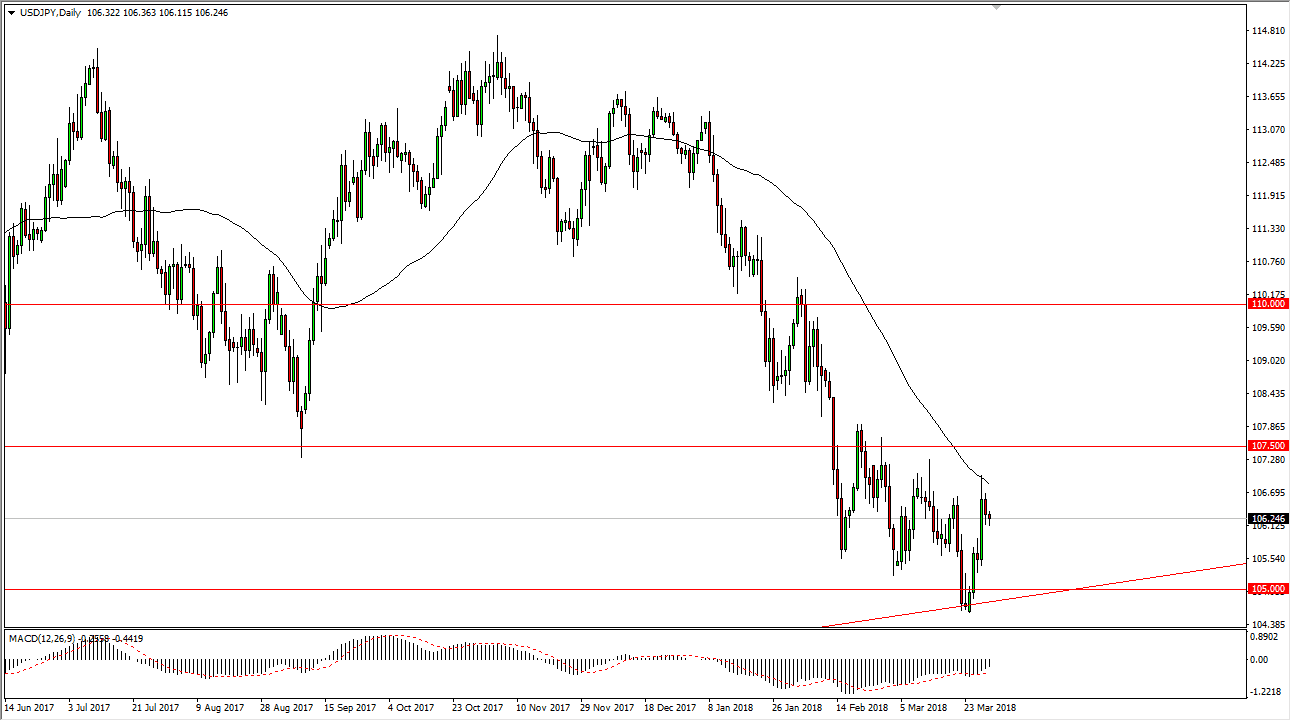

USD/JPY

The US dollar fell slightly during the trading session on Friday, but with a lack of liquidity I would not read too much into the candlestick. Because of this, I prefer to look at the totality of the move, as we have been shopping around, and I believe that the market is going to continue to see buyers trying to jump into this market, with the 105-level offering a major “floor” in the market. There’s also an uptrend line there that we should be paying attention to, so I think that the buyers will probably come back in and pick up this market somewhere in that area. However, if we were to close to make a fresh, new low, the market should then break down towards the 101 handle. I anticipate that the market should continue to be very jittery, due to the potential of a trade war. However, I think that if we can break above the 107.50 level, then we could go much higher.

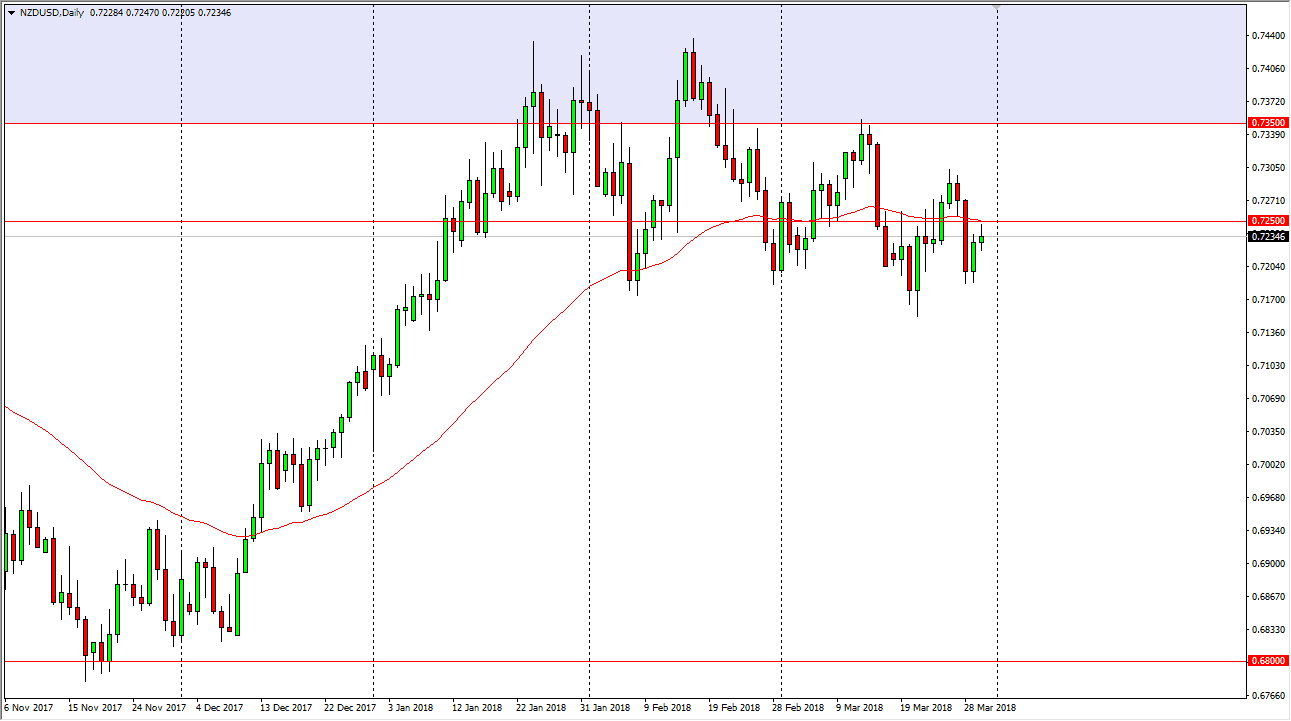

NZD/USD

The New Zealand dollar initially rallied during the day on Friday but found the 0.7250 level to be a bit too resistive. The 50-day EMA has offered resistance as well, and therefore we ended up forming a shooting star. The shooting star of course is a negative sign, so a breakdown below the bottom of the candle could send the market looking towards the 0.7175 level again, but if we break above the top of that, we not only cross the 50-day EMA, but we also clear the 0.7250 level, which would be a short-term bullish signal. I believe that this market continues to be noisy in general, but I think that we will continue to see buyers trying to pick up a little bit of value. However, a fresh, new low would unwind this market back down to the 0.70 level.