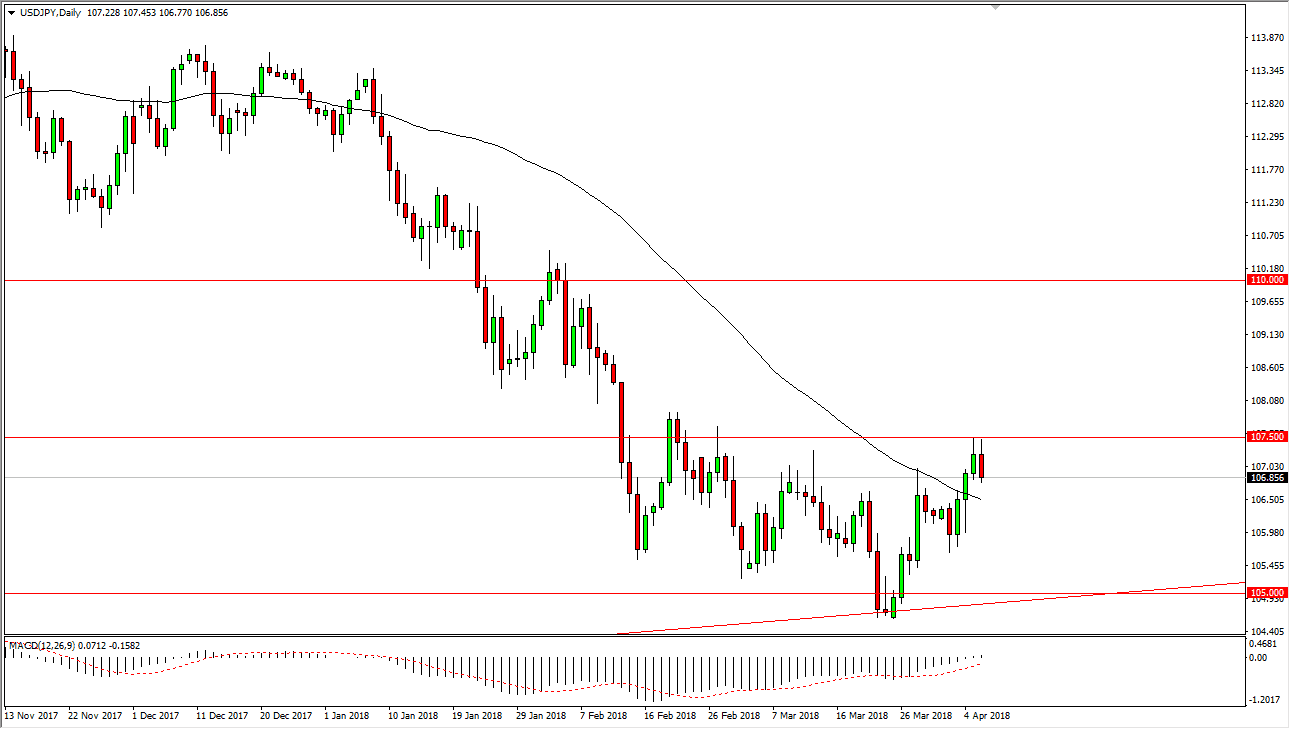

USD/JPY

The US dollar has initially rallied during the trading session on Friday but found enough resistance at the 107.50 level to turn around and form a resistive candle. When you look at the last couple of sessions, we had formed one big massive shooting star when you add them together, and therefore it looks very likely that we could pull back a bit, but I expect to find buyers underneath, with the 105-level underneath being massive support, coinciding nicely with an uptrend line. I believe that if we can break above the 107.50 level, then the market probably tries to get to the 110 level over the longer term. This is a market that’s very sensitive to risk appetite, so pay attention to headlines coming out of the US and China, as they can have a massive effect on what happens with the Japanese yen.

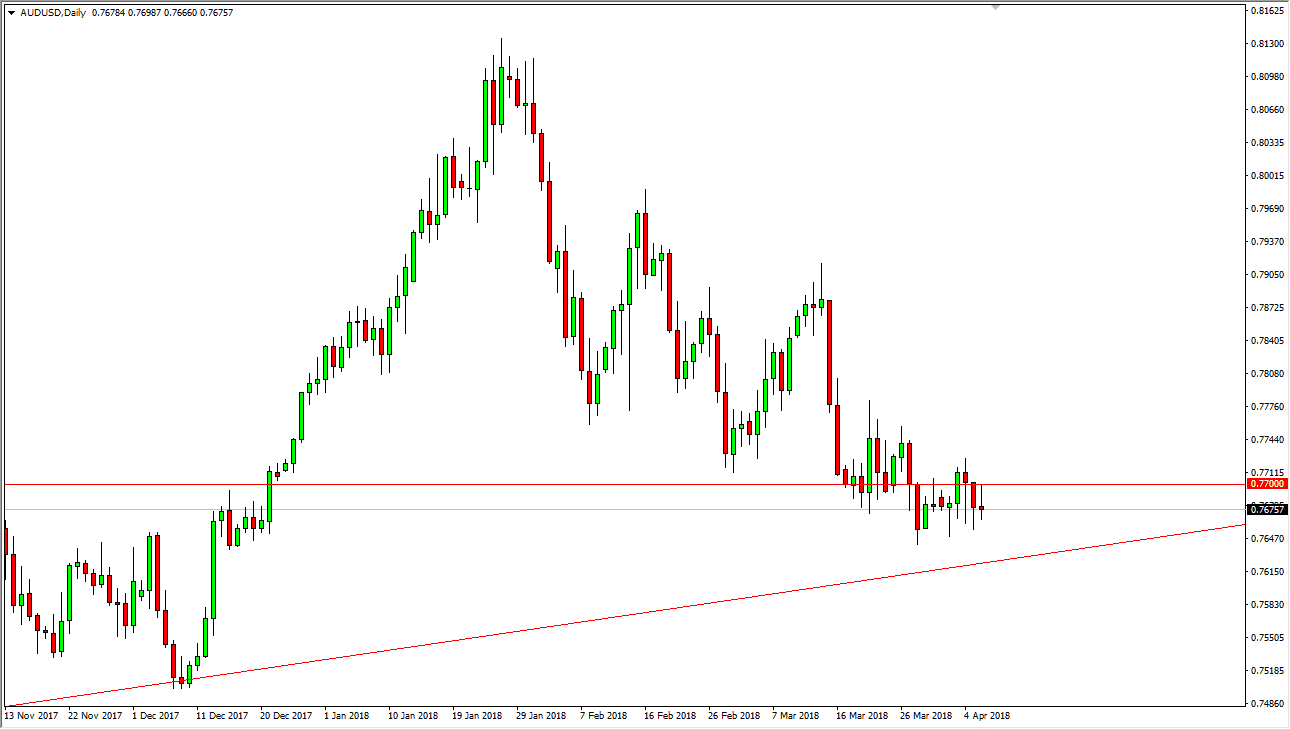

AUD/USD

The Australian dollar has initially tried to rally during the trading session on Friday but found a significant amount of resistance at the 0.77 level. That is an area that is important, but I think if we can break above the 0.7750 level, then the market will continue to go higher. We look at the chart, you can see an upward trend line that goes back to late 2015, so I think it is only a matter of time before the buyers come back into this market place, but if we were to break down below the uptrend line, that would be a very negative sign and could send traders into a frenzy and pushing the Australian dollar down to the 0.75 level. The US and China situation could be a major problem, so if trade war tensions heat up, then that could send this market lower.