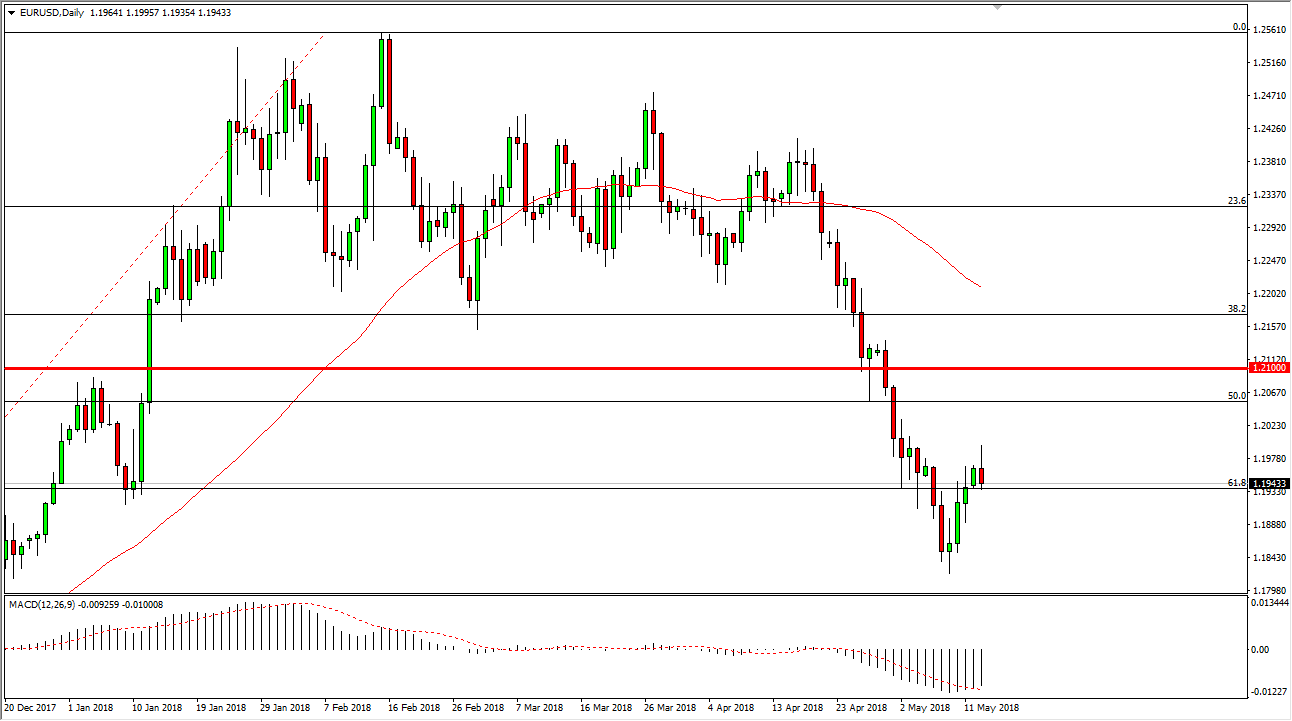

EUR/USD

The Euro rallied initially during the trading session on Monday but turned around to form a bit of a shooting star. By doing so, it put serious doubt into the short-term bounce, but the weekly chart also features a massive hammer. There was a bit of a spike in the Euro during the day as a member of the ECB suggested that perhaps quantitative easing was going to be cut back sooner rather than later, and this of course had people running to the euro. However, later in the day we have seen a complete reversal so that leads to the biggest problem right now: we have a weekly hammer, followed by a shooting star on the Monday session. Typically, when you get this type of conflict between the two separate time frames, it means that we are looking at consolidation. Because of this, I anticipate that we may pull back a little bit, but I don’t think were ready to break down quite yet. Beyond that, the pair is oversold.

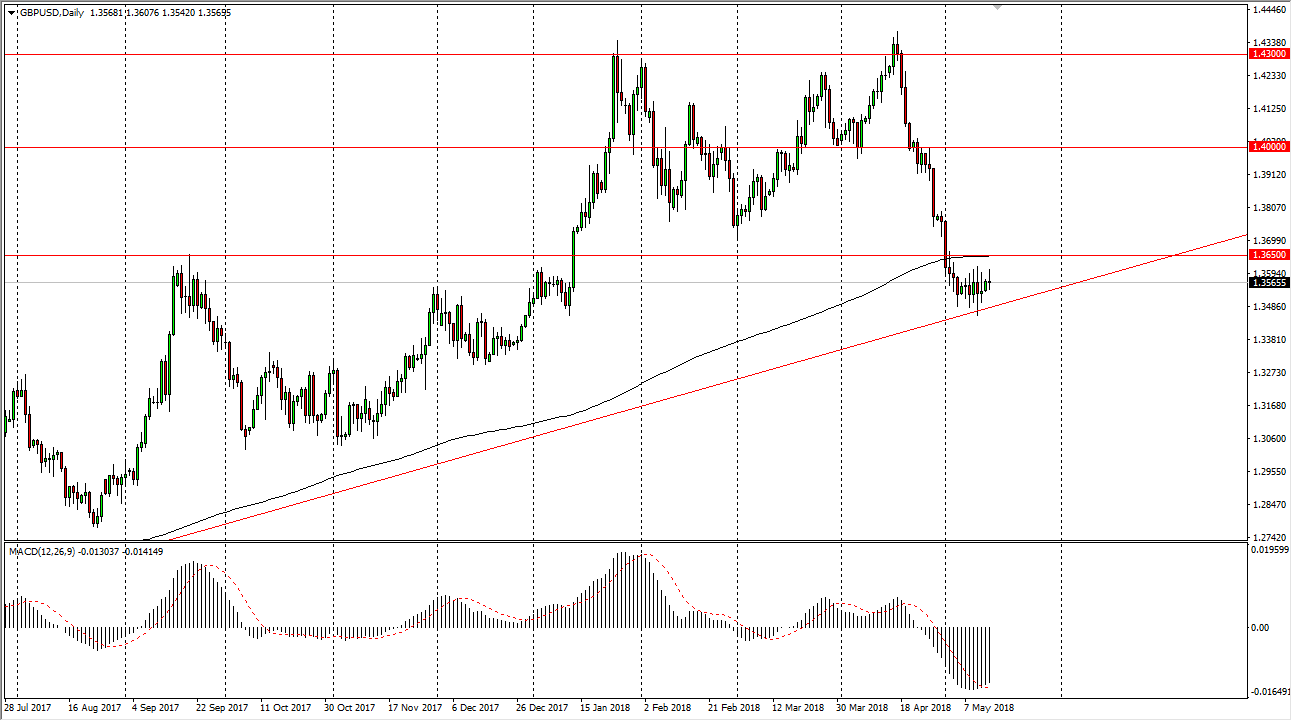

GBP/USD

The British pound continued to go sideways overall during the Monday session, as we also continue to respect the uptrend line. Just above, there is the 200-day moving average which is sitting at the 1.3650 level, which is a major round figure and of course a scene of previous resistance. If we can break above that level, the market could continue to go much higher. I think we did get a breakout, we will more than likely go looking towards 1.38 handle, followed by the 1.40 level. Alternately, if we were to break down to a fresh, new level, that would be by extension a breakdown below the uptrend line, and that should have this market unwinding towards a 1.33 handle, and then eventually the 1.30 level.