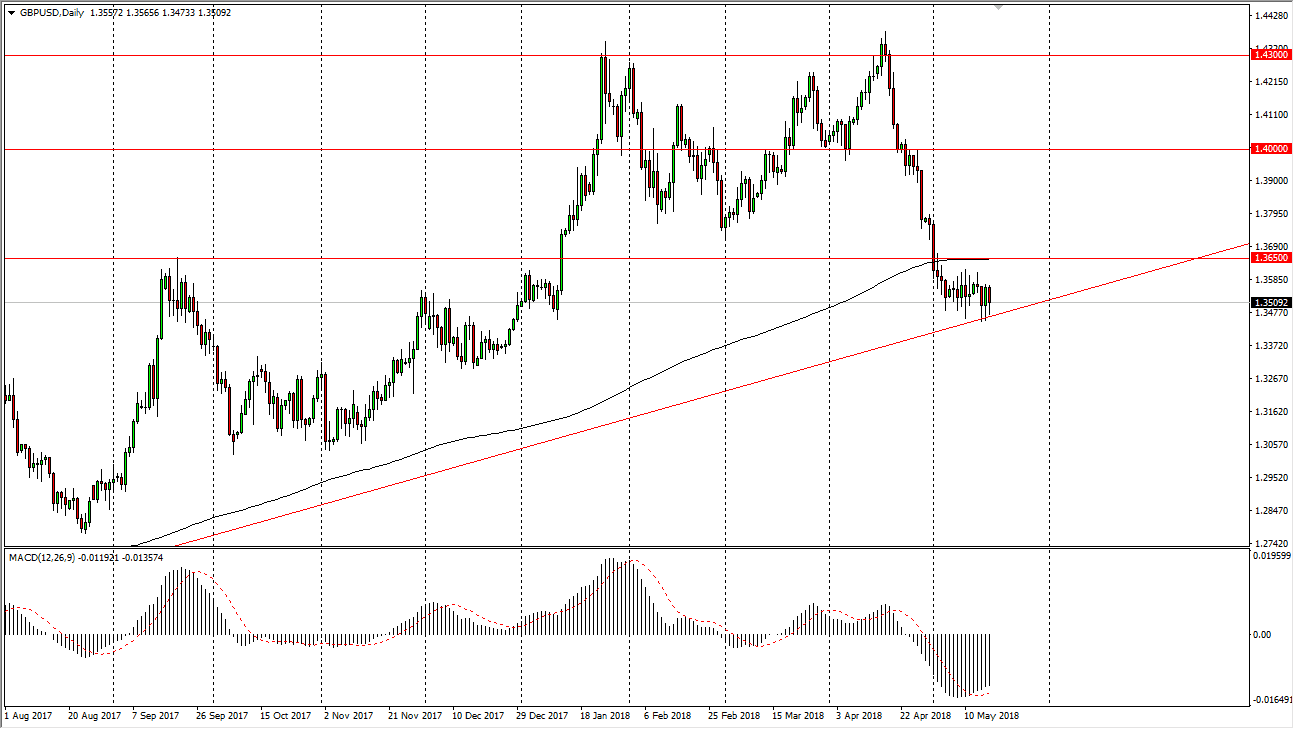

GBP/USD

The GBP/USD pair has fallen a bit during the day on Thursday, testing the uptrend line yet again. The uptrend line continues to hold, but at this point I think it’s only a matter of time before we make some type of major decision, and I have a couple of levels that I will be paying attention to, so I can put money to work. If we break down below the 1.3450 level, extensively a break of the uptrend line, then I think we could go much lower, perhaps the 1.33 level and then the 1.30 level. Otherwise, if we break above the 1.3650 level, then the market will be on the other side of the 200-day exponential moving average, sending this market much higher. That would prove that the uptrend line has held. I believe until we make some type of impulsive move, it’s probably best to stay away.