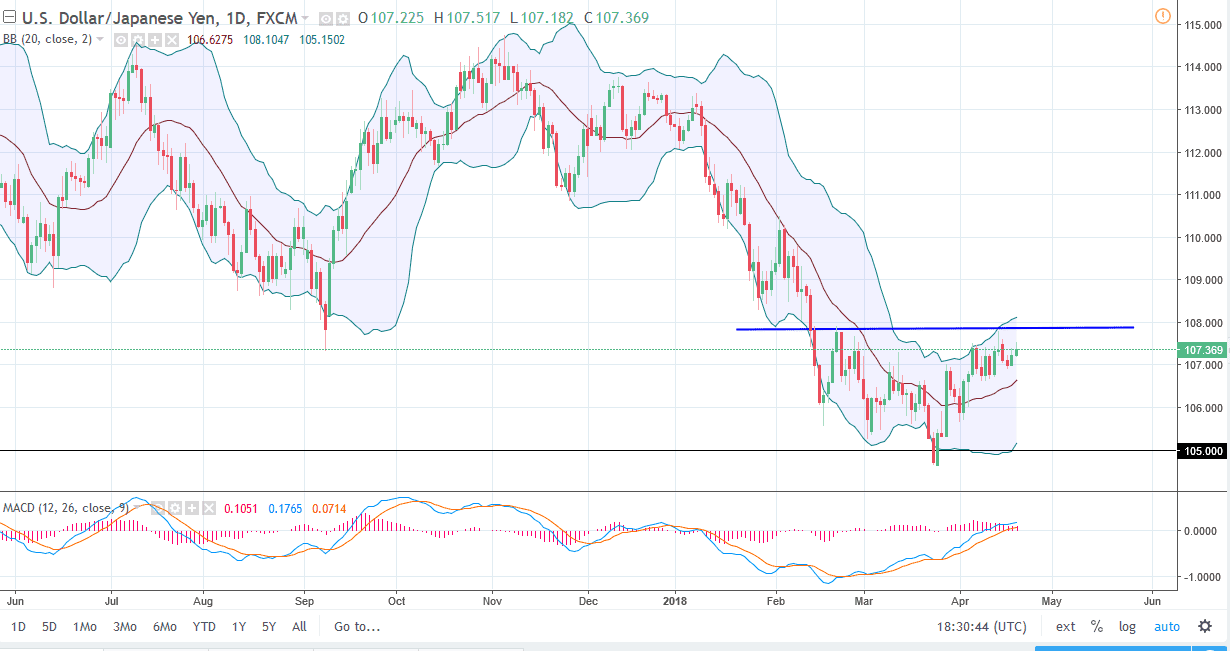

USD/JPY

The US dollar rallied slightly against the Japanese yen during training on Thursday but continues to struggle to go higher. I believe that the 108 level is a significant barrier, and if we can get above that we should continue to go higher. At that point, I would anticipate that the market should go to the 110 handle, which is even more important on longer-term charts. I believe that buyers will continue to come towards this market every time it pulls back, and I believe that there is a massive “floor” near the 105 level. In general, this tends to be a market that moves up and down with risk appetite, so if we can see stock markets start to rally again based upon global fundamentals, that should help this market to the upside as well. On the alternate side of things, if we see an escalation in a “risk off” sentiment type of situation, that will send this market reaching towards the 105 level again.

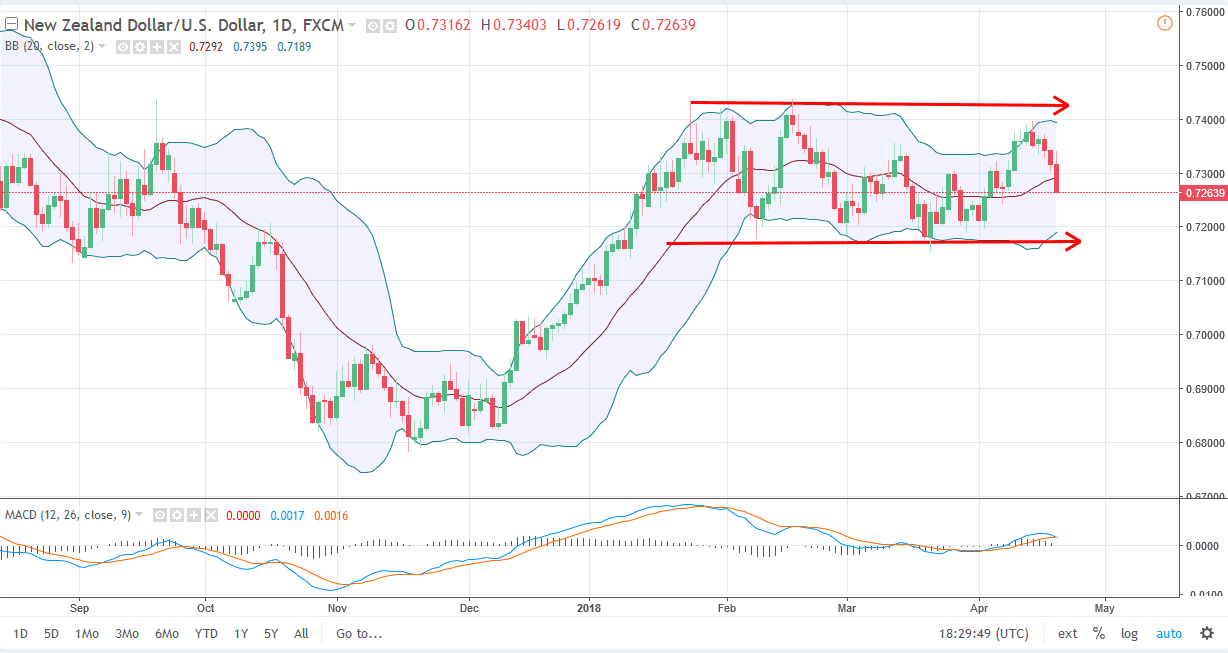

NZD/USD

The New Zealand dollar tried to rally during the trading session on Thursday but found enough resistance to turn around and break down. In fact, we break down below the 0.73 level, an area that is essentially “value” for the consolidation that we are in right now, which I see as bouncing around between 0.72 on the bottom and the 0.74 level on the top. I like the idea of buying this pullback as I think the support should hold at the 0.72 level, and I think that looking at this market through the prism of one that has recently rallied rather significantly, it’s easy to make an argument that we are catching her breath before the next move higher. Remember, this pair is also oversensitive just as the USD/JPY pair is.