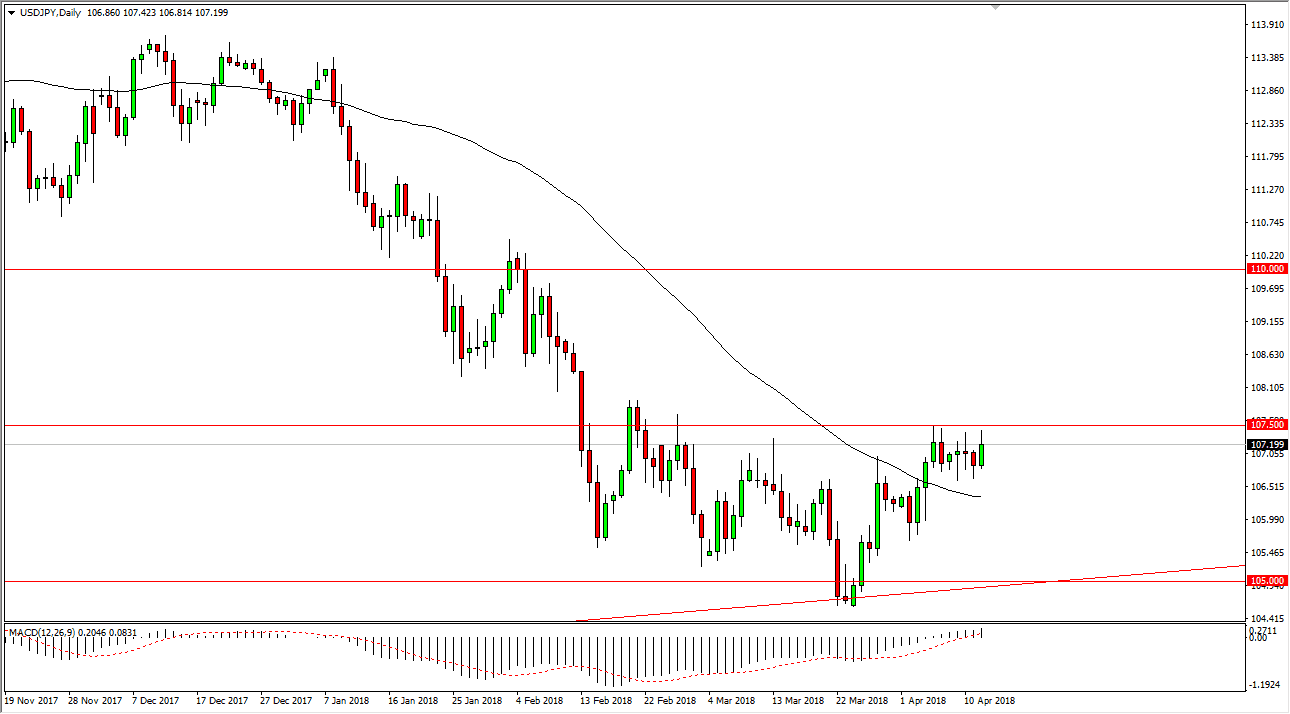

USD/JPY

The US dollar rallied again during the trading session on Thursday, reaching towards the 107.50 level. That’s an area that has been resistance in the past, and I think that the resistance extends to the 108 handle. Ultimately, if we can break above the 108 handle, we should continue to go much higher. That would free the market to go to the 110 level, perhaps even higher than that. Keep in mind that the market will be noisy and certainly be influenced by risk appetite in general, so with that in mind I think that you should keep the idea of where the S&P 500 and the Nikkei are going. If they go higher, I think that eventually this market will break out to the upside. However, we could get a pullback in this market, but I think that the 105 level is starting to act as the absolute floor in the market.

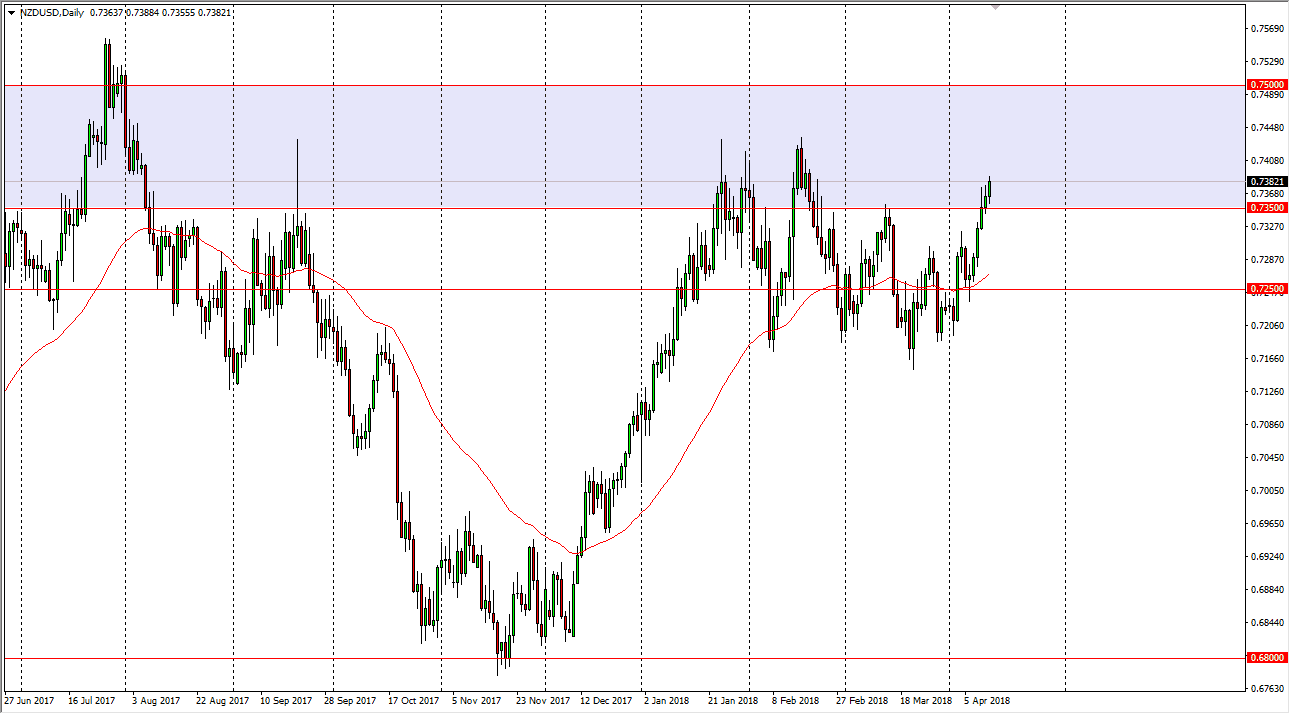

NZD/USD

The New Zealand dollar has rallied a bit during the trading session on Thursday, as we continue to see buyers jump into this market. I believe that the 0.74 level will be targeted, and then eventually we could see a move towards the 0.75 above there. I think that short-term pullback should offer buying opportunities, with the 0.7250 level offering a bit of a floor. I think this market continues to be very noisy and driven by what is going on as far as risk appetite is concerned. Pay attention the stock markets, and if they continue to rally it should send this market higher. Other than that, commodity markets have their usual influence on the New Zealand dollar as well, so if they rise, we should see strength here also.