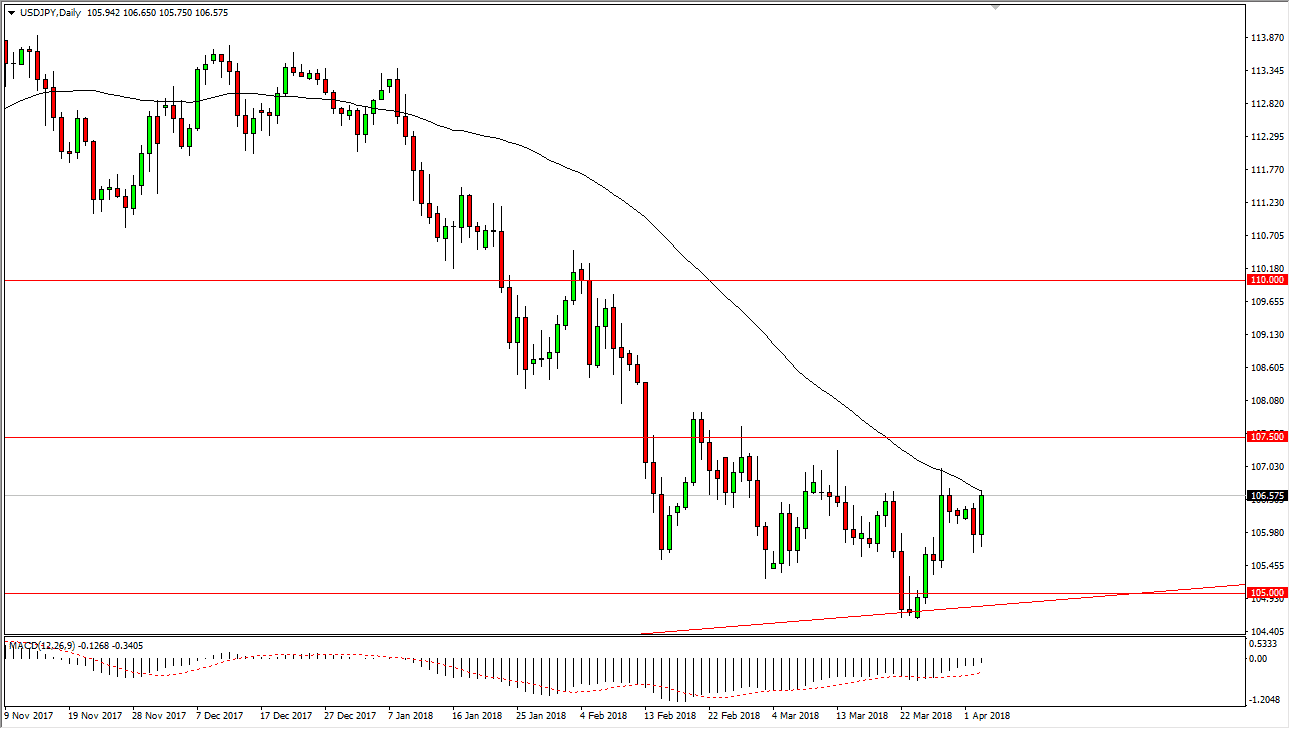

USD/JPY

The US dollar initially dipped a bit lower at the open on Tuesday, then exploded to the upside as stock traders rallied. We reached towards the 50-day EMA, which of course offers dynamic support and resistance over the longer term. I believe that if we break out to the upside, we will probably see even more resistance extending to the 107.50 level. I believe that we will see a lot of choppy trading more than anything else, as the jobs number coming out on Friday will be the next major catalyst as to where we go next. The 105-level underneath is massive support, so I do not anticipate that this market will break down below there between now and Friday.

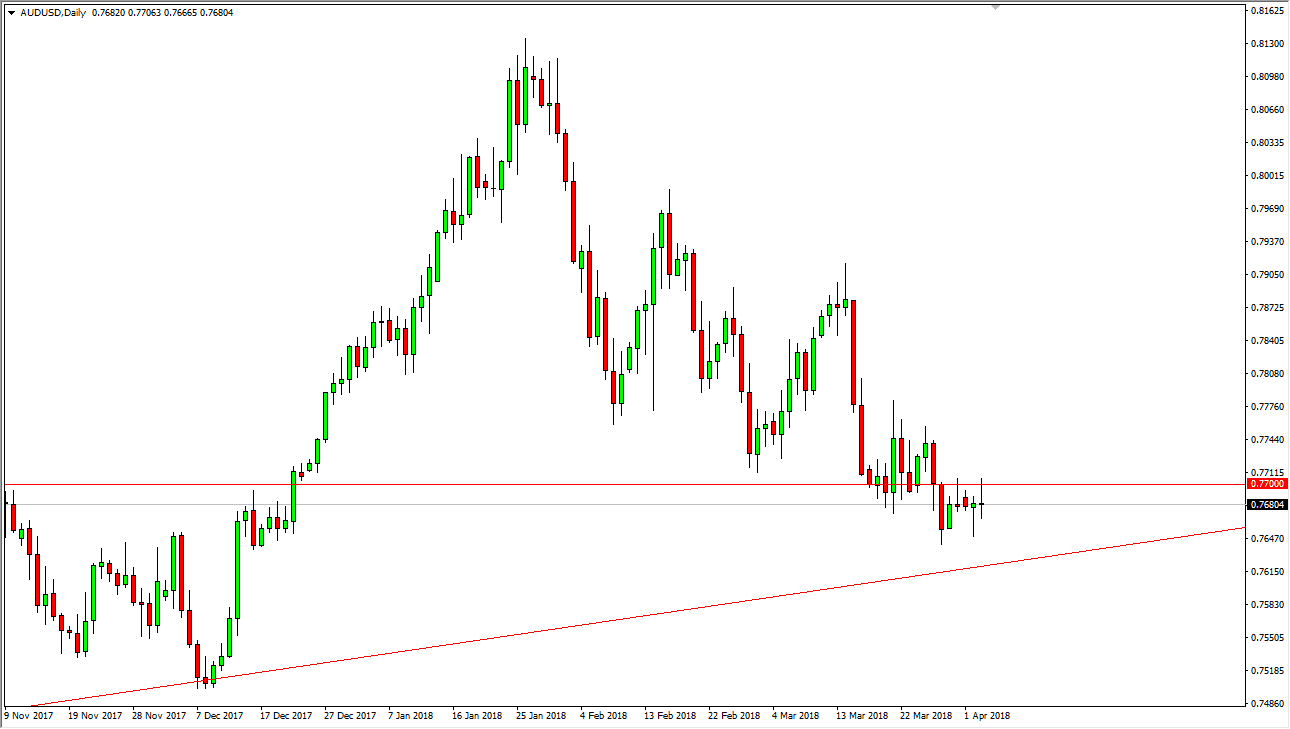

AUD/USD

The Australian dollar tried to rally on Tuesday but found the 0.77 level to be a bit too resistive. It’s an interesting area that, because below here we have the uptrend line from late 2015 that should continue to keep the market somewhat afloat. I don’t think that we break down below it between now and Friday, but if we did, that would be extraordinarily bearish. If we can break above the 0.77 handle, I think that we would target the 0.7750 level above, and a break above there could send this market even higher, perhaps reaching towards the 0.79 level. In the meantime, I think that we see a lot of back and forth trading, in anticipation of the Nonfarm Payroll figures coming out on Friday.

This is a market that will probably be very difficult to deal with over the next couple of sessions, but I think eventually we will get some type of impulsivity in the market that could send us to the markets with a better trading opportunity.